I’m continuing to time shift my consumption of audio: instead of listening to the radio in the car/work, I download a week’s worth of investing/finance/business podcasts on Sunday for my listening and learning. I load up iTunes or other podcast apps I use, and have a listening library of great financial content for the whole week.

Here are a few of the best investing podcasts that I find I continue to download and listen to:

Personal Finance (tips on spending, managing money, saving)

Open Account (SuChin Pak): Umpqua Bank’s podcast is brought to life by SuChin Pak, an engaging thoughtful host. Listeners step inside Pak’s own relationship with money as she interviews people thrilled, confused, and stressed out about money.

Money, Markets, and More (Marketwatch): MM&M looks at the intersection of money, investing, and consumer behavior. What are people doing with their money? Lively consumer tips and personal finance insights from MarketWatch reporters. This podcast took a hiatus earlier in the year and is now back in full-force. Part behavioral finance, part Smart Money.

Money for the Rest of Us (J. David Stein): David Stein is the former Chief Investment Strategist and Chief Portfolio Strategist at Fund Evaluation Group, LLC. Through stories, analogies and easy to understand examples, David gives individuals the tools and confidence they need to navigate an increasingly complex and unpredictable investing landscape.

Radical Personal Finance (Joshua Sheats): Joshua’s podcast is an enjoyable and educational romp through investing and personal finance. I love how much David shares about his own process — very easy to relate to and the topics he covers reflect that.

Investing

Value Investing (John Mihaljevic): If you enjoy value investing, this is a wonderful podcast by a wonderful host. You may know Mihaljevic from the great work he does on his blog, The Manual of Ideas. His value investing podcast fits in perfectly with interviews from great investors like Howard Marks, Mohnish Pabrai, James Montier, and a whole lot more.

The Meb Faber Show (Meb Faber): Bestselling author and investment fund manager, Meb Faber has some of the investment world’s top professionals join him on his podcast as he explores real market wisdom from some of the smartest minds in investing. Good balance between high level thinking and actionable, practical advice with an emphasis on smart beta, trend following, and value investing.

Taking Stock (Bloomberg’s Pimm Fox): Long time markets pundit, Pimm Fox does a good job analyzing breaking news, market movements and interviewing some of the smartest people in the asset management industry.

Investing Insights (Morningstar): Investment industry authority Morningstar’s podcast gives stock/fund/ETF picks and also bubbles up tips, analyzes breaking news, and interviews industry heavies. (VIDEO)

Wealthtrack (Consuleo Mack): Consuelo has one of the best program’s around, regularly interviewing top asset managers and thought leaders in the investment field. (also available in video)

Sound Investing (Paul Merriman): Named “Best Money Podcast” by Money Magazine in 2008, Sound Investing is hosted by best-selling author Paul Merriman. Good interviews with advisors, market analysis and debunkery.

Trading

The Trend Following Manifesto with Michael Covel (Michael Covel): The author of Trend Following is on a tear with great content, great interviews of some of investing’s greatest minds/investors.

General Interest (Markets, Money, Investing, Business)

Planet Money (NPR): The Planet Money podcast has really come into its own in the past couple of years. Great look at global economics, investing, and the people and institutions that are the cast and characters of the whole system.

McKinsey on Finance (McKinsey): More academic in nature, global consultancy McKinsey describes its cutting-edge research on finance, investing, economics and corporate finance.

Marketplace Money (American Public Radio): Billed as “the money show for the rest of us”, this weekly program is entertaining even for investment professionals. Looks at local/international stories and helps make sense of those events.

J.P. Morgan Insights (J.P. Morgan): Leverages the investment banks research to help make sense of markets, industries, and investing trends.

Options Action (CNBC): I’m not an options guy but I find this program enjoyable for the ideas, explanations, and applications of option theory. (Video)

Technical Analysis Podcast (Dorsey Wright): Dorsey, Wright is one of the most respected technical analysis shops and this podcast explores their research, markets, industries and asset classes.

This Week in Barron’s (Barron’s): Highlights top articles in the current edition of Barron’s magazine

Don’t forget to subscribe and listen to Tradestreaming’s own podcast, Tradestreaming Radio.

Have your own suggestions — what investment/finance/business themed podcasts do you enjoy listening to?

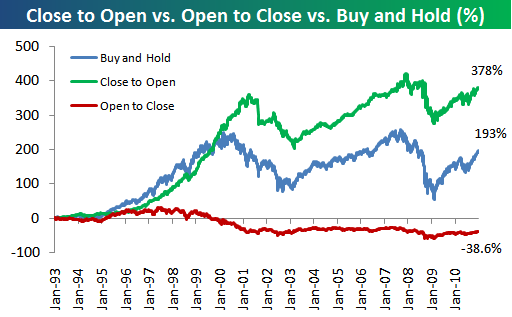

overlayed on top of stock index charts. GDT

overlayed on top of stock index charts. GDT