How payments providers can tap into the growing SMB market

- The POS market continues to grow, driven by digitalization and new vertical offerings, but there's a lack of available data around SMB revenue, growth trends, and other metrics to help capture these businesses as customers.

- Data firm Enigma provides comprehensive data about the identity and financial health of millions of businesses, enabling visibility into real revenues and financial trends across this growing market.

Imagine a world before the modern day point-of-sale (POS) system: use of cash registers, manual recording of sales & inventory, slower terminals for processing card transactions, and a host of other pain points to manage.

Today, point-of-sale (POS) systems are looking to level-up and become the go-to technology for businesses everywhere to help them grow their operations at a more rapid clip. Instead of relying on slower, more antiquated methods for sales transactions, businesses are leveraging POS technology to win over consumers with efficiency, track real-time transactions and inventory changes, and so much more.

The North American POS software market alone is set to grow at a 8.7% CAGR from 2023 to 2030, according to Grand View Research. By integrating into merchant operations, these systems are helping streamline the checkout process across industries — from retail to restaurants — and changing the way payments are handled for businesses of all sizes.

Small businesses, in particular, will spend more than $100 billion on payments services by 2025, according to McKinsey, and represent a huge opportunity for POS providers looking to capitalize. But one of the biggest blockers to capturing this high-value sector is the lack of available data around real revenue, growth trends, and other metrics needed to win this growing subset of the economy.

With Enigma data, POS providers — as well as anyone operating across the payments ecosystem — can see everything, from which SMBs are using specific payments systems to revenue trends based on card transaction data, and much more. With this kind of visibility, payments players can target merchants based on card revenue generated or average transaction size, for example, and find the right businesses to grow their top line.

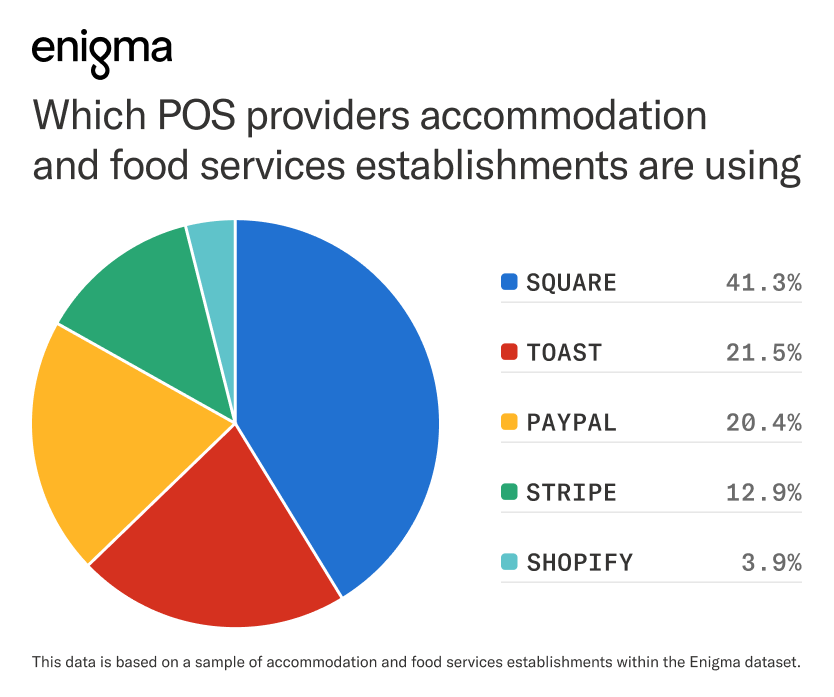

Enigma data also provides insights into the SMB landscape at large, giving payments players a view into broader trends across the ecosystem. For example, POS providers like Square, Stripe, Toast, and others can see the merchants using their technology and understand things like which industries are seeing higher adoption rates, or where they stand in comparison to their competitors.

Payments players should also pay attention to how this type of data can improve their overall growth across industries — and accommodation and food services, especially, is one of the major markets to pay attention to.

Food services is a hot target market for point-of-sale providers

The food services category is a heavy adopter of POS systems. In August 2023, Toast — which exclusively caters to the restaurant space — reached adjusted EBITDA profitability for the first time since going public in 2021. Beyond going after major partnerships, like its recent deal with Marriot to expand across the hotel chain, the company has also expressed interest in the SMB space.

“In the small SMB space, we’re optimizing pricing and packaging to meet the needs of that customer segment and leveraging an eCommerce sales motion and self-service onboarding to efficiently grow in this segment,” Toast Chairman and CEO Chris Comparato said via PYMNTS.

Within the Enigma database, we broaden the analysis to see that more than 28,400 accommodation and food services establishments exclusively used Toast as their sole POS system within the last 12 months. Still, more than a handful are adopting generalist Square — in fact, 41% (54,600+) of businesses within the segment are partnering exclusively with Square, according to Enigma data.

Accommodation and food services establishments partnering exclusively with Toast have the highest median revenue of nearly $1 million, whereas those using Square show a median of about $213,000, per Enigma data. Therefore, while Square operates across more businesses in the space, businesses exclusively using Toast have more revenue generated per business.

Additionally, the establishments partnering exclusively with Stripe have a median revenue of just over $434,000 — an interesting takeaway given its lower penetration across the overall market, as seen above.

Accommodation and food services is just one area where POS providers are gaining traction within the SMB space. To dig deeper into the broader landscape of where payments platforms are operating, download Enigma’s report on the payment platforms winning over SMBs here.