With chargeback volume set to hit 324 million in 2028, merchants and issuers need to find a way to protect their bottom line

- Factors like the increase in digital payments adoption are contributing to a rise in the global volume of chargebacks, and a significant chunk of this volume will reside in North America.

- Today's story gives an industry-wise breakdown on chargebacks, and a deep dive on what strategies merchants and issuers are currently using to combat chargebacks and where they can improve.

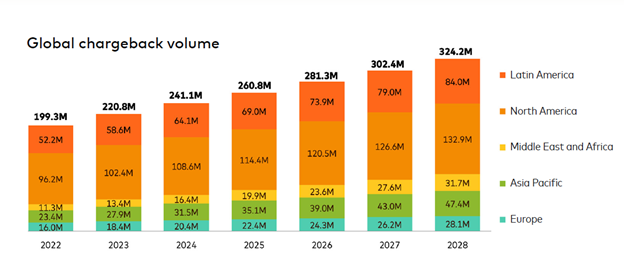

The ubiquity of digital payments is contributing to a surge in chargebacks. The global volume of chargebacks is expected to increase to 324 million in 2028, according to recent data from Datos Insights in partnership with Mastercard.

A significant chunk of the expected increase in chargebacks will occur in North America, with the expected volume of chargebacks reaching 132.9 million in 2028 from 114.4 million in 2025. By 2028, the total value of chargebacks is expected to increase to $41.69 billion, of which North America will be home to the biggest portion at $20.47 billion.

While the increased adoption of digital payments and the ability to submit disputes has helped build consumer trust, this rising tide of chargebacks has a direct impact on both merchants’ and issuers’ bottom lines.

How chargebacks are impacting business – a break down by industry

Not all merchants are experiencing the rise in chargebacks equally. In fact, merchants operating in the travel and hospitality industry report the highest average chargeback value at $120, with high-risk categories like gaming, gambling and cryptocurrency coming in second at $99.

One reason behind why travel is leading in chargebacks may be the proliferation of third-party travel booking websites and travel agents. Despite customers using these third parties to make reservations, they are not the first point of contact in case an issue comes up. Customers that dispute transactions based on a missed reservation or customer service problems often take up the matter directly with their issuer rather than seeking resolution through the third-party or the merchant directly.

How fraud complicates chargeback management

Added complexity arises with the possibility of fraud. When the amount is low enough, issuers and merchants often opt for write-offs rather than dedicating resources to handling the chargeback.

