Uncategorized

Bank of America keeps it simple addressing customer needs

- Thong Nguyen leads the bank's retail operations.

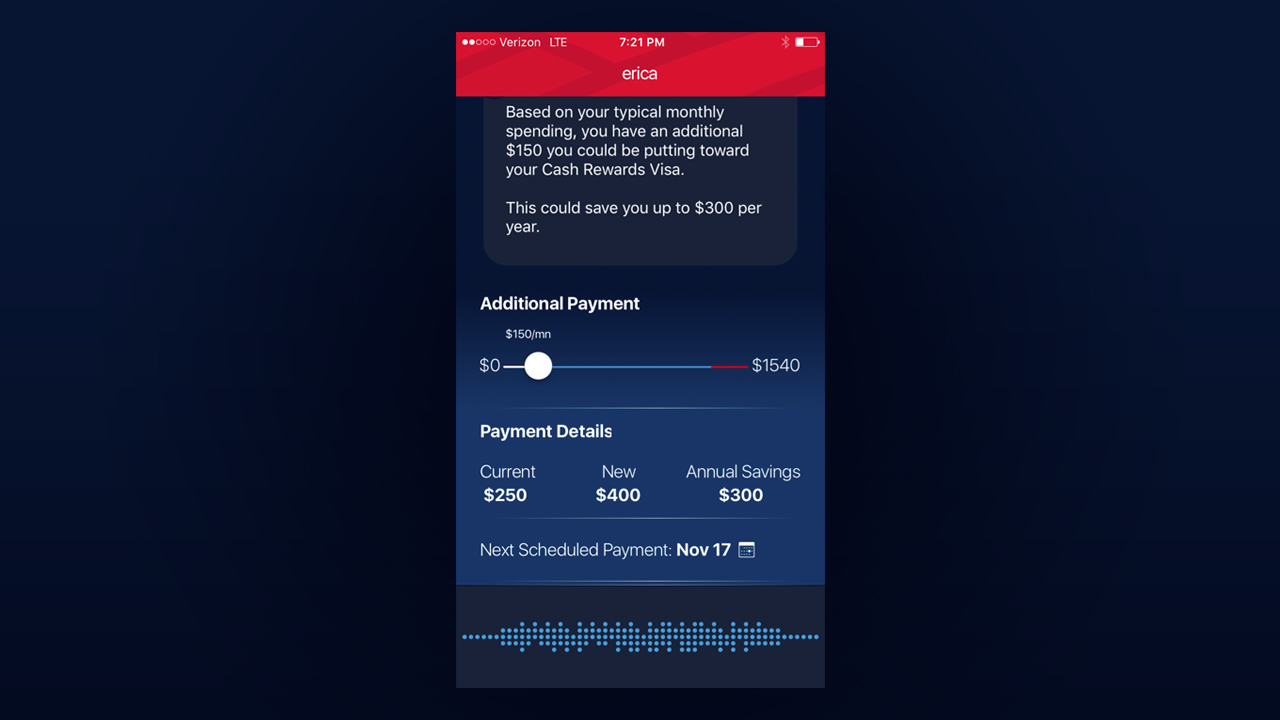

- Bank of America has recently launched a chat bot and roboadvisor.