The Customer Effect

Revolut is coming to the US this summer

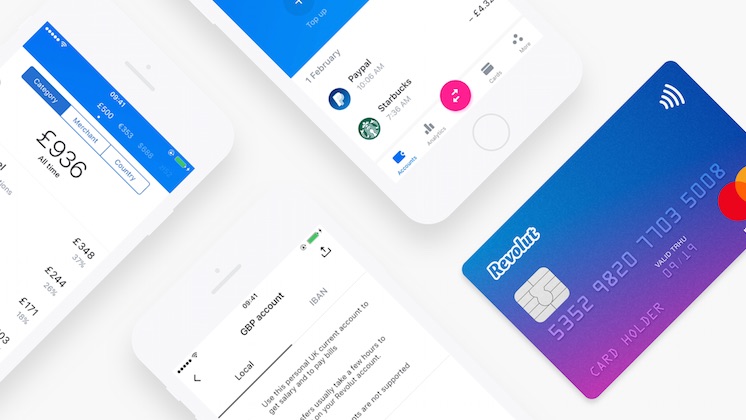

- U.K. challenger bank Revolut, bolstered by a $250 million fund raise, is on the cusp of global expansion beyond Europe

- The digital-only bank plans to focus on a millennial mobile workforce that would benefit from cross-border currency, multi-currency operability and peer-to-peer payments services