The Customer Effect

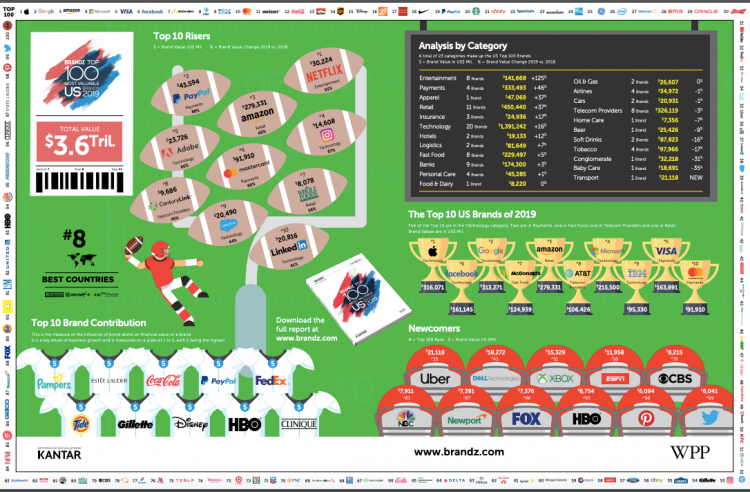

Visa, Mastercard, Citi and Chase among the most valuable US brands for 2019

- A recent study ranked the most valuable U.S. brands.

- Payment companies tended to score high in this report.