Banking

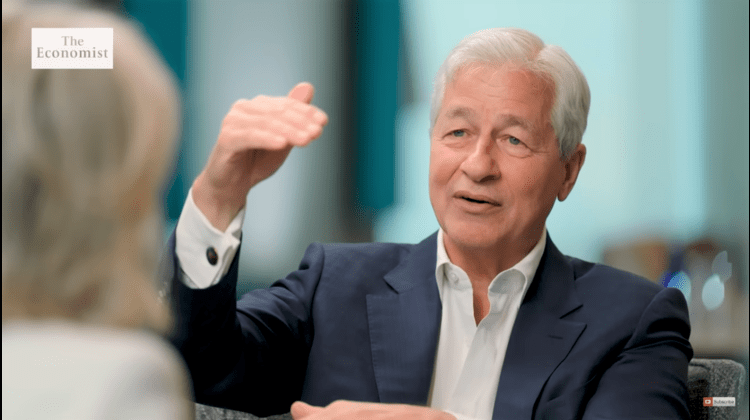

Is working from home the future? Label me a skeptic, says Jamie Dimon

- Jamie Dimon isn't all talk and no action when it comes to him being at odds with the remote working culture in the banking industry.

- Dimon’s fresh words and a recap of his persistent aversion to the WFH ideation reflect that the era of hybrid work is finally over for executives at the Wall Street bank.