How modernization positions FIs for growth as primary financial service providers

- Fintechs and digital banks are outpacing traditional banks in their effective use of technology, drawing in increased consumer interest.

- Financial institutions need to revise and realign their strategies to navigate fintech challenges and stay competitive in today's market.

Today’s rapid technological advancements are reshaping how we handle everything from ordering dinner to booking vacations, raising the bar for speed and customization. Consumers are now looking to their financial service providers for the same level of speed, convenience, and personalization they’ve come to expect in every other part of their lives.

Fintechs and digital banks are outpacing traditional banks in their effective use of technology, drawing in increased consumer interest. According to recent research by Datos Insights in collaboration with Galileo Financial Technologies, 85% of consumers are satisfied with their primary financial institution, yet many are using as many tools or services with other financial providers. This shift highlights the pressing need for traditional banks and CUs to modernize their core technology to maintain their relevance.

Banks can encounter significant challenges when updating legacy systems to incorporate modern technology. But they can start with small steps and approach this transition gradually. Instead of attempting a complete overhaul, banks can opt for incremental modernization, which minimizes risks and costs associated with digital transformation.

“A phased approach allows financial institutions to identify what can be modernized independently so they can prioritize their core modernization investments, like real-time payment processing, buy now pay later (BNPL), and new distribution models such as embedded finance. They can responsibly build, scale, and grow without disrupting day-to-day operations,” said David Feuer, Chief Product Officer at Galileo Financial Technologies.

