Surging profits: A closer look at JPMorgan Chase and Wells Fargo’s performances in Q2 2023

Wise reports FY2023 earnings: 3 questions with Matt Briers, CFO at Wise

A thorough investigation of Goldman Sachs’ involvement with SVB is well under way

From bearish to bullish: Big banks’ concerns might be getting bigger but they are starting to see a light at the end of the tunnel

Growing the high-yield game: Robinhood crosses $10 billion in total deposits

The debt ceiling deal may have saved the US from defaulting on its debt, but where does this leave the stock market?

Invest in franchises — with ApplePie Capital’s Denise Thomas

Don’t know about you, but owning or investing in a franchise business has always captivated me. Something about local ownership, the brand, a business in a box. But minimum investments were typically too high and who really wants to run a small restaurant or bagel place?

ApplePie Capital enables individual investors to build diversified portfolios by investing in franchise debt. Co-founder and CEO, Denise Thomas joins me, your Tradestreaming Podcast host, Zack Miller, to talk about this interesting “asset class” and how to invest in a portfolio of top franchises using ApplePie Capital’s crowdfunding platform.

Listen to the FULL episode

About Denise

Denise Thomas is the co-founder and CEO of ApplePie Capital. She has more than 20 years of executive leadership experience in business and market strategy development.

Denise Thomas is the co-founder and CEO of ApplePie Capital. She has more than 20 years of executive leadership experience in business and market strategy development.

Resources Mentioned In The Podcast

- ApplePie Capital (Denise’s company)

- FRANdata (a research company Denise mentioned during the podcast that has the largest library of Franchise Disclosure Documents — yearly reports about franchise businesses that she recommends as a get-smart resource for people interested in investing in franchise businesses)

Even More Resources

Getting financial information in the margins — with Akash Kapur

I don’t know about you but some of the most heated investing discussions happen after a company (say, like, Apple) announces earnings. Investors pore over earnings filings in pursuit for valuable information to support — or refute — an investment thesis.

You’re going to want to check out Two Margins, a new site that allows investors to annotate and share content around regulatory filings. It’s like an editorial and opinion layer on top of these really valuable documents. I’m joined by TwoMargins’ Akash Kapur this week on the Tradestreaming Podcast to talk about how investors are finding value in sharing their own opinion on regulatory docs.

Listen to the FULL episode

Resources mentioned in the podcast

Even more resources

The Ultimate Stock Market Investor’s Guide To Investing In Startups

I published this recently on OurCrowd’s blog and thought Tradestreaming readers would appreciate reading it here, too.

::::::::::::::::::::::::::::::::::::::::::::::::::::

Most investors ‘come of age’ learning the mechanics and strategy of investing through their involvement in stock markets. That makes sense: stock markets are typically comprised of the largest and most stable companies within a geography, with enough interest that investors can relatively easily buy and sell shares. Individual shares and mutual funds populate many long-terms investors’ retirement portfolios. And it’s the stock market, we’ve always been told, that deserves investors’ dollars and attention.

But as new technology enables investing in newer, different types of assets, stock market investors are beginning to look beyond just investing in the stock market and more towards investing in alternative assets: like real estate, commodities, and more often, startups.

But as new technology enables investing in newer, different types of assets, stock market investors are beginning to look beyond just investing in the stock market and more towards investing in alternative assets: like real estate, commodities, and more often, startups.

For the sake of this article, we’re going to focus on investing in small, growth-oriented private companies (startups). Small companies are the lifeblood of the US economy, driving growth and providing new jobs to the workforce. It’s the allure of large, outsized returns by investing in the next Google, Facebook and Apple that is captivating investors right now.

How stock market investors evolve to angel investors

So, how’s a stock market investor to invest in startups? How do stock market investors transition successfully to becoming an angel investors?

While there are shared commonalities between investing in startups and investing in stocks, there are certain nuances that can make the difference between generating market-beating returns or suffering disappointing losses.

Here’s how investors with experience in stock markets should best think about investing in startups:

Diversification

Diversification is a key concept in investing and whether you’re a stock market investor or angel investor, diversification is going to impact your investing results. At a high level, diversification is the only free ride we have as investors: by not putting all our eggs in one basket, we not only lower the risk in our portfolio – we actually improve our performance. This is backed up by some (pretty intense) math as part of the Modern Portfolio Theory.

Diversification is a key concept in investing and whether you’re a stock market investor or angel investor, diversification is going to impact your investing results. At a high level, diversification is the only free ride we have as investors: by not putting all our eggs in one basket, we not only lower the risk in our portfolio – we actually improve our performance. This is backed up by some (pretty intense) math as part of the Modern Portfolio Theory.

