Online Lenders

Top digital auto finance companies

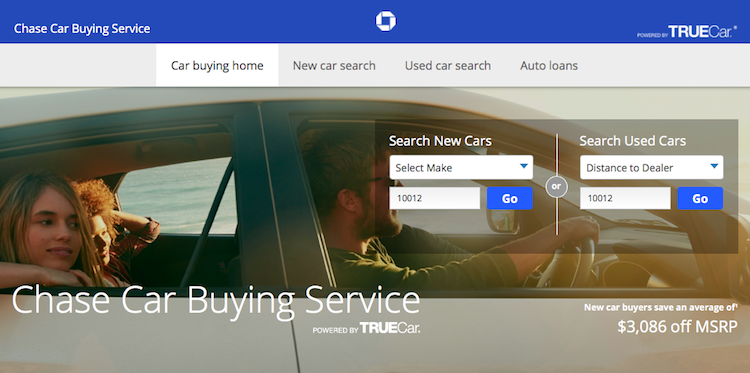

- The opportunity is huge for digital origination of auto loans.

- But, in the U.S., only 5% of car buyers have ever tried it.