On the road to voice payments, Google and Amazon pull ahead of Apple

Hi 5! The top five fintech stories we’re following today

Apple Pay jumps into ecommerce

John Sculley on what banks have to learn from Kodak

4 charts about mobile payment growth, or the lack thereof

WTF are mobile wallets?

5 trends we’re watching this week

Bloomberg’s BusinessWeek app launches to mixed reviews

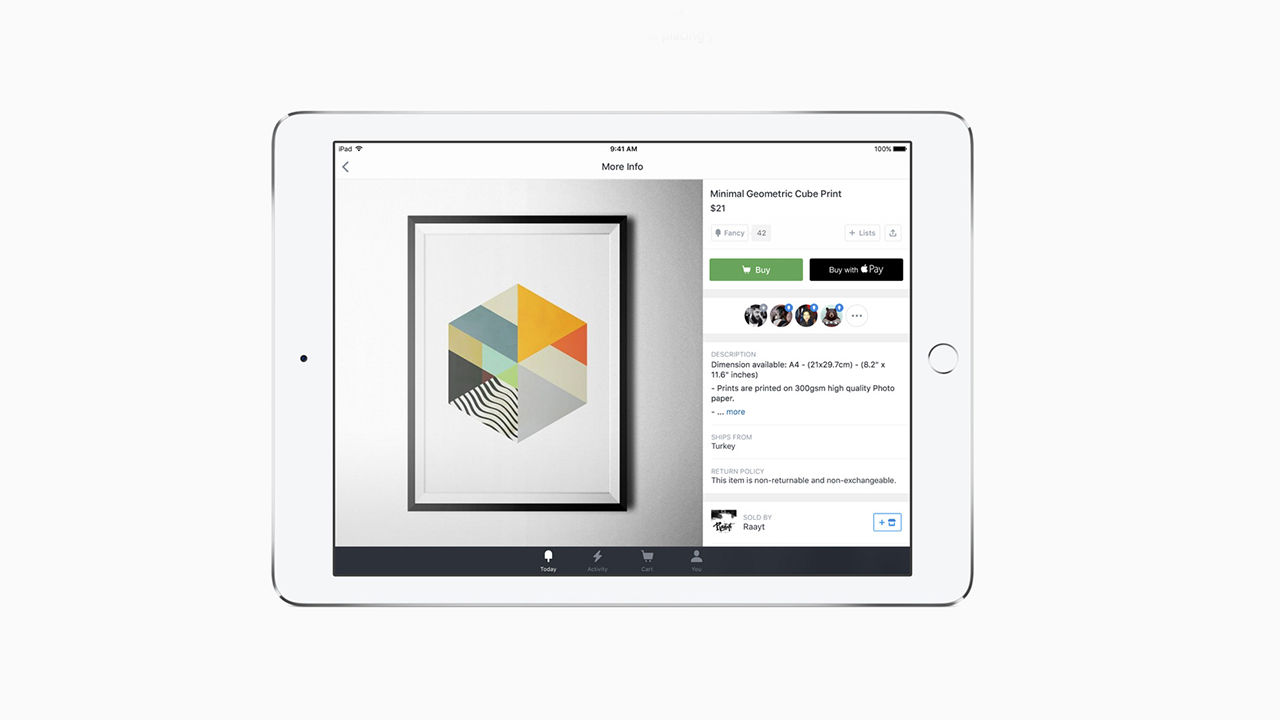

Bloomberg Businessweek announced the launch of a beta version of its new Businessweek iPad app, available as an iTunes subscription for $2.99/month.

Pro

Dan Frommer is a pretty glowing in his admiration of the app, actually impressed with Bloomberg Businessweek’s new iPad app.

Bigger picture: While you could say that weekly business magazines are already irrelevant in the Twitter era, Bloomberg is at least spending money on making good products. (That’s the beauty of having a cash-printing terminal business with which to fund Bloomberg TV, magazines, etc.)

Con

TechCrunch’s Erick Schonfield is underwhelmed, calling the app nothing more than a digital reproduction of the magazine.

But with the iPad app, I am not getting all of that. It is nothing more than a digital reproduction of the print magazine. The news changes only once a week. In a world where news changes every minute, that lag time is one legacy you don’t want to bring over from print. And Businessweek doesn’t have to either. It’s website changes every day, and there is no reason those articles shouldn’t show up in the iPad app. Even the search function in the app only works for iPad issues in your archives. It doesn’t return results from the website.

By making its iPad app less informative than its website, Bloomberg Businessweek is signaling to readers that if they want to stay up to date they will be better off simply going to the website, which is free. So Bloomberg Businessweek thinks readers will want to pay $2.99 a month for less information that is presented in a prettier format. What readers end up paying for, essentially, is the tablet experience and bigger fonts.

Bloomberg’s app for Businessweek joins a host of other magazines trying to recreate themselves in the age of social media, apps, and mobile devices. From the Financial Times to Elle to Popular Science, publishers are signing on to Apple’s subscription service (or intend to).