Tomorrow’s banking: The digital transformation of financial institutions

- For FIs, the vulnerability of both front- and back-end systems and processes was proven in the wake of the pandemic. But with these challenges comes unprecedented opportunities.

- In our latest whitepaper with Plaid, we break down how FIs are tackling the challenges of digital transformation and implementing the technologies driving it.

The wake of the pandemic brought about many challenges, like a rapidly increased reliance on digital solutions in the front, and closed branches, unprepared call centers, and overwhelmed lenders dealing with PPP loans in the back. More importantly, it presented financial institutions with a timely opportunity: a call for innovation.

According to a late 2020 IDC survey, only 20% of financial systems worldwide said they’d “recovered to a new normal” from the effects of COVID-19 on their internal systems. Yet the shift is here to stay.

In Plaid’s 2021 survey on fintech use, 88% of U.S. respondents said they use technology to manage their finances. This jumped from over half (58%) of respondents in 2020.

This new digital era is an opportunity for financial institutions to remain agile in the face of constant change. Fintechs, companies applying modern technology and user experiences to financial services, are filling gaps traditionally overlooked by financial institutions.

In Tearsheet and Plaid’s latest whitepaper, we explore:

- The opportunity presented by digital transformation

- Key challenges financial institutions face

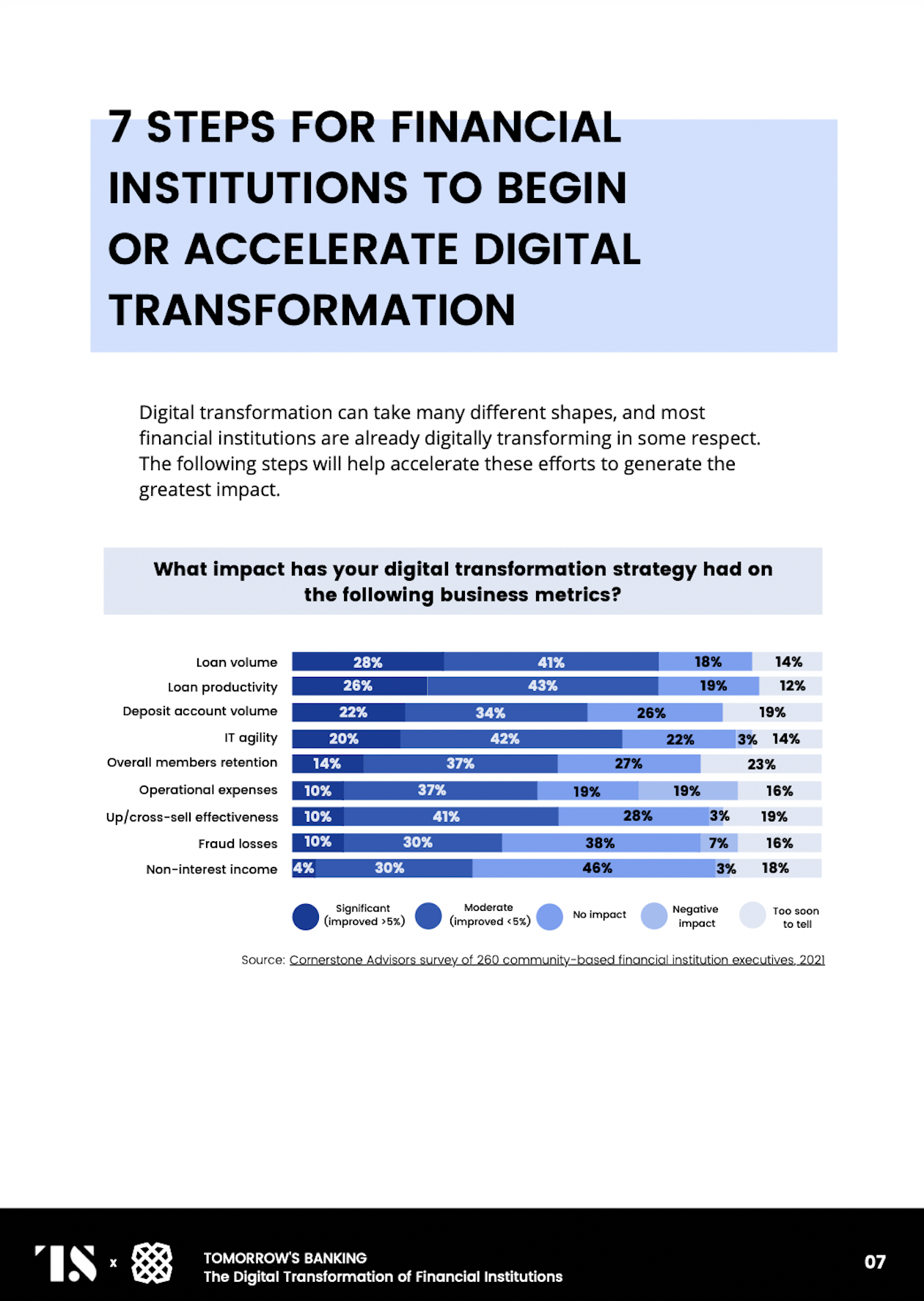

- A 7-step strategy to tackle those issues

- The technologies driving digital transformation into tomorrow

- Input from decision makers at Plaid, Chase, US Bank, and Goldman Sachs.

Read the full whitepaper here.