Future of Investing

Wells bundles in unlimited human advice with its robo-adviser

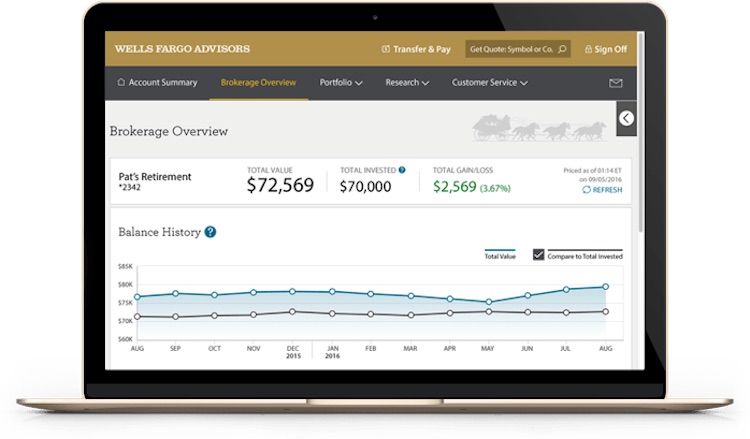

- Wells Fargo launched Intuitive investor, a hybrid human and digital advice investment product.

- The move into robo-advice puts the bank in a space to compete with both startups and other incumbents, with the goal to reach those who still trust a human over a robot.