The Customer Effect

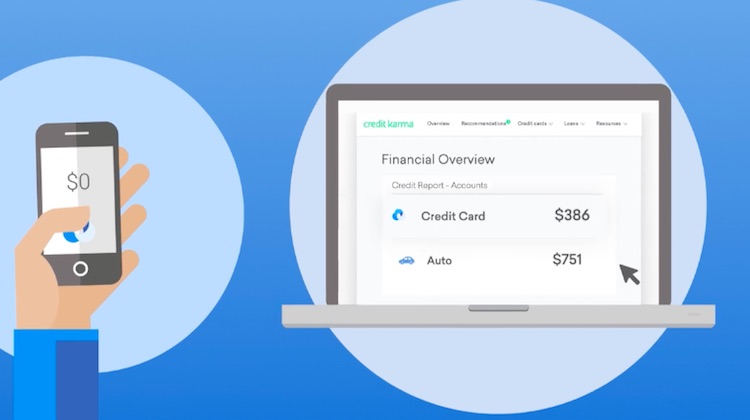

How Credit Karma is using data to become a central finance hub

- Credit Karma wants to build trust with customers through a chatbot

- The chatbot will build a stronger connection to customers and provide an additional source of data for its product-recommendation engine