Agentic AI is knocking. Here’s how banks are answering the door

- A growing number of institutions are assessing how to deploy Agentic AI systems securely within their established governance structures, as they anticipate a shift toward greater automation in financial services.

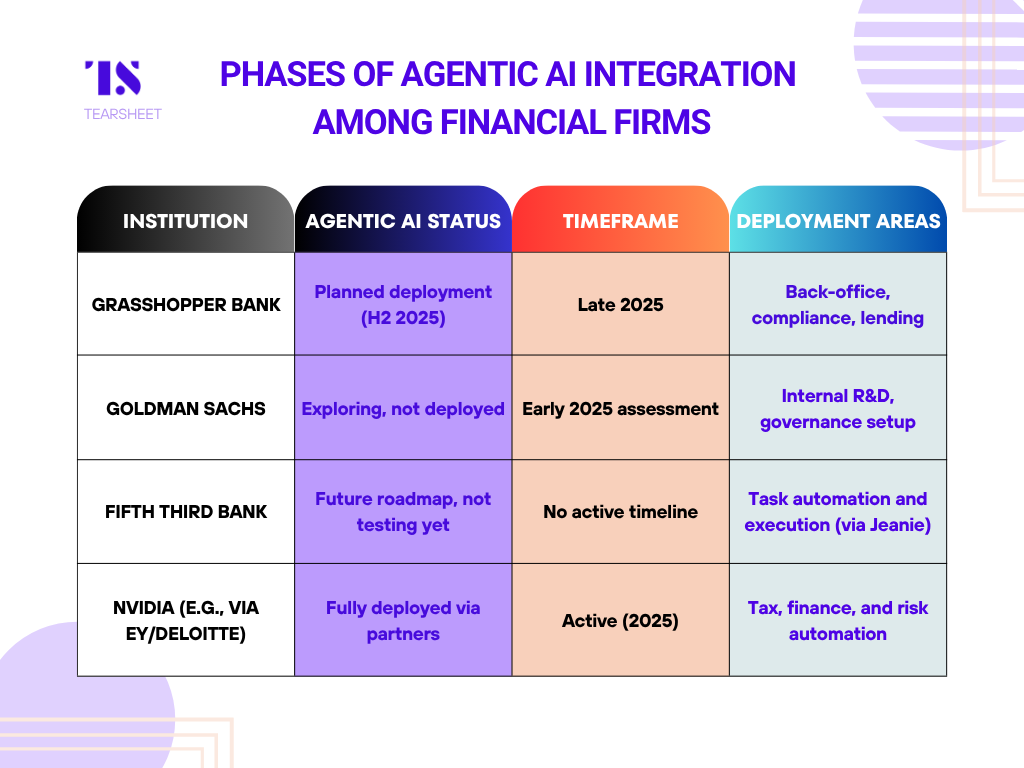

- Our analysis focuses on financial institutions that have implemented or are planning to implement Agentic AI, as well as the present state of their integration initiatives.

For years, artificial intelligence in financial services has moved between two poles: fear and fascination. The rollout of chatbots, cloud migrations, and cautious experimentation characterized the early 2020s. However, it now appears that financial firms are adopting a more moderate approach as their AI efforts mature. They are entering a new phase, one that reimagines AI as a semi-autonomous agent capable of executing multistep tasks with limited oversight.

The shift is subtle. Where earlier AI applications focused solely on isolated efficiency gains like summarizing a document or parsing a client inquiry, Agentic AI systems, with memory, intent, and reasoning capabilities, promise to do more than just assist.

Many institutions are exploring how these systems can be deployed safely within existing controls and are preparing internally for what could become a new layer of automation in financial services.

Emerging Agentic AI adoption: Who’s deploying, who’s preparing

This analysis covers financial firms that have embraced or are gearing up to adopt Agentic AI, as well as the current status of their integration efforts.

1. Grasshopper Bank: Building toward autonomy without surrendering control

Status: Agentic AI deployment planned for late 2025.

Use case focus: Back-office orchestration, taking on more complex, cross-functional responsibilities, and laying the groundwork for scalable automation throughout the organization.

Pete Chapman, CTO of the digital-first business bank, Grasshopper, noted that when it comes to AI developments, the bank isn’t chasing headlines; it’s playing the long game.

“AI means different things to different people,” Chapman said. “We focus on being intentional about how and where we use AI technologies.”

Currently, Grasshopper uses GenAI (via Google Gemini) for productivity tasks and RPA for rule-based automation across its operations: Google Gemini helps employees draft reports, answer emails, and prep presentations. Bots automate routine steps between systems.

But the agenda for the bots doesn’t end there.

Later this year, the bank plans to roll out intelligent AI agents — Agentic AI that can operate beyond the rules-based automation bots the bank currently uses. These new agents will be capable of handling broader, more nuanced tasks, creating a foundation for scalable automation across departments.

But there’s a line Grasshopper doesn’t want to cross, according to Chapman, referencing all future AI rollouts.

“Modern generative models often function as ‘black boxes,’ and we are committed to explainability and auditability in all client-facing decisions,” he said.

That means no fully autonomous credit decisions, and no opaque risk modeling. Grasshopper’s agents can help, not rule. In lending, they may help draft memos or support underwriters, but never replace them.

“We aim for a thoughtful balance… automating wherever possible without sacrificing human judgment where it matters most.”

2. Goldman Sachs: Early signals in a long Agentic AI game

Status: Agentic AI is in research and under internal assessment, with future deployment likely but not scheduled.

