Online finance lags

The news of personal finance tool Wesabe shutting down last year made it pretty clear that Mint.com is on its way to fully owning the online personal finance space. The company’s port-mortem pretty much capitulates that. But personal finance is just a small part of a much larger, overarching problem that affects all of us: planning for a financial future. While this certainly includes managing household cash flows, it also involves buying a home, choosing 401(k) plans, putting money into the stock market and fixed income investments, and planning for retirement.

This begs the question: with so much money at stake, why does online finance continue to trail other industries like travel? When planning an international trip online, I know exactly whom to trust for advice and why they’re trustworthy, where to look to compare similar products, and have transactional platforms into which to submit my order. But in finance, most people still don’t even know where to begin.

Current Players

- Personal Finance: Startups in this space are focused on developing value-added services to help users track and manage money flows.

- Tracking/Tweaking: Mint.com has done really well capturing new users to adopt web/mobile tools, just as Quicken was a similarly powerful force on the PC. Intuit, which now owns both products, is positioned really well for future expansion. Personal finance is a huge problem to tackle and it’s really early in the game.

- Investing: The investing process involves researching various options, transacting, and ongoing portfolio management with analytic tools.

- Researching: Investors begin the investment process with idea discovery, bubbling up ideas to populate their portfolios.

- Piggybacking investment ideas: New services like AlphaClone not only make easier tracking of the investment activities of storied investors like Warren Buffett but also provide portfolio development tools to backtest and manage entire portfolios made up of piggybacked ideas.

- Long tail of financial content: As the costs of publishing have been pushed to zero, we’re enjoying a bull market in investment content. Sites like Seeking Alpha and StockTwits provide great tools to plug into the collective tradestream. Wikinvest has taken more of a collaborative approach with its content and data.

- Screening 2.0: Smarter tools like Validea help investors filter through large numbers of stocks using algorithms and artificial intelligence to identify worthy portfolio prospects.

- Crowdsourcing stock picks: Sites like Piqqem allow investors to tap the wisdom of the investment crowds.

- Expert networks: SumZero is an online investing club of super-smart people sharing really good analysis on stocks. Other Q&A tools like those at LinkedIn and Quora and even Facebook are enabling the sourcing of ideas from domain experts. With the FBI/SEC’s crackdown on offline expert networks, investors will look more towards these tools for help in sourcing and validating investment ideas.

- Transacting: Once an investor knows what action he would like to take, execution comes next.

- Online Brokers: E*Trade, TDAmeritrade, and Schwab still dominate the online brokerage space (with recent news that Merrill Lynch is getting back into the game). It’s interesting to watch as online brokers woo existing traditional brokerage clients with automated, professional-grade services delivered online, blurring the line between full-service and DIY investing.

- Hybrids: Covestor and kaChing (now Wealthfront) are the eBays of investment advisory services — marketplaces of investment services. Users synch their online brokerage accounts to mirror the portfolio models managed by advisors on these platforms. In a move to the mainstream, Covestor’s tradestream now includes the real time audited trades from participating investment managers. This is a big fuckin’ deal and it’s freely available through Yahoo Finance’s Market Pulse. Newer entrants like Tech Crunch Disrupt finalist Betterment provide automated investment services. Other investment advisors like Formula Investing provide a mixture of full service and DIY tools.

- Managing:

- Ongoing monitoring: As markets undulate and investors’ financial health changes, tools help automate changes that should be made in portfolios. A number of new professional-grade, automated tools are helping head this cause. Firms like MarketRiders help with ongoing changes in asset allocation and services like Goalgami help address life’s incessant barrage of financial goals that need planning.

- New asset managers: Fusing the low-cost distribution model that social media affords with new methodologies to manage funds for clients, both old and new asset managers are launching all kinds of new securities in an attempt to capture part of a huge pie. With actively managed ETFs in the infancy and good comps for successful exits, new asset managers like GlobalX are growing AUM and positioning themselves well for future growth.

- Analytics: Like Google’s Urchin/Analytics acquisition, analytics are core to the effective management of any platform. TC Tear Down star, Steve Carpenter founded and sold Cake Financial to E*Trade earlier in 2010. Cake helped investors make more sense of the activities in their portfolios. With Cake Financial bowing out, the market is wide open. Look to Wikinvest’s recently launched Portfolio tool to take off where Cake left off.

- Researching: Investors begin the investment process with idea discovery, bubbling up ideas to populate their portfolios.

Why there is still a huge window of opportunity

In spite of the flurry of activity, most of these startups haven’t even begun to dent the market for financial services. Some of these verticals are so narrow that participants need to expand horizontally into other silos, which both incumbents and startups are racing to do.

Some firms have advanced product-based approaches, trying to build better mutual fund mousetraps and have enjoyed a modicum of success. Next-generation mutual funds, exchange traded funds (ETFs) have almost $800 billion in assets, an increase of 34% over 2009 levels, but that’s still only 7% of all invested assets in the U.S. In spite of all the high quality content, investors still struggle with basic financial concepts, portfolio management, and continue to make bad decisions. The flurry of activity has unleashed a bull market in financial content; We’ve gone from scarcity to too much content. We now require tools to cut through the data smog and help us with comprehensive solutions to make better decisions.

The $11,000,000,000,000 Grand Prize goes to…

The market size of the investment industry is so big that there is room for multiple players to establish hugely profitable businesses. Look for large incumbent players, most specifically Bloomberg, to expand their businesses through acquisition in an attempt to capture more marketshare. Bloomberg’s multi-billion dollar empire of financial hardware and data recently purchased BusinessWeek in an attempt to move downstream toward retail investors. The giant investment expert network, Gerson Lehrman Group, may get deeper into online expert Q&A sourcing as the firm continues to enable person-to-person expert research for professional investors.

Real-time transparency is making its way to the online brokers. E*Trade joined TDAmeritrade in recently announcing upgrades to its own API to allow 3rd party software developers and services to reach investors through their brokerage logins – the holy grail for the entire value chain. Investors get access to new apps, software developers can finally tap online brokerage clients through trading platforms, and the online brokers can provide value-added services without having to develop them.

The fact that we’re beginning to seeing ivory-tower asset managers make their way onto Twitter is, in fact, a good sign of things to come in the future. But the field is still wide open for comprehensive solutions.

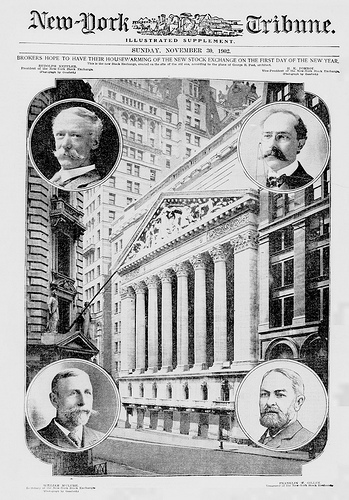

photo courtesy of frankblacknoir

Flash Player 9 or higher is required to view the chart Click here to download Flash Player now

Flash Player 9 or higher is required to view the chart Click here to download Flash Player now