For investors putting money into the stock markets, the prevailing rule of thumb is that a properly-diversified portfolio contains 15-20 securities spread across different industries (which perform differently in various economic environments). The idea is that by putting your money into different investments, some will perform well, while others struggle, lowering an investor’s exposure to general market risk and increasing returns in the process. Of course, too much of a good thing can go the opposite way; there is a point where an investor can be over-diversified.

Angel investors also have to deal with risk. But for angel investors, the issue is more acute. If 3 out of 4 startups fail, managing risk becomes paramount for someone investing in startups. As opposed to investing in publicly-traded securities which rarely flop, startups have a much higher attrition rate. Experienced angel investors understand the portfolio dynamics unique to this asset class: typically, a handful of their investments fail, a few have small returns, and just 1 or 2 have such large, out-sized returns that they pay for all the losses (and then some). The data show that to get those sexy returns that headlines boast of (2.5X over 4 years), you’re going to need to invest in at least 10-15 startups. Returns continue to improve with angel portfolios of up to 50 investments. We call this the portfolio approach to investing in startups.

Angel investors also have to deal with risk. But for angel investors, the issue is more acute. If 3 out of 4 startups fail, managing risk becomes paramount for someone investing in startups. As opposed to investing in publicly-traded securities which rarely flop, startups have a much higher attrition rate. Experienced angel investors understand the portfolio dynamics unique to this asset class: typically, a handful of their investments fail, a few have small returns, and just 1 or 2 have such large, out-sized returns that they pay for all the losses (and then some). The data show that to get those sexy returns that headlines boast of (2.5X over 4 years), you’re going to need to invest in at least 10-15 startups. Returns continue to improve with angel portfolios of up to 50 investments. We call this the portfolio approach to investing in startups.

Follow-on rounds

Investors in the stock market have learned that one of the best ways to increase their returns over the long term is to consistently reinvest their dividends. That means, any cash that’s generated from an investment should get ploughed back into the company, increasing ownership over time by taking advantage of any fluctuations in stock prices. The research proves that dividend reinvestment really works to build wealth: From 1988 to July 2013, $10,000 invested in the S&P 500 would have grown to $68,200. But reinvesting dividends would have almost doubled that return, jumping to $120,600. That’s improving returns 2X as much by merely reinvesting.

The story is a bit different with startup investing. Just because you find a hot tech company in which to invest $10,000 doesn’t mean you’re done tapping into your wallet. Startups typically need to raise more money in the future (called follow-on rounds). Early investors typically get the opportunity to re-invest in their portfolio companies along the way to exit. Meaning, when companies need to raise future rounds of capital, you should have the opportunity to invest again (hopefully, if things are going right, at a higher valuation). If you don’t exercise your right to reinvest, you run the risk of getting massively diluted as your portfolio companies raise larger rounds in the future.

To invest profitably in startups, it’s important to understand the entire lifecycle of an investment in a startup. Take a look at the following Slideshare we created to address the entire lifecycle of startup investing:

An angel investor sits in a good position: you get to invest early, while later on gaining access to ensure your equity stake doesn’t get diluted as valuations go up. As 500Startups’ famed investor, Dave McClure, counsels angel investors simply: Invest in a company BEFORE it achieves product/market fit and then double-down AFTER through follow-on rounds. As an angel investor, definitely keep some money as dry powder to continue to invest in the best-performing companies in your portfolio as they conduct follow-on rounds of funding.

Liquidity constraints

Most of the time, in a major market, stock market investors don’t think too much about liquidity. If you’re buying Apple ($AAPL) or Google ($GOOG) stock, you click a button, and boom! The stock automatically appears in your portfolio. The transaction is nearly instantaneous and the price an investor pays is pretty much the price the seller of the stock receives. The same dynamic mostly holds true whether you’re buying a large cap stock, exchange-traded fund or mutual fund (which price at the end of every day). Liquidity is not a thought that most stock market investors are concerned with while transacting in common instruments.

Most of the time, in a major market, stock market investors don’t think too much about liquidity. If you’re buying Apple ($AAPL) or Google ($GOOG) stock, you click a button, and boom! The stock automatically appears in your portfolio. The transaction is nearly instantaneous and the price an investor pays is pretty much the price the seller of the stock receives. The same dynamic mostly holds true whether you’re buying a large cap stock, exchange-traded fund or mutual fund (which price at the end of every day). Liquidity is not a thought that most stock market investors are concerned with while transacting in common instruments.