Use case focus: Multistep automation, internal workflow agents, improve personalization and UX.

At Goldman Sachs, artificial intelligence has already found a desk.

10,000 employees now use the GS AI Assistant, the bank’s own productivity tool that helps summarize content, translate code, and analyze internal data. But according to CIO Marco Argenti, this is just the warm-up act.

“The AI assistant becomes really like talking to another GS employee,” he said earlier this year. Over time, it will evolve beyond mimicking responses to reasoning and decision-making more like a real Goldman worker, potentially within three to five years.

The vision Argenti described for the bank’s AI Assistant overlaps with Agentic AI traits, though Goldman is still in the exploration phase, testing how and where these systems could operate safely.

The GS AI Assistant is not powered by Agentic AI. But the next evolutionary step, capable of multistep task execution with reasoning, is being studied as part of Goldman’s 2025 AI strategy.

The potential is huge, so are the challenges.

That’s why Goldman has created a network of internal “AI champions” — employees across business units who surface viable use cases, identify guardrails, and pressure-test the tech internally. These employees act as the “connective tissue” of Goldman’s AI strategy, said Belinda Neal, the firm’s COO of core engineering, head of product management, and head of engineering partnerships, in a recent interview. “That is an absolutely critical part of how [AI] adoption is going to be driven and where we’re going to see the highest value from,” she noted.

Agentic AI isn’t ready for prime time at Goldman just yet. The stakes are high, and the bank isn’t deploying agents into workflows until it’s confident in how agentic systems handle data, adhere to guardrails, and align with regulatory expectations.

While experimentations remain early-stage, Goldman’s moves reflect another angle: the real value of agentic AI may lie not just in the tools themselves, but in how they are coordinated and integrated.

3. Fifth Third Bank: Traditional AI now, Agentic AI on the horizon

Status: Agentic AI is part of future roadmap thinking, but not yet active in testing or production.

Use case focus: Customer service automation, language expansion, execution of tasks on customers’ behalf.

When Fifth Third Bank built its chatbot Jeanie, it was just trying to answer customer calls at scale during the pandemic.

That early version of Jeanie was rules-based, modest, and sometimes clunky. But over the years, the bank retooled the system, refining its natural language understanding and raising intent recognition accuracy from 20% to 87%. Today, Jeanie fields customer requests 24/7 and routes issues to live agents when needed.

The bank’s homegrown chatbot is run on a well-established traditional AI system, but isn’t yet powered by generative or agentic technologies. It handles customer inquiries using structured conversational flows and topic modeling.

“We are using what I would call a traditional AI [for Jeanie],” said Michelle Grimm, Senior Director, Conversational AI at Fifth Third.

But Grimm confirmed that Agentic AI is on the horizon: “When I talk about Agentic AI, the possibilities are vast.”

Those potential outcomes include:

- Agents that complete transactions, going beyond guiding users through them.

- Multilingual service for Spanish-speaking users. Initially, the idea is for Jeanie to spot when a customer prefers Spanish and hand them off to a human. Eventually, the vision is for Jeanie to manage Spanish interactions directly.

Fifth Third is building its agentic muscle through feedback loops, user behavior analytics, and speech sentiment scoring that are laying the groundwork for smarter automation.

4. Nvidia: The Agentic infrastructure no one sees, but most are using

Status: Actively enabling Agentic AI through partnerships in 2025. Agentic AI is already live via partnerships with consulting firms like EY and Deloitte.

Use case focus: Tax, regulatory reporting, risk modeling, business operations.

As banks brainstorm and experiment with Agentic AI at the application layer, Nvidia, manufacturer of graphics processing units (GPUs), is becoming the technical backbone for Agentic AI in financial services.

While Nvidia doesn’t offer turnkey solutions for banks, it provides the foundational infrastructure, including model optimization, inference pipelines, and data pre-processing, on which financial applications can be built.

In March 2025, Nvidia introduced the Llama Nemotron family of open-reasoning models, designed specifically to power agentic systems that can perform complex, multistep tasks. Nvidia isn’t building banking software. But it is enabling some of the most advanced agentic AI deployments in financial services, via partnerships.

Nvidia’s Agentic AI is operational across its customer platforms, including:

- EY.ai Agentic Platform: It uses Nvidia models to support over 150 AI agents, helping 80,000 professionals handle tasks across tax, compliance, and finance.

- Deloitte’s Zora AI: It harnesses Nvidia’s tech to run autonomous agents in finance, procurement, and risk, with internal cost savings and productivity goals of 25% and 40%, respectively.

These firms are actively piloting and deploying fully operational agentic systems in consulting, tax, and compliance, with use cases that are starting to be adapted for financial services clients.

Recap:

The risk of delegating too much too soon

Beyond being an additional technological capability, what’s fueling the Agentic AI plans among financial firms is a need for actionable intelligence that fits into their existing governance models.

Financial firms are past asking: “Can AI help?” They’re now asking: “Can it do the work responsibly, repeatably, and transparently?”

Agentic AI solutions hold the potential to meet this need by:

- Automating multistep processes

- Enabling human-in-the-loop review

- Supporting governance, not replacing it

Adoption, however, is uneven. Most financial firms, even those leading the charge, are still in the piloting and learning stage. Since much is on the line, especially in regulated environments, institutions are wary of delegating too much too soon.

And that’s the way the banking industry likes to operate.