Modern Marketing

How a Goldman Sachs brand is trying to erase debt stigma

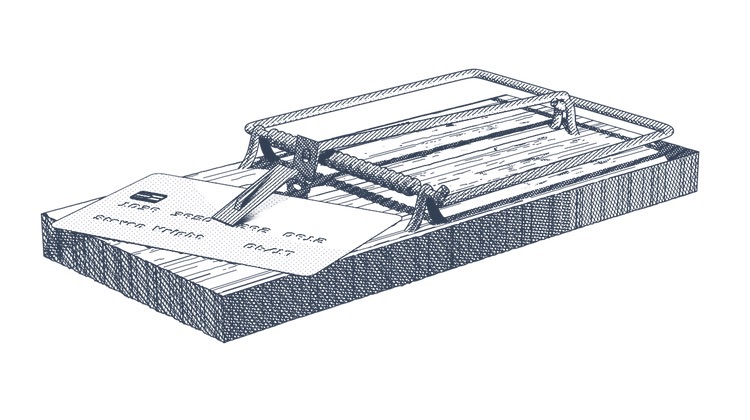

- Goldman Sachs wants customers to know they're more than the debt they owe.

- Marcus, the online lending startup built inside the investment bank, is focused on a speaking a different language to a different type of client.