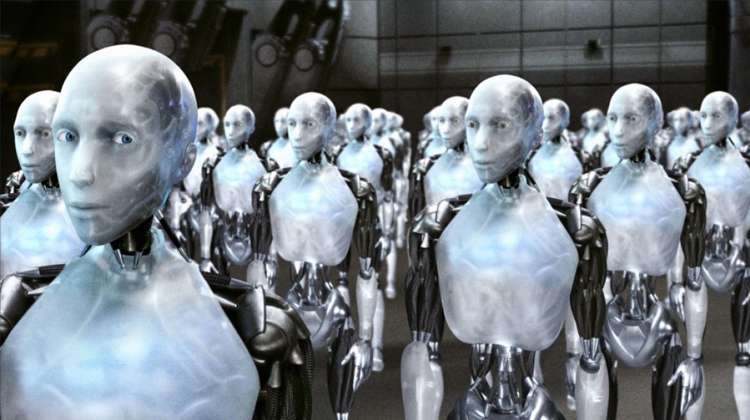

Artificial Intelligence

Are robots the answer to DoL rule challenges? Maybe, maybe not.

- Roboadvisors offer a way forward for advisors to service smaller accounts.

- But, experts question whether robo advice can be considered fiduciary.