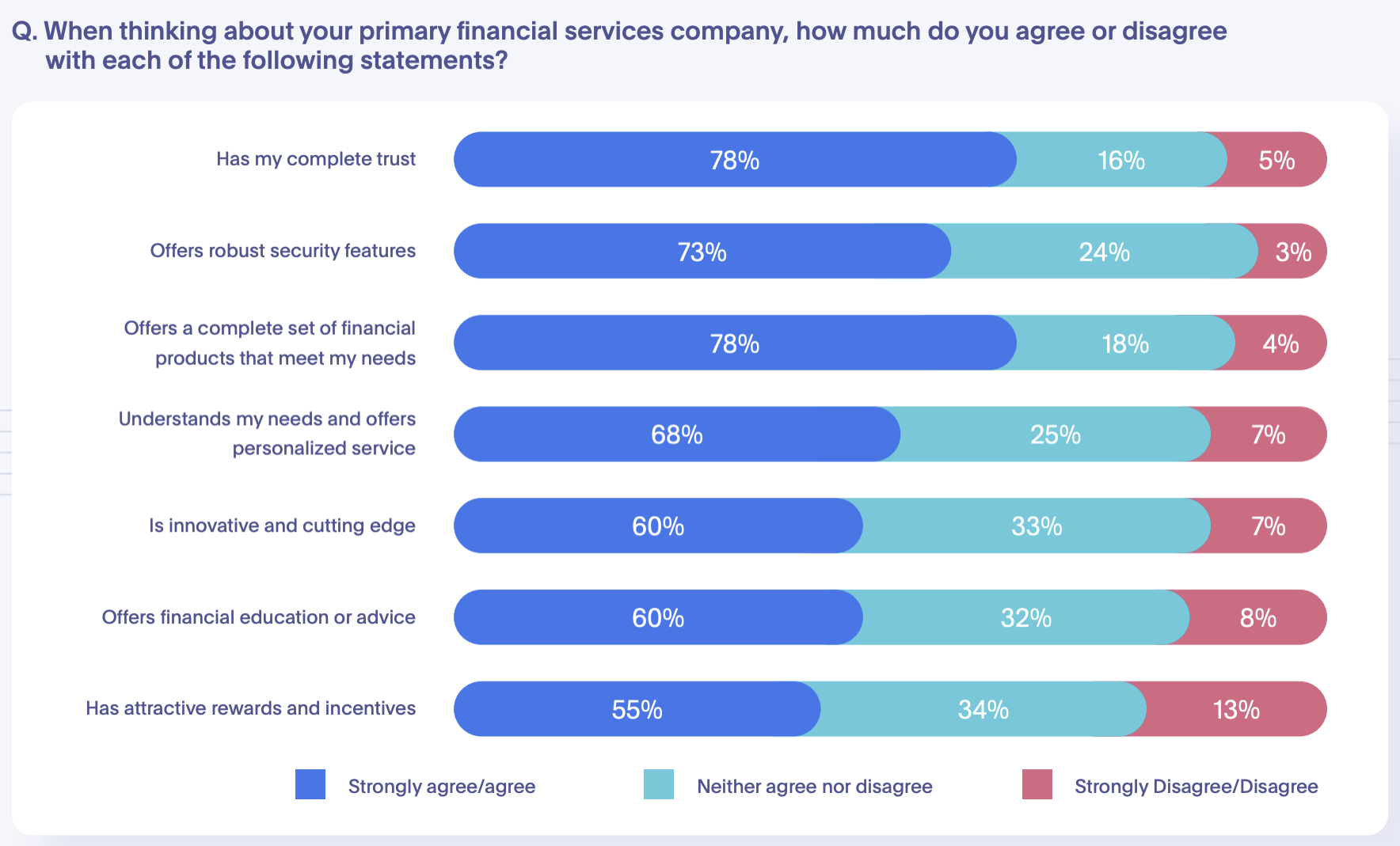

A major advantage for traditional banks is their deep-rooted consumer trust (78% say they have complete trust in their FI) and long-standing relationships. Although consumers are increasingly drawn to the modern features of fintechs and digital banks, they are not yet ready to completely sever ties with traditional banks. These institutions have long been a staple in their parents’ and grandparents’ financial lives, serving as the only option available back then.

