Member Exclusive, New banks

What Google’s foray into banking means for incumbent and challenger banks

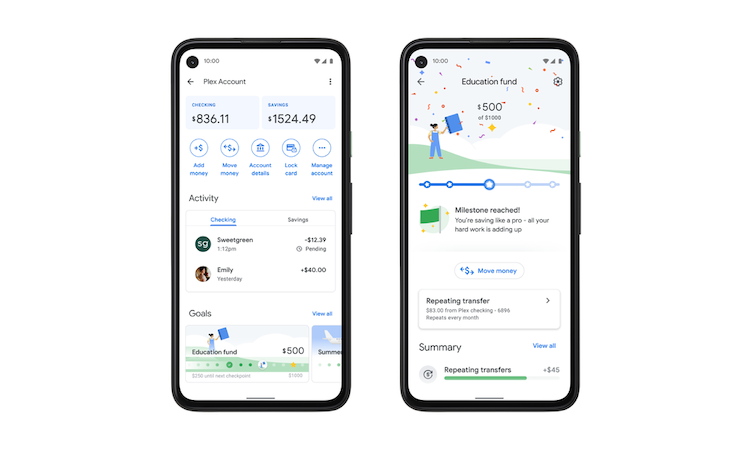

- Plex accounts by Google Pay are a bold example of big tech’s foray into banking.

- Big tech finance players are threatening challenger banks.