Banking

Due to data fragmentation, finding the right information is a pain for banking employees

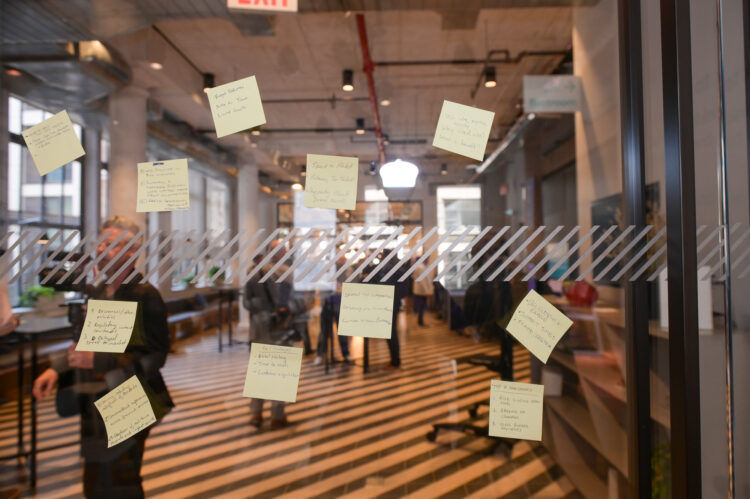

- Finding the right information is difficult for bank employees due to not having access or having to sift through information from multiple sources.

- But there is a possibility that Generative AI can help, if a few problems can be worked out first.