How PayPal is bridging crypto and commerce through payments

- PayPal is carving out a spot in the crypto landscape but with a calculated approach.

- We take a closer look at PayPal’s crypto evolution, its applications, and the give-and-take of digital transactions.

A few years ago, firms diving into crypto were tiptoeing through uncertainty. Fast-forward to today, a Bitcoin-focused product strategy within the lineup seems to be a safer bet.

Take Block, for example. Its early, all-in stance on Bitcoin now seems like a stroke of genius, given that crypto markets are maturing, Bitcoin is reaching new peaks, and a new administration is seemingly opening the door to crypto and Web3.

PayPal is another payments firm carving out a spot in the crypto landscape with a more calculated approach. It has woven Bitcoin into its strategy over the past five years.

“Several years ago, we began testing cryptocurrency transfers to better understand the technology as it relates to payments and immediately saw the value it could provide,” says May Zabaneh, VP of Product at PayPal.

“The ability to send a payment over the blockchain in seconds at a fraction of the cost was simply incredible. We needed to explore it further and determine in what capacity we wanted to be involved. That’s when we realized that we wanted to bring this incredibly promising technology to our users,” she shares.

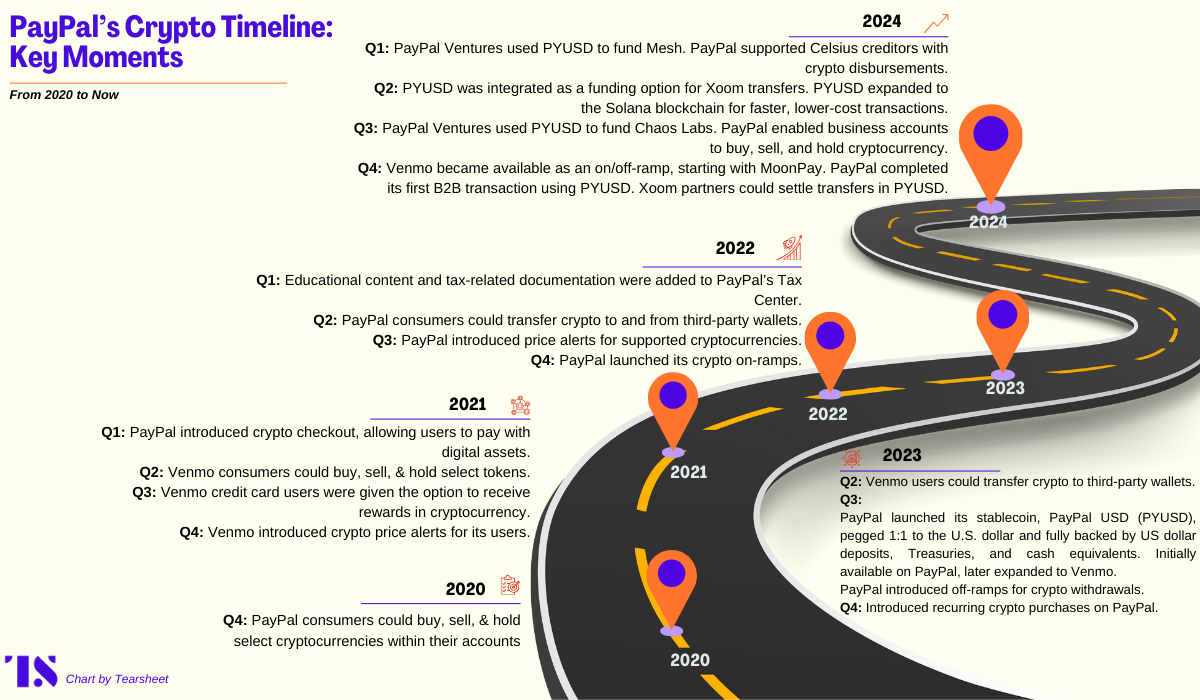

In late 2020, PayPal took its first crypto leap, letting users buy, sell, and hold select digital currencies within their accounts. By 2024, its stablecoin PYUSD — initially launched on Ethereum — expanded to Solana for faster, lower-cost transactions. PYUSD is now on both Ethereum and Solana. That same year, PayPal extended crypto trading capabilities to business accounts.

We take a closer look at PayPal’s crypto evolution, its applications, and the trade-offs that come with digital currency transactions.

PayPal’s crypto evolution

PayPal laid the groundwork for its crypto venture by obtaining approvals and engaging with regulators.

The firm received a conditional Bitlicense from the New York State Department of Financial Services (NYDFS) in October 2020 and became one of the first companies to receive a full Bitlicense in June 2022. “PayPal chose to become fully licensed because it was the best way forward to offer cryptocurrency services to its users, given the robust framework provided by the NYDFS for such services,” notes Zabaneh.

With regulatory approval in place, PayPal took decisive steps forward each year, as illustrated in this chart:

…