Online Lenders

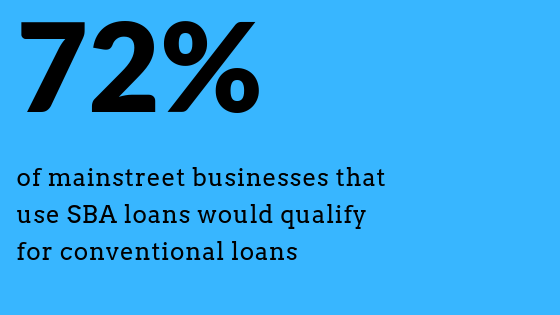

‘7 out of 10 could qualify’: Government lending shutdown can provide boost for fintechs

- The US government shutdown will impact mainstreet businesses.

- Fintech lenders can find a way to pick up the slack.