Uncategorized

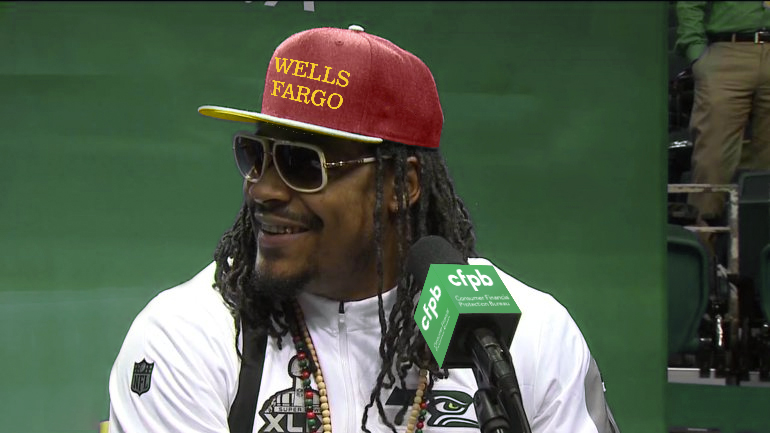

Wells Fargo fined for opening two million accounts without customer consent

- More than two million fake deposit and credit card accounts were created since 2011.

- Bank employees funded the fake accounts by transferring funds from authorized accounts.