Modern Marketing

Inside robo-adviser Wealthsimple’s content strategy

- Canada-based robo-adviser Wealthsimple uses an online magazine to grow its reach among customers

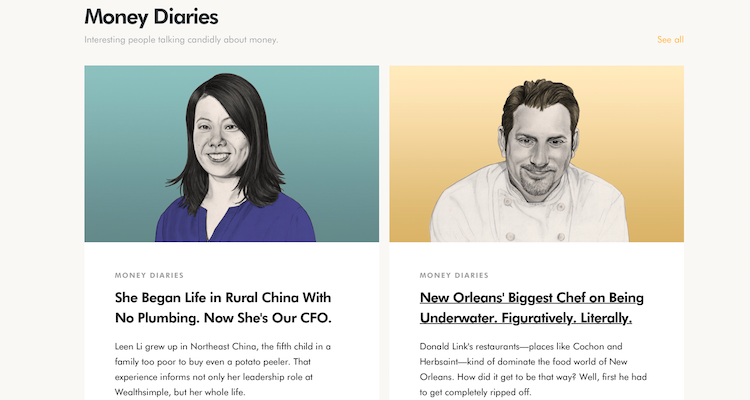

- Wealthsimple's focus on engaging content with powerful visuals adds consistency and credibility for the brand