Data Snacks, Getting the rules right, Member Exclusive

Risk on the mind: Shadow bank loans and AI may be a risk to the financial system

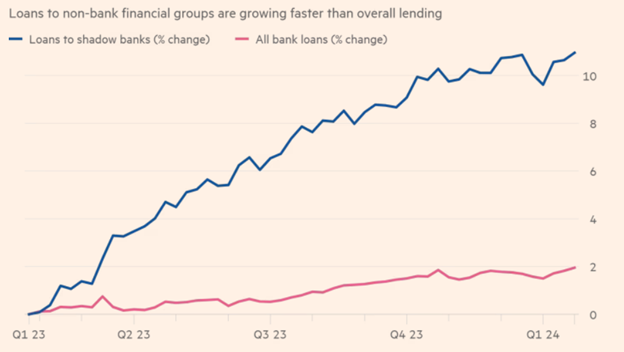

- Data by the Federal Board of Governors revealed that lenders in the US have loaned upwards of $1 trillion to non-deposit-taking financial companies.

- Along with loans to shadow banks, regulators are also eyeing AI and its possible negative impacts on the financial system.

The Financial Stability Oversight Council (FSOC), which brings the leadership from the Federal Reserve and Securities and Exchange Commission under one roof to monitor systemic risks, has identified loans to shadow banks and growing AI usage as possible risks to the current financial system.

Shadow bank loans: Last week, data by the Federal Board of Governors revealed that lenders in the US have loaned upwards of $1 trillion to non-deposit-taking financial companies like fintechs and private credit investors by the end of January this year. The total amount of loans to shadow banks increased by 12% last year while general lending growth remained slow.