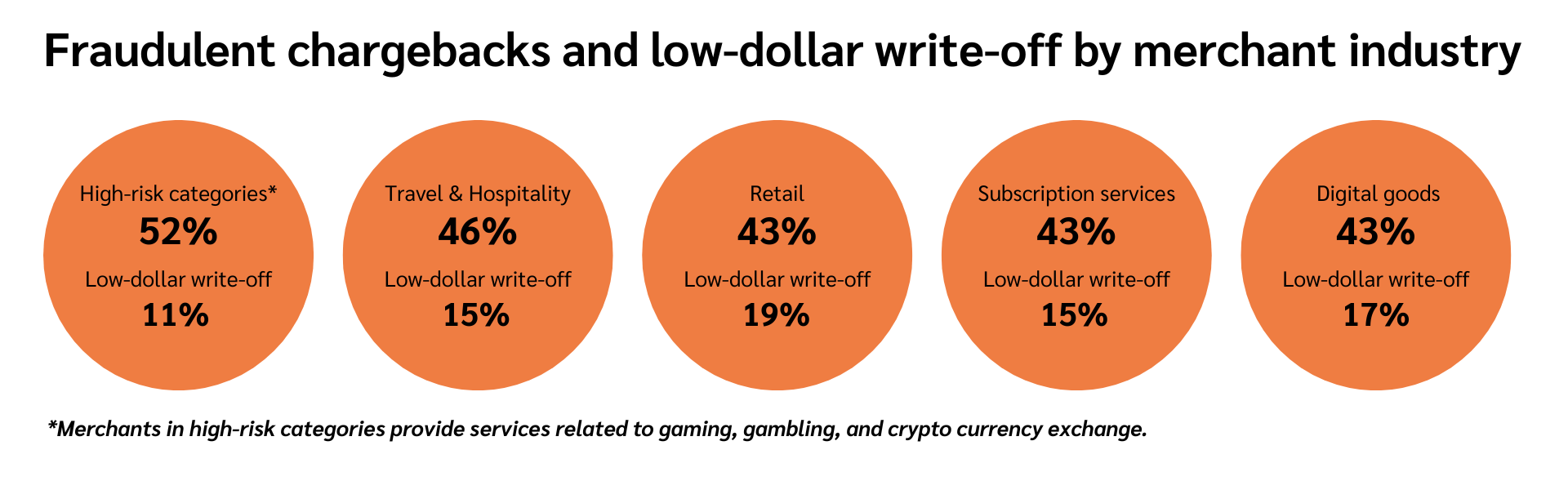

For merchants, fraudulent chargebacks, including first-party fraud and third-party fraud, account for 45% of chargeback volume globally.

Despite having a lower average chargeback value than merchants operating in the travel and hospitality industry, merchants in gaming, cryptocurrency and gambling experience a higher rate of fraudulent chargebacks at 52%, and 11% of these chargebacks are written off.

Due to the increase in customers’ ability to dispute a transaction through digital channels, as well as the emergence of bad actors intentionally misusing the dispute process, fraudulent chargebacks are increasingly having an impact on merchants’ and issuers profit margins.

How issuers and merchants manage chargebacks

The increase in chargeback volume also means that both issuers and merchants must dedicate an ever-increasing amount of resources to chargeback management, putting a further strain on their bottom line. Currently, financial institutions (FIs) in the U.S. employ on average more than 200 back-office staff for chargeback management, with one full-time employee dedicated to every $13k to $14k in annual incoming cardholder disputes.

These chargeback teams play an important role: the limited data gathering in chargeback disputes require FIs to research the case in more depth before it can be resolved. While countries like Brazil are turning customers towards digital channels to submit disputes, research shows that this leads to a 30% to 40% increase in dispute volumes.

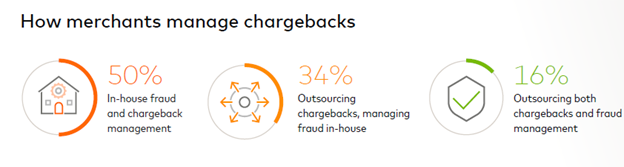

Merchants, on the other hand, are using both in-house and third-party channels to handle chargebacks. Mid-market companies are more likely to lean on outsourcing than large enterprises, which have bigger budgets to dedicate to in-house dispute management.

Regardless of size, all merchants are investing more heavily in technology that can help in handling the dispute process and chargeback management overall. Around 1 in 8 large enterprises report that their technology costs in the area have increased by more than 25%, and 15% of mid-market companies report cost increases of up to 24%.

How merchants and issuers can build effective chargeback management infrastructure

Merchants and issuers face a greater volume of chargebacks and an increase in management costs. Firms should turn towards prevention mechanisms, including AI-driven review processes, to cut down on the resource-intensiveness of chargeback management.

Strategies like real-time alerts from an FI can allow merchants to act swiftly to refund a customer’s order or cancel it altogether, preventing the dispute from escalating to a chargeback.

But issuers can help take this process even further: digital tools that can help customers identify their transaction more accurately, as well as subscription management tools embedded in the banking app, can empower customers to stay on top of their spend and not turn so quickly to disputes.

Technology is also making it possible for FIs to better identify fraudulent transactions, increasing the rate at which first-party fraud is identified and handled. As innovative digital payments continue to increase, these strategies can ensure that merchants and issuers are not dedicating an inordinate amount of resources to chargeback management, without compromising product delivery and customer experience.

To get a deeper breakdown of how chargebacks are impacting merchants and issuers around the globe and what strategies these firms are using to safeguard their bottom lines, download this report from Mastercard.