Payments

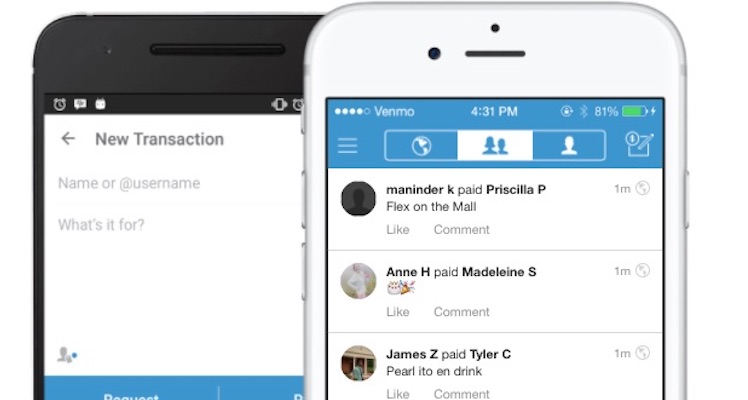

Venmo rising: Why PayPal wants you to pay for purchases using the app

- PayPal's CEO announced that customers will soon be able to use Venmo to pay for purchases anywhere PayPal is accepted.

- 'Pay with Venmo' is part of a larger strategy to connect with brands and generate additional revenue for the service.