Breaking down PayPal’s Q4 earnings: The hits and misses

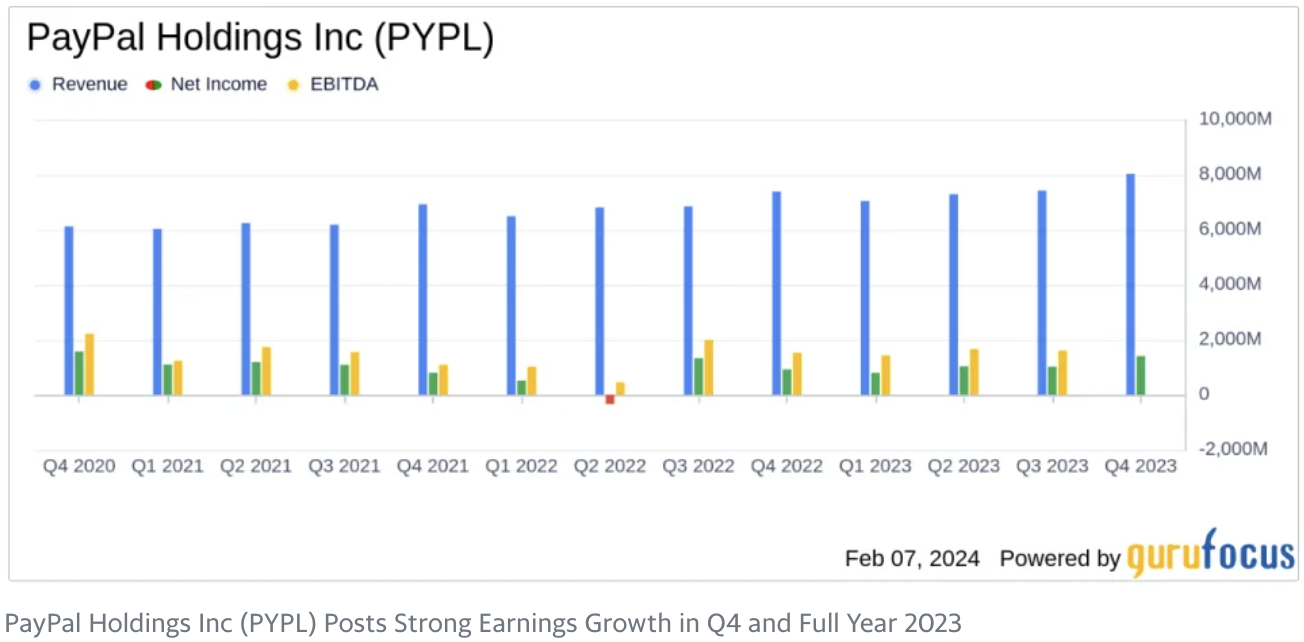

- PayPal reported its earnings for the final quarter of 2023 with a solid 9% increase in Q4 revenue, reaching $8.0 billion

- While the earnings reflected a profitable growth trajectory and beat expectations, the 2024 guidance fell short of analysts' expectations.

Wins and areas for improvement went hand in hand.

by SARA KHAIRI

As PayPal charts its course, it rides a roller coaster of experiences, new product feature rollouts, layoffs, and earnings fluctuations.

Last week, the payments firm reported its earnings for the final quarter of 2023 with a solid 9% increase in Q4 revenue, reaching $8.0 billion, while FY 2023 revenue climbed 8% to $29.8 billion. The company encountered obstacles, too, such as a 2% decline in active accounts and a 1% decrease in transaction margin dollars to $13.7 billion over the course of the full year.

A couple of weeks before reporting its financial results, PayPal unveiled upgrades to its services, including AI-driven personalizations and checkout experiences for merchants and consumers – something it has been working on for a while.