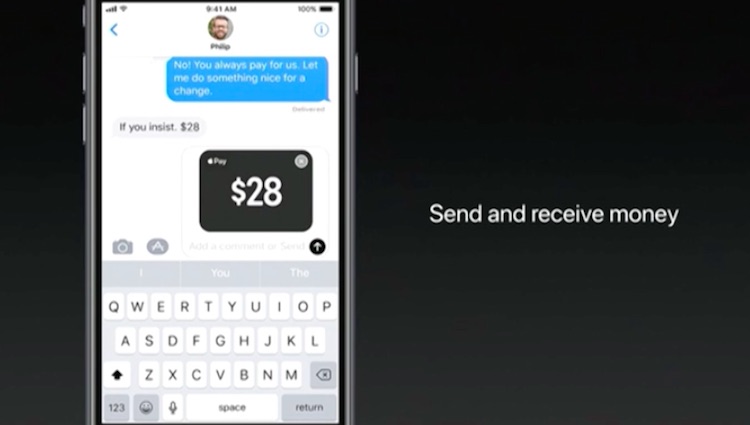

Payments

Why Apple Pay won’t (and doesn’t need to) be a Venmo-killer

- Apple's peer-to-peer payments offering won't kill Venmo's business in the short term, and in the long term it's about so much more than that

- Fintech is becoming less about dominant innovators and game changers, and more about more companies offering more choice