Modern Marketing

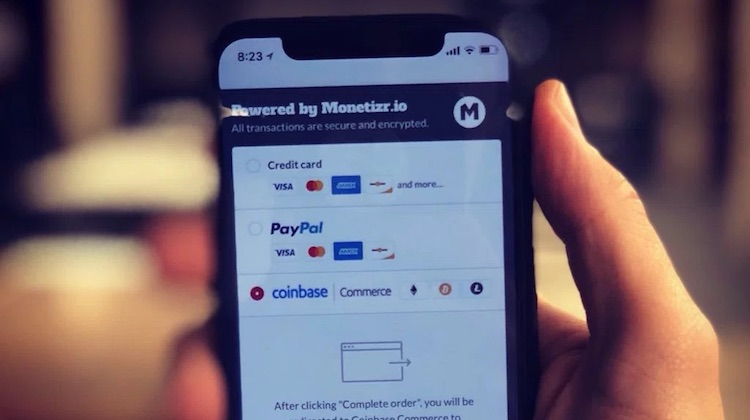

Gaming companies are using crypto to attract new customers

- Incentives for customers to adopt digital payments are more about marketing than meaningfully driving adoption

- Without a compelling reason, customers are unlikely to change their payment behavior