Modern Marketing, New banks

Embracing ‘side bank’ status: 5 questions with Aaron Wollner, CMO of Quontic

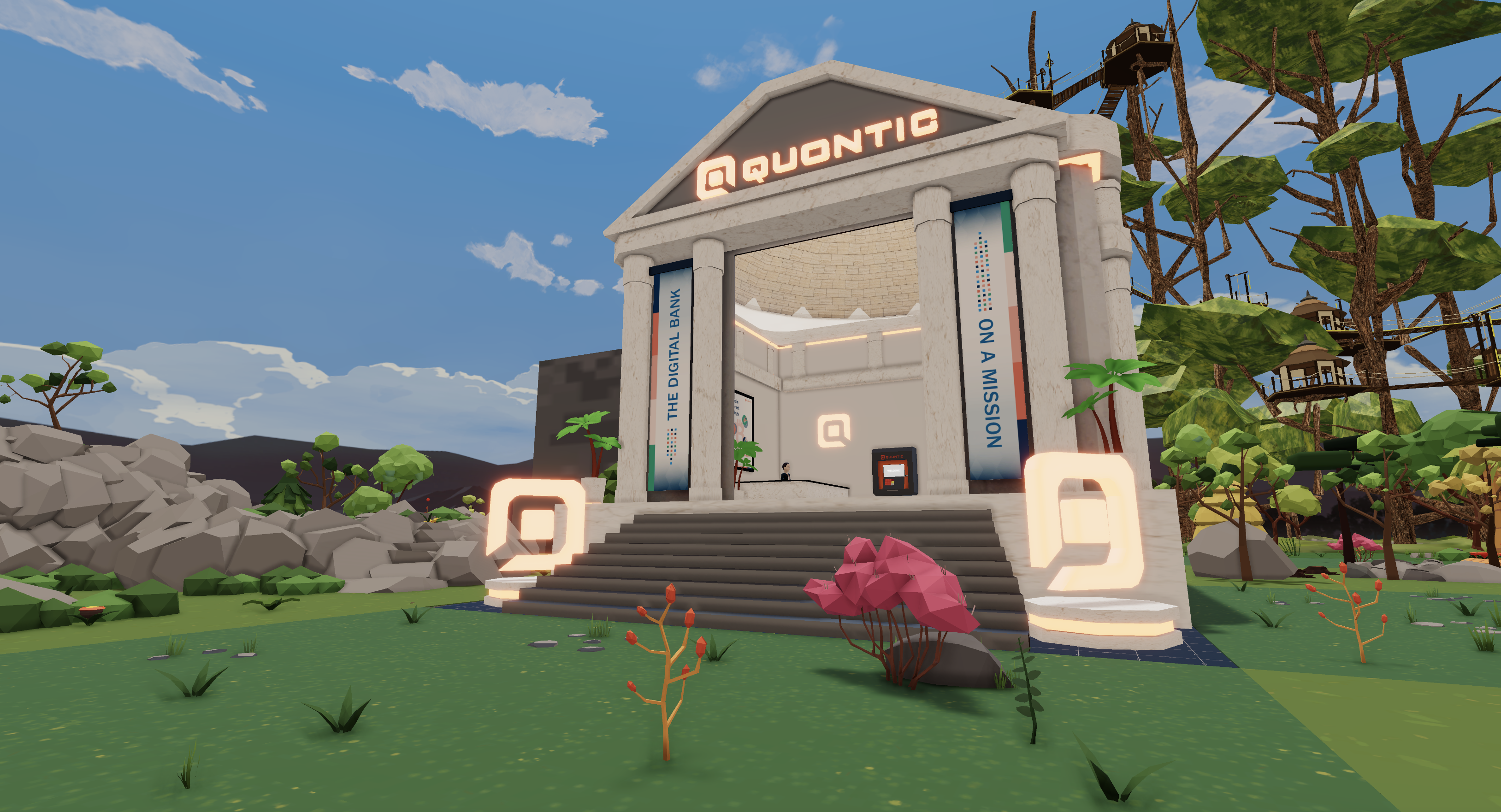

- As a community bank turned digital bank, Quontic has its own unique challenges in sticking out of the crowd.

- In this Q&A, CMO Aaron Wollner talks about what’s new in the digital bank’s campaign work and how it’s been shifting its messaging to fit the current financial climate.