That’s definitely not the case if you’re transacting in a small-cap company with little daily trading volume. The Bid and Ask price — basically, the price the buyer is willing to pay for a stock and the price at which a seller is willing to sell — can be significantly different. More than that, a single investor transacting in an illiquid stock can severely impact the price level by trying to buy or sell just a small amount of stock. This lack of liquidity has to be taken into account when making an investment in an illiquid investment or while considering when to exit one.

Private companies, like startups, can be one of the most illiquid types of investments an investor makes. There isn’t really a market for shares in small startups and that means when an angel investor makes an initial investment, his or her holding period really is forever. Even purchases are a bit more complicated than just clicking a button — there is more paperwork and contractual agreements that go into investing in a private company. And unless that company gets bought, IPOs, or goes bust, the investor is most likely going to hold the investment forever. So, David Cummings’ advice is sound:

“The next time you think about making an angel investment, remember the lack of liquidity challenge and make sure that the money isn’t needed for a long, long period of time.”

Time frame

Stock market investors have been trained to think about their portfolio and investment activities associated with time frames. The return profiles of different asset classes differ and what’s more, because of risk associated with some investments, the suggested time frame for each asset class diverges (professionals generally caution investors to hold riskier investments for longer time frames to get exposure to the real returns of the asset class).

It’s when we look at long term returns, we generally see a connection between liquidity and investor holding periods. For stock market investors, we’re used to discussing investment horizons over the short term (1-5 years), medium term (5-10 years) and long term (over 10 years). That said, the prevailing sentiment in the stock market is overwhelmingly short-term focused. That’s why we have 24/7 cable networks focused on the minutae of every market gyration. It’s a rare investor nowadays who mimics the Oracle of Omaha, Warren Buffett, who once claimed thathis favorite holding period was forever.

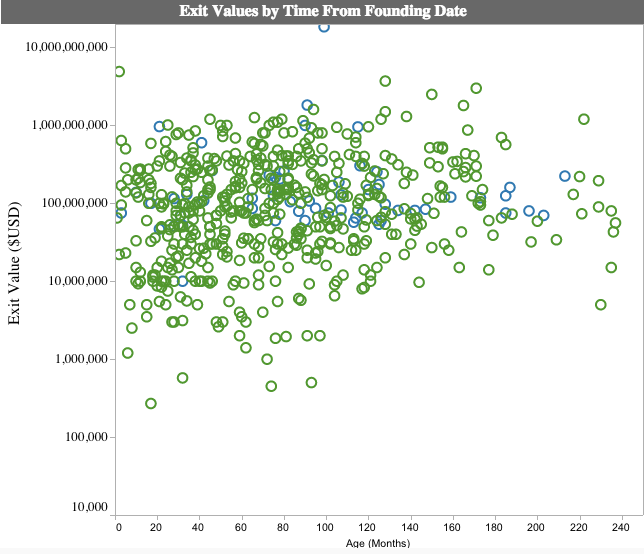

Liquidity and holding periods impact angel investing as well. Because there isn’t liquidity, investors have to be comfortable holding on to a startup investment until there’s an exit (IPO or M&A) or a failure. Companies that get acquired are typically 7 years old.

There’s something else at play when you look at the holding period for private investments. For professional venture capitalists, limited partner agreements are structured over 10 years, of which they spend the first 4 years deploying a hefty percentage of that capital. This 10-year structure means there are some interesting dynamics that impact both companies pitching VCs as well as the limited partners investing in VCs. If you look at individual angel investors, they’re not really in the business of raising funds and deploying them and rinsing/repeating. Angels are attached at the hip to their investments and it can take multiple years before angels reap the full returns on their successful companies.

Long term returns

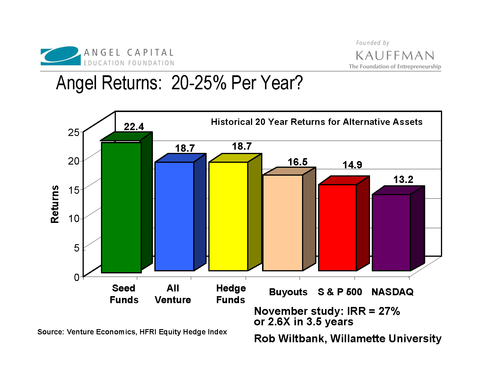

The long term success of the stock markets has been touted for years as a reason for people to park their retirement funds in the market. While we’re used to talking about the stock market’s long term returns as ranging between 11-13% (which doesn’t account for inflation), this focus misses the point: that many of the moving parts that make up the markets have seen really different returns over the long term. For example, small cap stocks typically see more volatility and over the long term are expected to perform better than larger companies that are more stable and have less steep growth trajectories. Domestic U.S. stocks perform differently over time than do foreign stocks. The point here is that in a diversified portfolio, investors gain from the fact that different asset classes perform differently, lowering volatility and improving returns over the long run.

