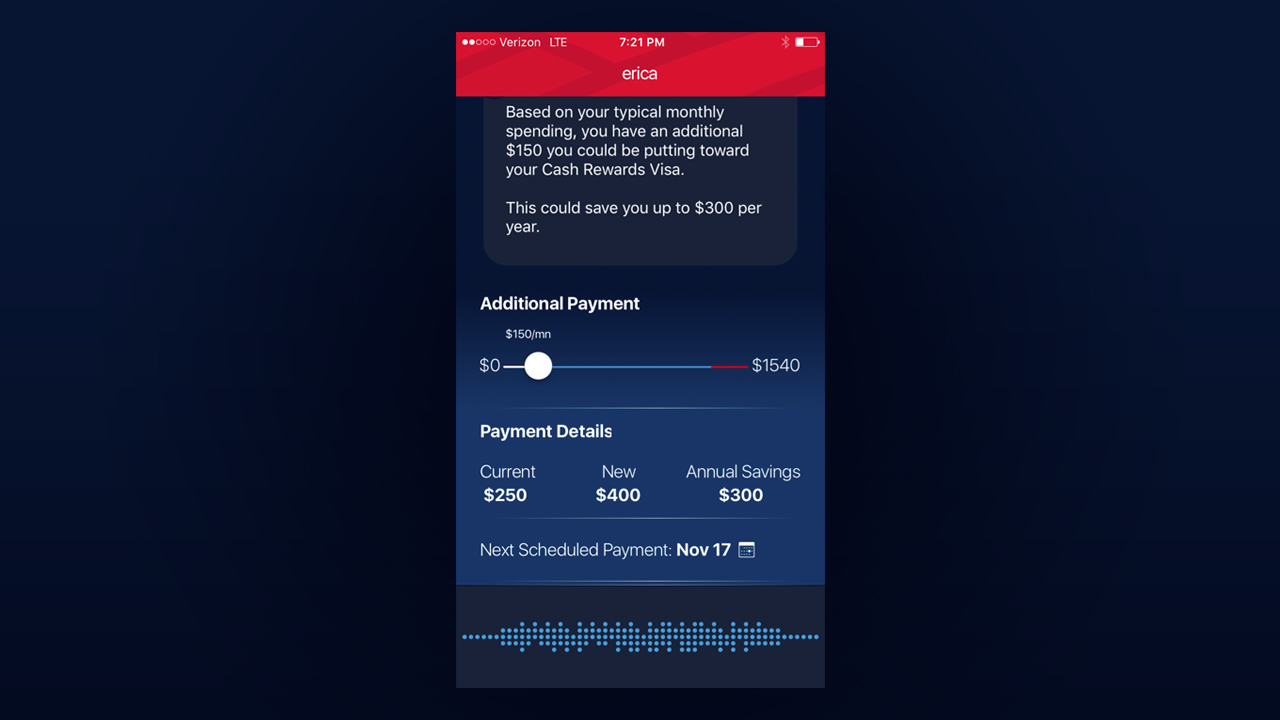

Inside the development of Erica, Bank of America’s AI-powered bot

Inside Bank of America’s mobile-financing strategy for small businesses

What war on cash? ATMs are the distributed bank of the future

Accountingtech firm Expensify launches AI-powered personal assistant

Bank of America keeps it simple addressing customer needs

The top five most popular fintech baby names

Prison payments: An old system incarcerating financial choice

5 trends we’re watching this week

[alert type=yellow ]Every week at Tradestreaming, we’re tracking and analyzing the top trends impacting the finance industry. The following is a list of important things going on we think are worth paying attention to. For more in depth trendfollowing, subscribe to Tradestreaming’s newsletter .[/alert]

- More banks sign up for SWIFT nascent payment tech initiative (PYMNTS)

- DTCC wants to coordinate industry activity on distributed ledger tech (Finextra)

- Why bank fintech accelerators are destined to die (American Banker)

- Is VC the right money for fintech? (TechCrunch)

- What Bank of America’s race to cardless ATMs says about the future of banking (Tradestreaming)

What Bank of America’s race to cardless ATMs says about the future of banking

It started on Monday when JPMorgan Chase announced it would be introducing card-free ATMs this year. The first generation of these new ATMs, according to a bank spokesperson, will give customers the ability to access the machine via an access code found on their Chase mobile app.

Not to be outdone, Bank of America countered today that they, too, would be rolling out a series of new ATMs that enable clients of the bank to use their phones to withdraw cash or complete other tasks using their cellphones instead of their bank cards.

The bank, according to CNBC, acknowledged the initiative to introduce cardless ATMs in the US with an initial pilot program in Northern California and a few other big cities with a broader launch expected for later in 2016.

War on cash? ATM growth and usage

For the most part, this is part of larger upgrade cycle underway at most banks around the world. With the exception of China, which according to the Global ATM Market and Forecasts to 2020, grew its domestic ATM footprint by 18% in 2016, most mature economies are seeing flat growth to contraction in their number of ATMs.

But the growth of ATM machines is just part of the picture — while the number of machines may be stabilizing, they’re being used more frequently. ATM usage is seeing a pickup as global ATM cash withdrawal volumes grew by 7% in 2014 with a total of 92 billion withdrawals made. By most measures, with all the talk of bitcoin, blockchain, and other cryptocurrencies, demand for cash is ostensibly strong and in fact, growing.

That’s a far cry from the commentary coming out of Davos as world and business leaders converged on the city situated in the Swiss Alps to talk about the future. Deutsche Bank CEO, John Cryan forecasted the demise of cash by the end of this decade. “Cash I think in ten years time probably won’t (exist). There is no need for it, it is terribly inefficient and expensive,” he said in a group dedicated to discussing fintech.

Banks of the (near) future

The introduction of new ATM technologies at Bank of America and Chase appears to come at the expense of physical branches. Bank of America is on an ATM upgrade cycle as it pares back its own brick-and-mortar locations. Bank of America grew its ATM network by 1% in 2015 to 16038 while its retail locations were scaled back 2.65% to under 4800 in the same time period. Smarter ATMs with more consumer-focused technology enable banks to deliver high quality service with fewer in-person tellers. Indeed, Chase now does more transactions each month via ATMs than with tellers.

Growth in the ATM business is happening amidst the background of an industry merger of two of the largest players in the ATM industry. Diebold’s revenues are expected to just about double after it closes the transaction to acquire its German competitor, Wincor Nixdorf. The deal is valued at $2 billion and is the largest in Diebold’s 156-year history. But the acquisition is more than just about creating a global war chest, according to Diebold’s CEO, Andy Mattes. He explained to Fortune that the new ATMs his company is developing are no longer “cash and dash” machines. Instead, they’re able to “connect the physical worlds of cash with the digital worlds of cash”. ATMs, like the kinds that Chase and Bank America are rolling out, are able to conduct 90% of the jobs traditionally done by tellers.

That resonates well with banks’ younger clientele who are digital natives and comfortable using their smartphones for most financial transactions. And surprisingly, of all demographic groups in the US, millennials actually have the highest usage of cash. So, while the future may or may not be cashless, the present is definitely cardless.

Photo credit: pennuja via Visualhunt.com / CC BY