The story of how Affirm found its second growth engine

Big announcements are often greeted with fast fanfare, but sometimes clues of fintech’s evolution and a company’s growth roadmap are tucked inside quarterly filings. That’s the case with Affirm’s Q4 2025 results, which came out at the end of August.

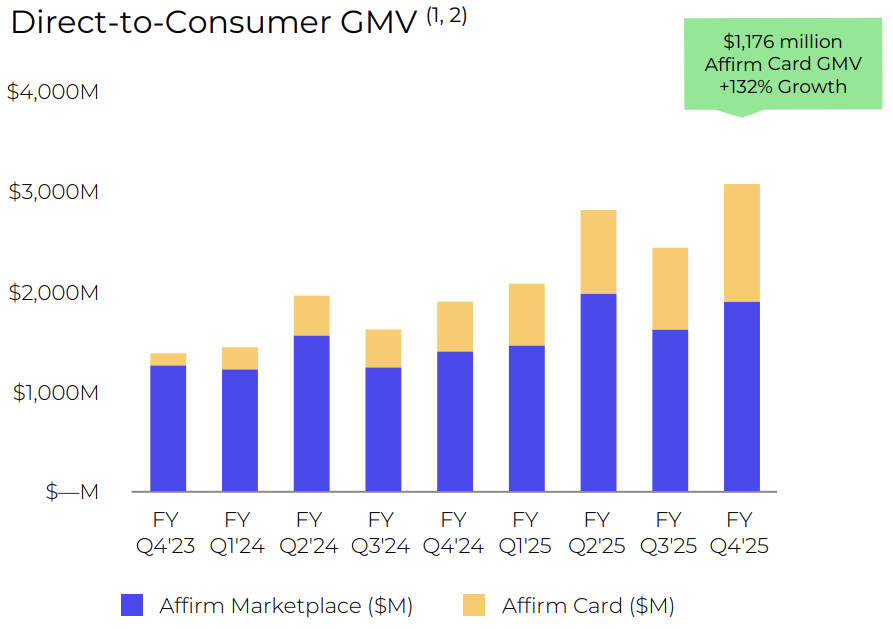

The earnings figures were notable: $876 million in revenue, up 33% year-over-year, a swing to $69 million in net income, and Affirm’s GMV growth year-over-year was about 43%, from $7.2 billion to $10.4 billion in Q4.

Given how often Affirm has been boxed in as a BNPL (buy now pay later) pure-play, the move into sustained profitability on its own could have carried the story. This time, though, the detail worth dwelling on was buried in the product data, and how a specific product is emerging as Affirm’s second growth engine. The first growth engine remains BNPL at checkout.

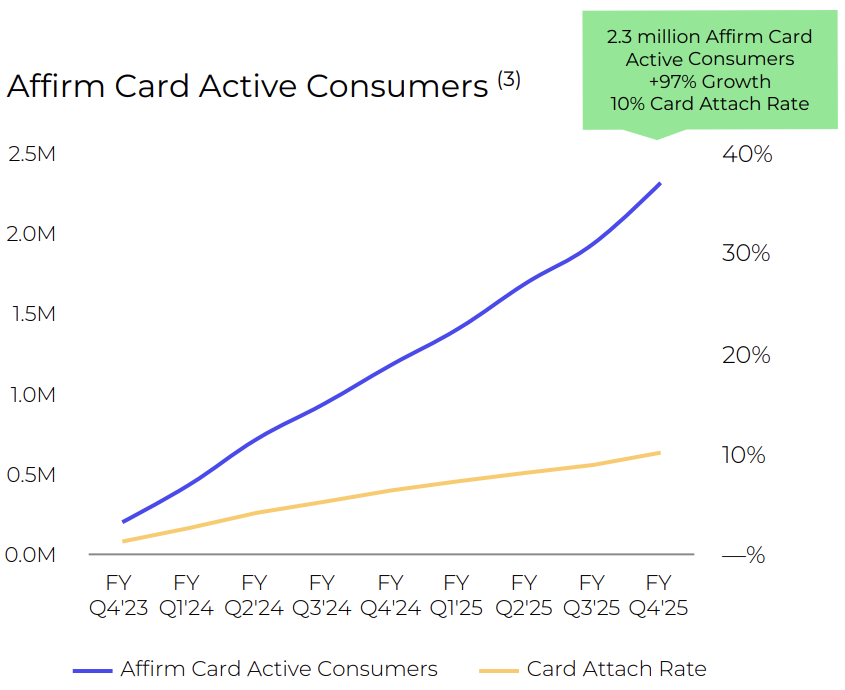

The product in focus is the Affirm Card, which has steadily grown over the past five years since its launch. It’s a debit card that lets users decide whether to pay upfront or make payments over time, all managed through the Affirm app.

In the recent earnings, Affirm card GMV more than doubled, up 132% to $1.2 billion. Active cardholders nearly doubled, reaching 2.3 million, and in-store spend increased by 187%. These are beyond just signs of adoption; more like Affirm turning its card into a core payments habit. With early AdaptAI deployments driving an average 5% increase in GMV for adopting merchants, you get a picture of the fintech doing more than selling installments. Affirm is moving into an infrastructure that merchants, especially SMBs, can build on.

…