When you look at startups, performance is interesting. On the one hand, if you look at the chances that an individual investment will be a successful, it’s pretty bleak. In any ONE investment, an angel is more likely than not to lose their money. But, here’s where portfolio management comes in: by having a diversified portfolio of multiple startup investments (10-15), angel investors average a 2.5X return over 4 years(source).

So, while investors should diligence each opportunity as though it’s the only investment their making, the real returns come from having a long term, diversified portfolio.

Ability to add value

Stock market investing is pretty passive. Outside of hyperactive day traders, real investing is a dispassionate activity and shouldn’t actually take that long to determine what to invest in. Once a portfolio is built, prevailing wisdom is to periodically rebalance (quarterly or yearly). Other than that, there isn’t much more for a stock market investor to do to better his or her performance.

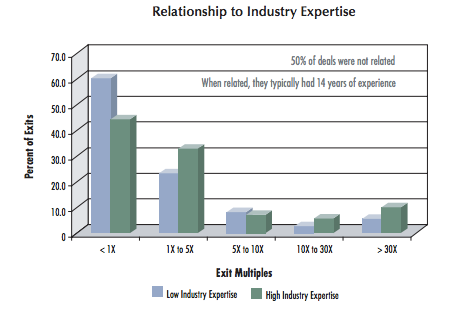

That definitely isn’t the case for angel investors. Startup investing is probably the only type of investing where investors have the opportunity to provide real value to their portfolio companies. Angel investors bring their rolodexes and their real-world experience to the private investments they make. It’s not only a common practice for early stage investors to assist their companies, the data show that it’s a profitable activity. The Kauffman Foundation’s research on angel investing shows that investor expertise has a material impact on earned returns. In fact, investment multiples were twice as high for investments in ventures connected to investors’ industry expertise.

That definitely isn’t the case for angel investors. Startup investing is probably the only type of investing where investors have the opportunity to provide real value to their portfolio companies. Angel investors bring their rolodexes and their real-world experience to the private investments they make. It’s not only a common practice for early stage investors to assist their companies, the data show that it’s a profitable activity. The Kauffman Foundation’s research on angel investing shows that investor expertise has a material impact on earned returns. In fact, investment multiples were twice as high for investments in ventures connected to investors’ industry expertise.

The need for quality deal flow

As a stock market investor, you can just boot up your computer, log in to your brokerage, and invest in pretty-much anything you want. There’s no centralized market for investing in startups (at least not yet — companies like OurCrowd and AngelList are helping to make this happen). To become a good angel investor, you’re going to need to get access to high quality deal flow. We wrote recently onhow top angel investors improve the quality of the deals they’re seeing. The more high quality investment opportunities that come across your desk, the better your chances of making the 2.5X return over 4 years, as the data show.

One clear way stock market investors can get quality deal flow is by signing up to equity crowdfunding platforms like the kind we’ve built at OurCrowd. We see over 100 deals in top startups from around the world – every month. Our diligence team stretches, pokes, and turns these opportunities inside-out until we find just a handful of investable startups that pass our investment criteria checklist. We provide access to accredited investors of all kinds (including investors with experience investing in the stock market) who want to choose their own investments from among a professionally-curated group of early stage investment opportunities.

One clear way stock market investors can get quality deal flow is by signing up to equity crowdfunding platforms like the kind we’ve built at OurCrowd. We see over 100 deals in top startups from around the world – every month. Our diligence team stretches, pokes, and turns these opportunities inside-out until we find just a handful of investable startups that pass our investment criteria checklist. We provide access to accredited investors of all kinds (including investors with experience investing in the stock market) who want to choose their own investments from among a professionally-curated group of early stage investment opportunities.

Making the change: Becoming an angel investor

Investing in startups can be extremely lucrative…if you know what you’re doing. Stock market investors may have a wealth of knowledge behind them about what makes for sound investing practice. The differences in stock market investing and angel investing are manageable enough that the transition should be smooth. Angel investing is learnable; there are plenty of entrepreneurs who built startups themselves, who have made the transition to investing in startups and are making a lot of money. To do it right, understand the differences to leverage your investing experience to apply it to this new asset class of private, startup companies