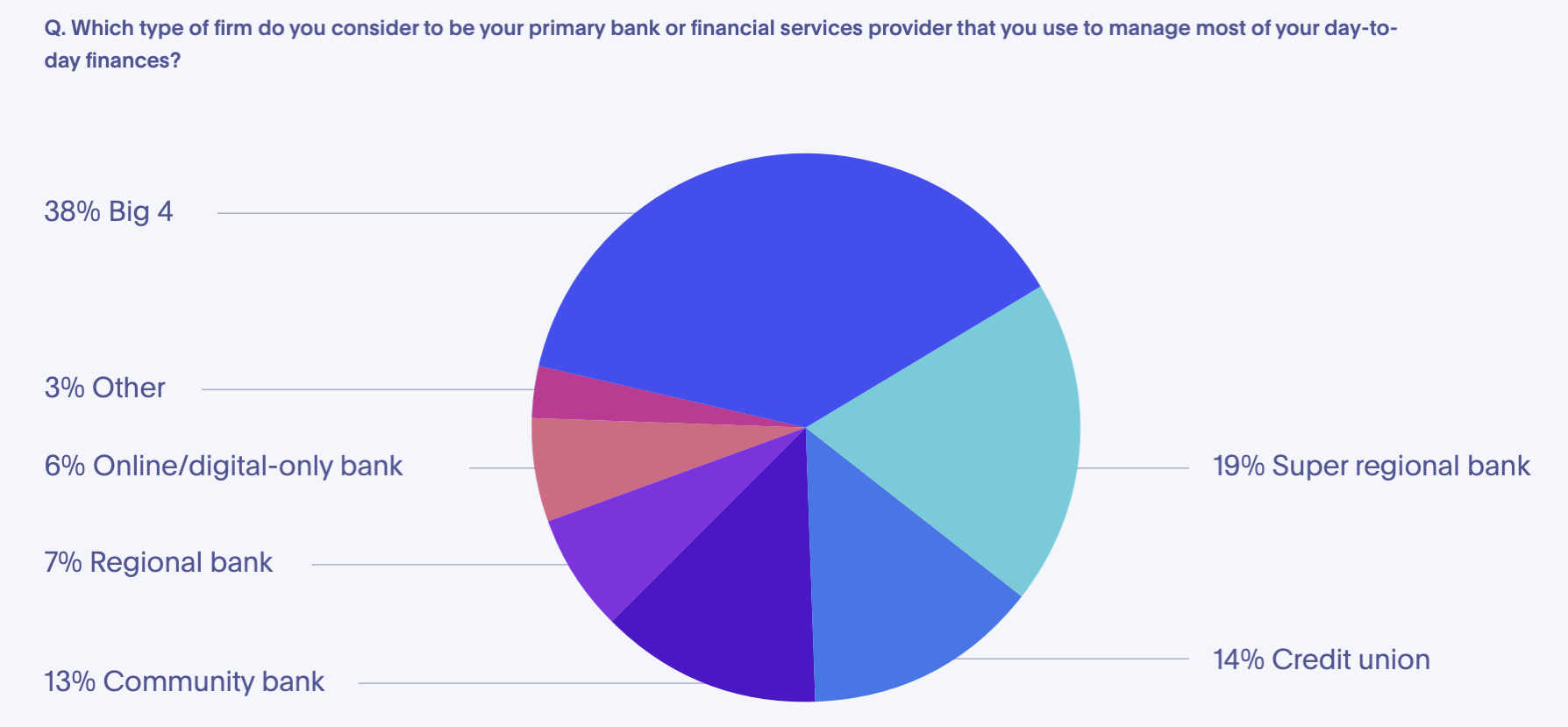

Consequently, many consumers embrace a hybrid strategy, using modern fintech tools alongside their traditional banks, which continue to be their primary financial service providers. Surprisingly, 66% of Gen Z primarily bank at a Big 4 or super-regional bank, while older millennials and Gen Xers are the biggest users of online banks, according to Galileo’s research.

“The digital maturity gap is widening at a time when customers expect more. Banks risk losing share as digital-first competitors grow faster. Banks can’t retain customers or grow market share with outdated legacy tech that doesn’t allow them to build products and services for how customers are using them today. If customers aren’t engaging, they aren’t creating value,” said Feuer.

Consumers may be exploring options outside of their primary service providers because of poor communication. While bank marketing efforts do have an impact, the root cause of customer attrition may lie in traditional financial institutions’ struggle to clearly articulate their services and value propositions from the outset of their relationships with their customers.

“Financial institutions are missing out on valuable revenue from existing customers and potential new ones because they do not have full visibility of how customers engage with them, and, even more importantly, where they are not. FIs that don’t have this data miss a big opportunity to meet that need before a competitor does,” said Feuer.

This hybrid approach of customers using both fintechs and banks underlines two significant issues facing financial institutions at present:

- First, despite their significant market share, banks are now sharing that space with emerging challengers.

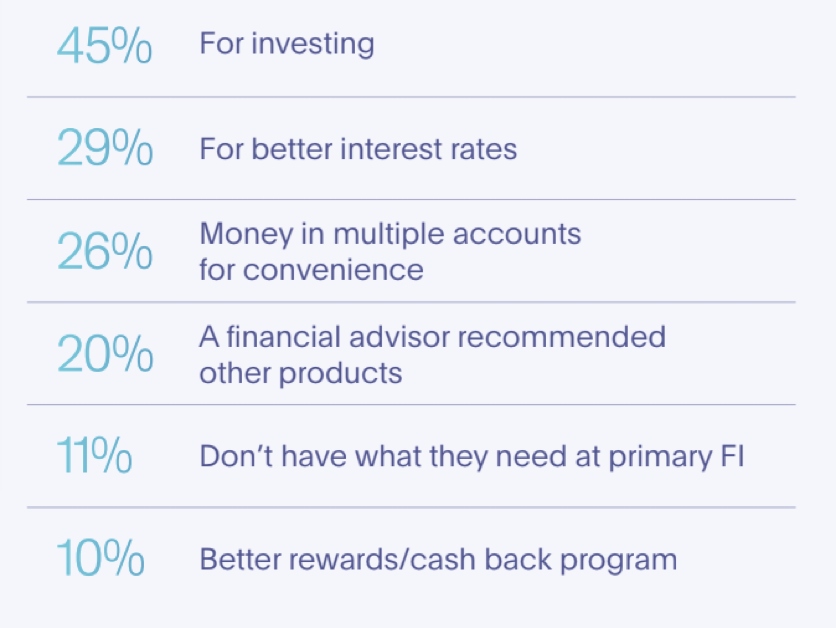

- Second, consumers are increasingly looking beyond their primary traditional bank for additional or alternative services where they can find greater returns. For example, 45% of consumers are turning to secondary providers for investment opportunities, while 29% are seeking more favorable interest rates on their deposits, indicating a growing inclination to explore other options.

