The Customer Effect

Why big banks are exploring shared ATMs

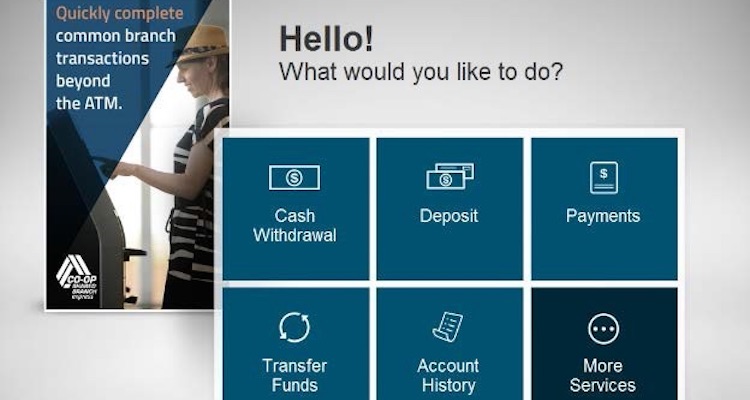

- One major coalition of credit unions is sharing ATMs and branches as a means to expand their reach and offer customers more access to services.

- Analysts say big bank brands are less interested in shared ATMs because of the cost and the risk of watering down the differentiated brand experience.