The Customer Effect

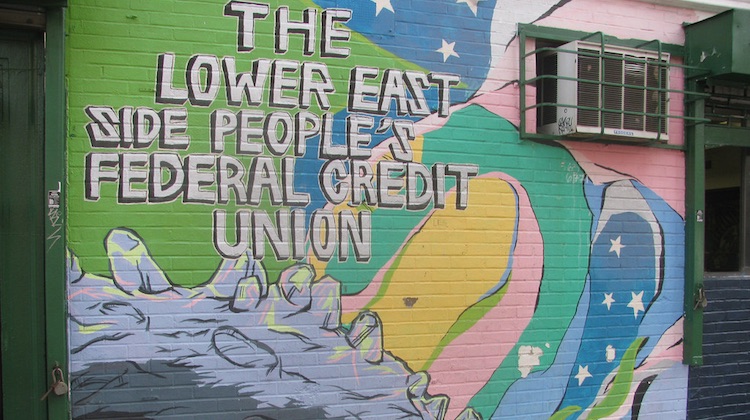

How credit unions can advance inclusion

- Since credit unions are owned and operated by their members, they are uniquely positioned to advance social, economic and environmental objectives.

- As credit unions attract new types of customers, the challenge will be to stay true to the member-centric vision.