“Fintechs have the ability to launch new offerings quicker because their tech stacks are more nimble. That agility also helps them build personalized financial services to connect with customers in their time of need. Banks have recognized the need to respond to the market shift where consumers are increasingly curating their own financial experiences,” said Feuer.

Why are consumers using providers outside their primary FI?

So, the real question is: How long can banks retain their primary position in the face of these developments?

The stakes are high — losing their status as the go-to financial institution could mean diminished customer retention and a drop in lifetime value for FIs.

To address these issues effectively and compete in the current market, financial institutions should revise and realign their strategies.

1. More AI-enabled, self-managed experiences

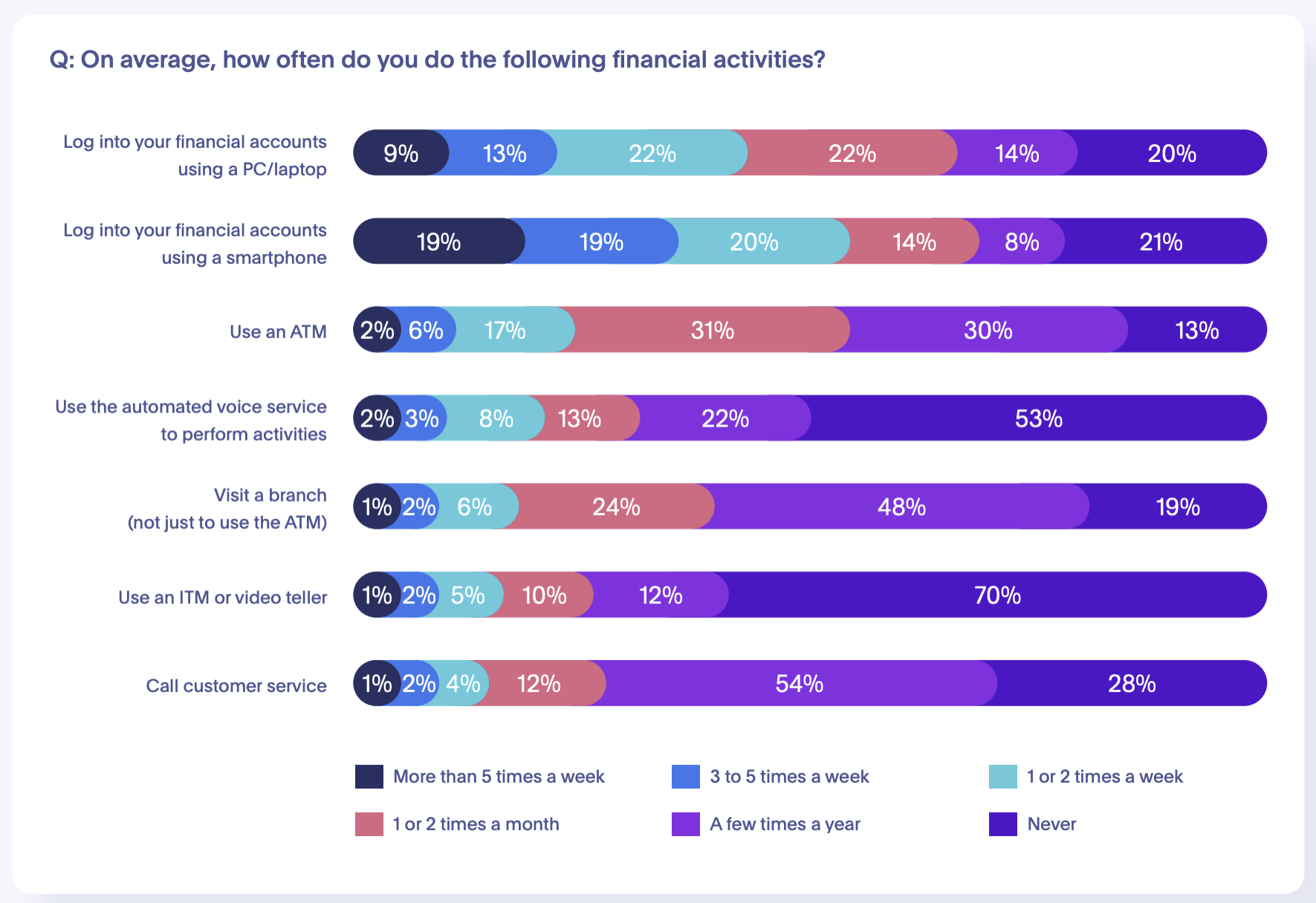

Bank customers are increasingly choosing self-service tools for their convenience. This implies that customers prefer accessing financial services through their preferred channels, such as online platforms or apps, and generally steer clear of phone interactions whenever possible. Customers also show a strong preference for chatbot support or virtual assistants, as these tools provide instant help and lessen the reliance on call center service.

But most customer needs still can’t, or aren’t, being met online or via an app. As a result, customer expectations are not met, leading 33% to visit a branch and 19% to call customer service at least once a month, according to Galileo’s research.

At the same time, the majority of consumers say they (60%) prefer to bank without any human interaction at all.

Some digital natives like SoFi are replacing the use of chatbots with intelligent digital assistants (IDAs) to support their members with faster response times. By integrating Galileo’s AI-driven IDA, Cyberbank Konecta, SoFi was able to increase response time by more than 65%, resulting in 50%+ fewer people dropping from chat.

Other banks and CUs could draw inspiration from SoFi’s integration of Konecta. This IDA represents just one success story from a big player in the industry, and there’s still a long road ahead for other banks to create similar AI-powered digital solutions that match their scale and adapt to their audience’s needs.

2. Hitting the mark with omnichannel strategy

