Why venture capital infrastructure is finally getting automated

- The manual processes that used to require lawyers, fund administrators, and accountants to set up private investment vehicles can now be handled by software in days instead of months.

- Sydecar's founder explains how standardizing legal documents unlocked automation across the entire investment lifecycle, and why major banks are now acquiring platforms to bring private market access to retail investors.

Welcome to the Tearsheet Podcast, where we explore financial services together with an eye on technology, innovation, emerging models, and changing expectations. I’m Tearsheet’s editor in chief, Zack Miller.

The venture capital world has a liquidity problem. With IPOs scarce and M&A exits few and far between, investors have been stuck in positions for years, unable to return capital to their LPs or move into new opportunities. But while traditional exit doors have stayed shut, technology has opened up new ones—specifically, platforms that make it possible to create and trade Special Purpose Vehicles at scale, something that used to require armies of lawyers and fund administrators.

Today I’m joined by the CEO and co-founder of Sydecar, a platform that’s turned what used to be a manual, months-long process into something you can do in days. He started his career as a securities attorney at firms like Weil Gotshal and Cooley, where he spent his days drafting the same documents over and over for venture deals. That experience showed him that much of what venture capitalists were paying lawyers to do could be standardized and automated, which led him to found Sydecar in 2021.

In our conversation, he explains how technology is reshaping private market infrastructure, what gets automated and what still needs human expertise, and how software is changing who can participate in venture investing.

Watch

Listen

Subscribe: Apple Podcasts I SoundCloud I Spotify

Standardization unlocks automation

The key insight that unlocked SPV automation wasn’t about the fundraising process—it was about standardization. By creating a static legal document with well-understood terms where only a few parameters change, Sydecar transformed SPVs from negotiated contracts into something more like clickthrough agreements. “If we could just create a static document that has well-understood terms and then just change the few parameters that people actually care about, you can create almost like an end-user license agreement,” the founder explained. “You can just click through it rather than negotiate it.”

Downstream effects of legal standardization

That standardization has downstream effects that go far beyond the initial setup. Once the legal form is standardized, everything that follows—capital account maintenance, waterfall operations, distribution processing, tax matters, books and records—can also be standardized and therefore automated. “The legal form dictates all of the support work over the life of a private investment,” he said. “Standardizing the legal form allows you to standardize all these downstream processes, which then enables you to apply software to handle those jobs—to build basically a calculator for all the downstream jobs to be done.”

Private markets going mainstream

The shift toward private markets as a mainstream asset class is accelerating. What used to be the domain of sophisticated venture capitalists is increasingly accessible to retail investors, with major banks acquiring platforms to facilitate secondary trading in private company shares. “It’s no longer atypical or an outlier investment to invest in a private business,” the founder noted. “Now it’s almost going to be part of everyone’s portfolio going forward.”

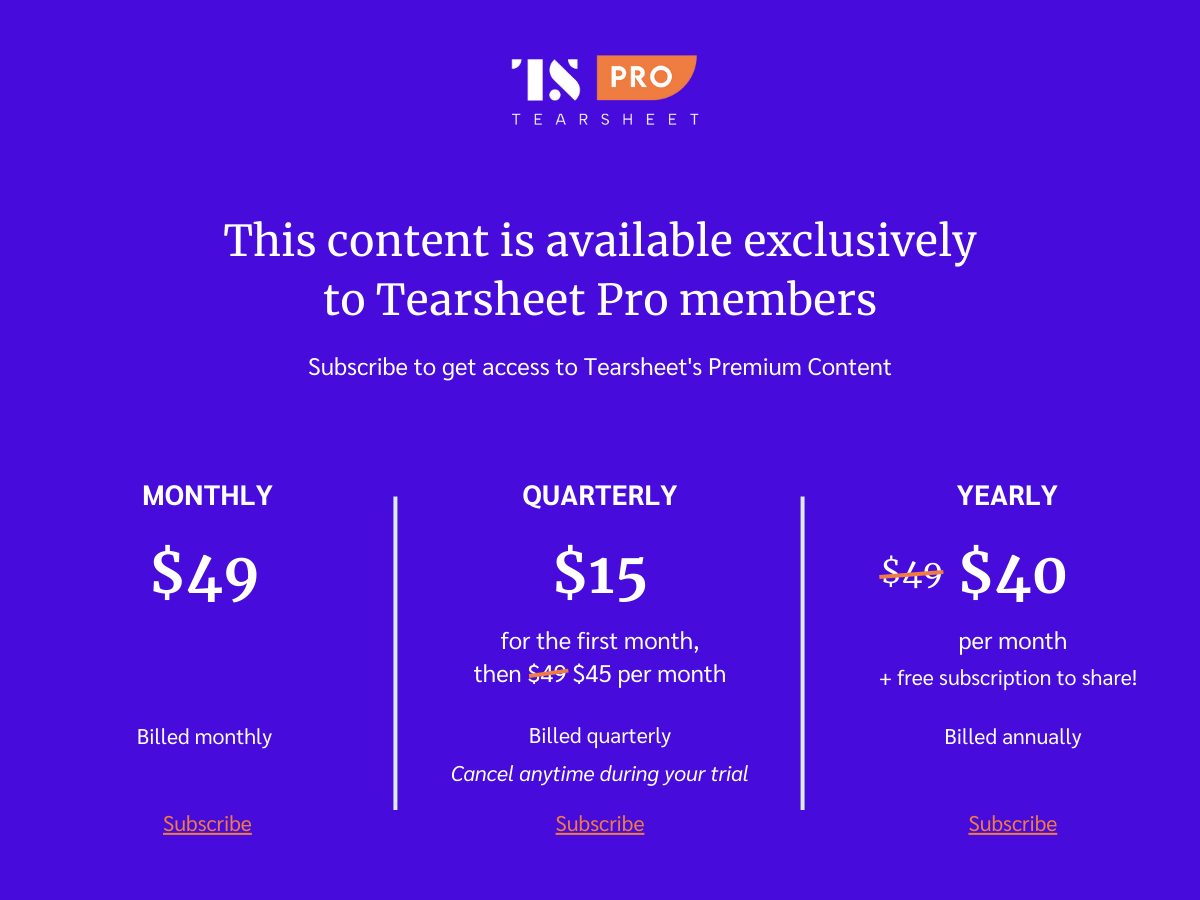

Read the transcript (for TS Pro subs)