It’s time to un-bland your financial brand: Why 2024 is the year to escape the sea of sameness

- It's getting increasingly harder for a financial brand to stand out from the crowd in a sea of sameness.

- Chip Walker, from transformation and creative agency StrawberryFrog, demonstrates how some of the most valuable financial brands in the world have rallied around and activated their brand purpose.

By Chip Walker, from New York-based StrawberryFrog, the creative agency that has collaborated with the world’s foremost banks and fintech brands to craft captivating narratives and purpose strategies.

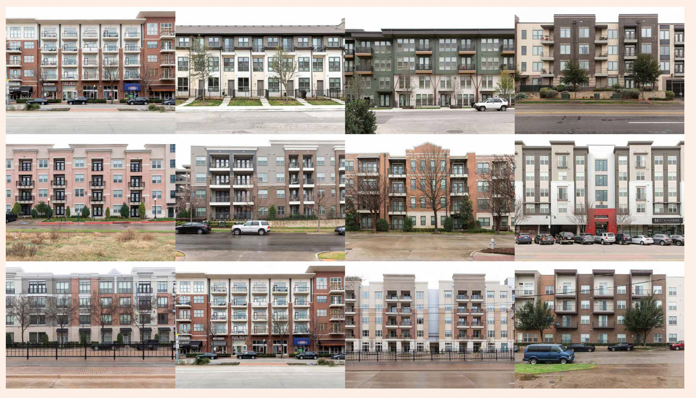

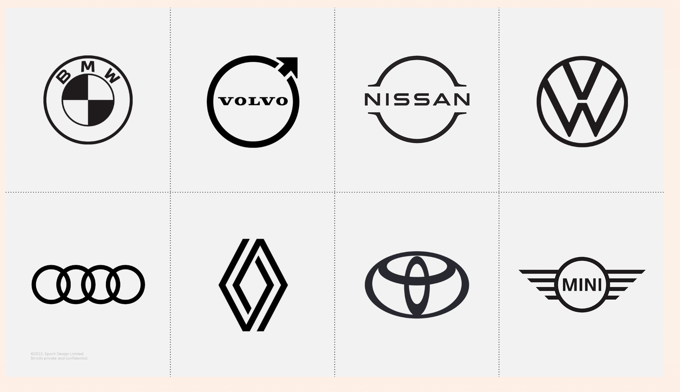

It’s an undeniable cultural truth in 2024: everything is starting to look like everything else. It’s been called “The age of average” in a well-read blog post by Adam Murrell, which cites examples of interiors, architecture, cars, people, media, and brands starting to look the same. Contagious Magazine calls this phenomenon “Distinction Rebellion,” as more and more brands draft away from distinctiveness and towards conformity. Fast Company has referred to as this trend as “blanding” with brands all seeming to follow the same paint-by-numbers approach of a made up word name, a sans serif type-face and the right amount of white space.

In category after category, we see marketing among competitors that is essentially a sea of sameness, and banking and financial services are prime examples. Banks are heavily regulated and real product and service differences are few. Much of bank marketing employs the same familiar messaging themes (e.g., empowerment, progress,) uses the same situations and problems (retirement, buying a home, starting a business), and the same functional benefits (e.g., convenience.) If I showed you advertisements for major financial brands without the logos, you would likely be hard pressed to identify which ad is for which brand.

Some have argued that this growing sameness isn’t a big problem because, in many cases, it’s sameness at a higher quality level. Cars look alike because all manufacturers test them in the same type of wind-tunnels that make them more aero-dynamic. Logos look alike because we’ve learned what makes things more legible in a multi-screen world. Ads all look alike because all the competitors do the same extensive consumer testing to determine what consumers really want. But I will argue that ultimately, growing sameness is not only a problem, it is potentially deadly to your brand’s health.