Despite their reluctance, customers have to reach out to call center support or visit a branch when bank apps or digital tools fall short in functionality. This exposes a larger issue: while financial institutions have access to a wealth of data across different parts of their operations, they aren’t generally utilizing it cohesively. As a result, they’re missing key opportunities to elevate their services, strengthen their value proposition, and provide a unified omnichannel experience for their customers.

Upgrading bank app features is important but it is just one part of the equation. Implementing an omnichannel strategy is key to fully meeting customers’ needs by integrating and connecting various service channels.

“Outdated legacy systems are holding back financial institutions that are locked into disparate data silos that don’t talk to each other, making it impossible to improve the customer experience, quickly launch new products and services, reduce operational costs, or scale profitably to meet customer demand,” Feuer said.

For instance, if a customer starts a mortgage application online and then contacts the bank’s call center for assistance, a connected system across all channels can enable the bank representative to pick up right where the customer left off by accessing the incomplete application. This connection minimizes customer effort, confusion, and inconvenience by ensuring that account details and preferences are updated and synchronized across all touchpoints.

3. Data and personalization are becoming must-haves

The omnichannel approach can also open doors to more personalized banking experiences. Banks can leverage analytics to gain a comprehensive understanding of customer behaviors and preferences by consolidating data from all customer interactions and touchpoints. This holistic perspective provides deeper insights, enabling more accurate support, quicker problem resolution, and tailored product offerings, including enhanced cross-selling opportunities.

Consequently, customers can experience greater satisfaction and a stronger sense of being valued, seen, and heard by their banks.

To maintain their position, financial institutions should leverage customer data to provide personalized solutions that meet customers’ needs precisely when they arise.

“Data-driven financial institutions can create tailored experiences, seamlessly inserting themselves into customers’ ever-evolving needs across all digital channels. Leveraging customer data allows financial institutions to understand customer preferences, improve interactions, and increase value in their ecosystem,” said Feuer.

Find out how your institution can navigate fintech challenges and stay competitive with actionable strategies by downloading The Galileo Consumer Banking Report by Datos Insights.