Modern Marketing

How CIT is using videos to reach the small-business loan market

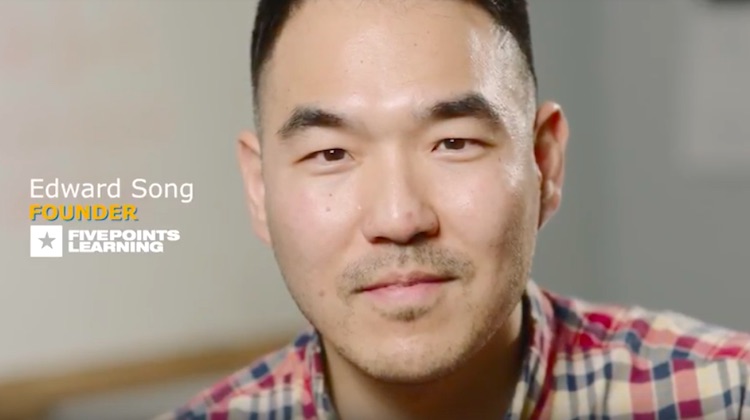

- CIT, in partnership with Operation Hope, launched a series of video mini-profiles of business owners to chronicle the human side of running a business

- The videos present the image of the bank as a trusted adviser -- an important relationship-building consideration on the minds of business owners