I say that because the most significant independent study of what drives brand financial performance, WPP’s BrandAsset Valuator, has repeatedly concluded that the single biggest driver of brand financial return is perceived differentiation. Powerful brands like Apple, Nike and Las Vegas are perceived as highly differentiated, whereas lackluster brands like Greyhound and K-Mart are not, with the financials to match. Humans are simply hard wired to notice differences, and the most successful brands take advantage of that.

Unfortunately, that’s not the initial approach most senior leaders at financial brands take when faced with the banking category sea of sameness. Instead, the tendency is to try and find small leverageable ‘points of difference’ vs competitors and amplify those. Our checking account has X, our mobile app has y, and our online banking has Z. But as Harvard Business School Professor Sung Myung Moon writes in her brilliant book “Different: Escaping the Competitive Herd,” this strategy often has the opposite effect of what was intended. When each competitor in a category is hawking minor product differences, consumers struggle to tell them apart, and at some point, they all blend together. Think for example about the last time you went to the toothpaste aisle in the drugstore. Ironically, trying harder to be different based on minor product differences can make your brand seem more like competitors than different from them.

At StrawberryFrog, our proven approach to escaping the sea of sameness is to frame your brand in a fundamentally different way. It’s an approach we call “Movement ThinkingTM,” and it is based on the underlying principles of successful societal movements. All movements, from #MeToo to the Women’s Movement, start with dissatisfaction and a change that adherents want to see in the world. Therefore, when we advise brands, rather than start with functional differentiators, we start with culture and some dissatisfaction that both the brand and its audience share. Based on that dissatisfaction, we define what the brand is AGAINST in the world – its cultural nemesis – and what it is FOR in the world, the stand it and its followers will take to bring about positive change.

An example of this situation is StrawberryFrog’s client, Northwell Health, the largest hospital system in the greater New York City area. When Northwell came to us, the brand was the category leader but not perceived as such. It was blending into the woodwork of category marketing clutter, one in which major competitors were all hawking things US news ranking, similar high-tech equipment, and similar patient success stories. Our solution: positioning the brand in culture, not the hospital category. Specifically, we played into the dissatisfaction greater NYC consumers had with the quality and accessibility of healthcare. We created a movement call “Raise Health” that is against quality healthcare for the few, and for quality healthcare for all. “Raise Health” has come to life in marketing campaigns for societal issues that New Yorkers care about, like better women’s healthcare and for gun-violence prevention. The result is that now Northwell is squarely perceived not only as a category leader, but as standing for something truly different.

Another good example of Movement Thinking is for professional services firm Crowe LLP, which competes against the likes of Accenture, Deloitte, EY and PWC. There is no way Crowe could get much competitive leverage against these giants, who outspend them ten to one, by following a traditional marketing playbook. To help Crowe escape the competitive herd, we once again turned to positioning the firm in culture rather than the category. And the culture nemesis that is threatening all of Crowe’s C-Suite targeting audience is growing marketplace volatility – and the uncertainty and doubt that come with it. We created the “Embrace Volatility” movement for Crowe, which positions the firm as the C-Suite’s ally in viewing volatility not as a threat but an opportunity for positive change and growth. As a result, Crowe has broken through category clutter and is seeing significant improvements in its brand differentiation.

We’ve found that the biggest barrier to senior leaders breaking from category norms is actually bravery. It takes courage and cojones to flee from the pack and do something that may raise eye-brows because it is unfamiliar and untried. Are you ready? Ask yourself these 3 questions:

- Is your brand genuinely differentiated vs. competition?

- Does your brand regularly break through the clutter to get on people’s radar?

- Is your brand’s marketing distinctive rather than derivative?

If you can’t answer yes to all three definitively, there’s a good chance you’re floating in the sea of sameness. The good news is that, as I’ve outlined above, Movement Thinking is a proven way out of this sea. We’ve found that it not only lets brands escape the competitive herd to compete in culture, it rallies a community of like-minded kin who see that brand as trying to do something not only positive but fundamentally different. So here’s to a more difference – and less sameness – in 2024 and beyond.