Payments

How Walmart’s money services compete with payday lenders and check cashers

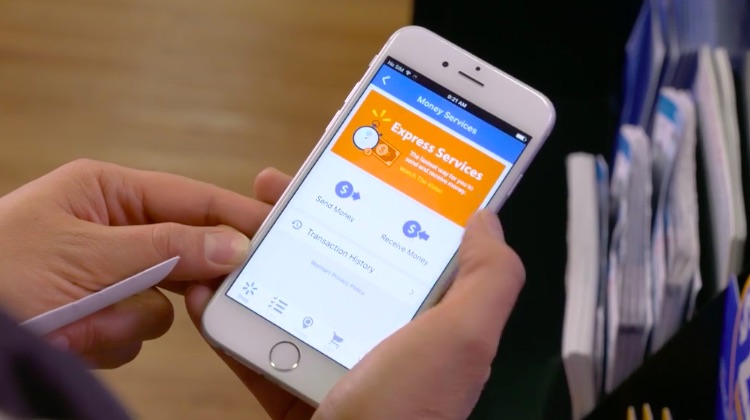

- Walmart customers can now carry out mobile-enabled money transfers in stores, an upgrade of its financial services offerings

- Walmart is moving to keep customers in the retailer's stores rather than create a new financial services empire