Branding 101: How Klarna translates its branding principles into product and UX design

- Given mounting competition, one way a brand can build awareness among consumers is branding, and Klarna is one of the best.

- Dive into Klarna's branding principles and marketing campaigns to find out how the Swedish brand manages to stand out, marrying its design ideals to its products.

In the financial services industry where standing out is much harder due to the many competitors and the strict regulators, branding is in a double bind: it should be recognizable and responsible at the same time.

One of the best examples of pushing the envelope in this industry comes from Klarna. The Swedish brand’s website, app, products, and messaging all sing the same catchy harmony and it stays with you. This is how:

Find the right tone and voice: Klarna’s branding principles of “curiously bold”, “strikingly relevant” and “offbeat optimists” are strong examples of how branding can inform design, marketing and products.

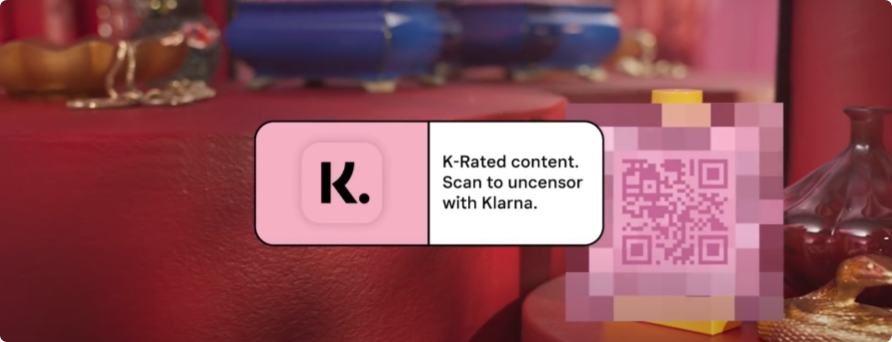

- Curiously Bold: Some time back the brand ran an interactive ad campaign called the “K-rated”. The ads had scannable pixelated images which curious customers would have to scan to get information of the product and access to deals. The whole campaign took inspiration from sex and porn and turned it into an interactive shopping experience. Klarna worked with the creative agency Thinkerbell on the campaign and Thinkerbell founder, Adam Ferrier told me that the idea was developed collaboratively by the two companies.

“Creating scarcity, or making something seem like it’s not easily available has the impact of people wanting to see it more. We used this psychological tool to make everyday objects seem ‘k-rated’, and could only be viewed via scanning the item via a QR code,” Ferrier said.

- Strikingly Relevant and Offbeat Optimists: Klarna’s target consumers are young and the way the brand uses eye-catching colors and photography reflects that. But the design goes deeper – its recent launch of Wikipink (which is a cool name for a well-designed and detailed About Us page) reflects the younger generation’s demand for transparency. Moreover, the firm’s partnerships with companies that have less of a carbon footprint, their Climate Fund, and prioritization of environmental friendly brands in the UX all reflect how branding informs and is informed by products.