In Tradestream your Way to Profits, I wrote about how smart investors can use hedge fund filings to create a wining portfolio. By tracking the holding information of some of the most successful investors on the planet, individual investors can piggyback on hedge fund returns.

Many in the media — including some people I believe are smart, intelligent investors — poke holes in these replication strategies. I’m not sure of their motivations, but the data are clear: By methodically creating a portfolio that seeks to mimic specific hedge funds (not all are good candidates for replication), individual investors get a big piece of the returns many of these funds have generated for years. Here’s a webinar I hosed last year on the subject of cloning hedge funds.

My ‘hedge fund’ portfolio

I’ve been developing a Tradestreaming.com Guru Portfolio this for the past couple of years (testing for 1 and using it with client funds for 2). While the S&P 500 was essentially flat last year, my Guru Portfolio generated close to 6% before fees. Even more impressive, it’s up close to 190.3% over the past 3 years with a 13.4% drawdown.

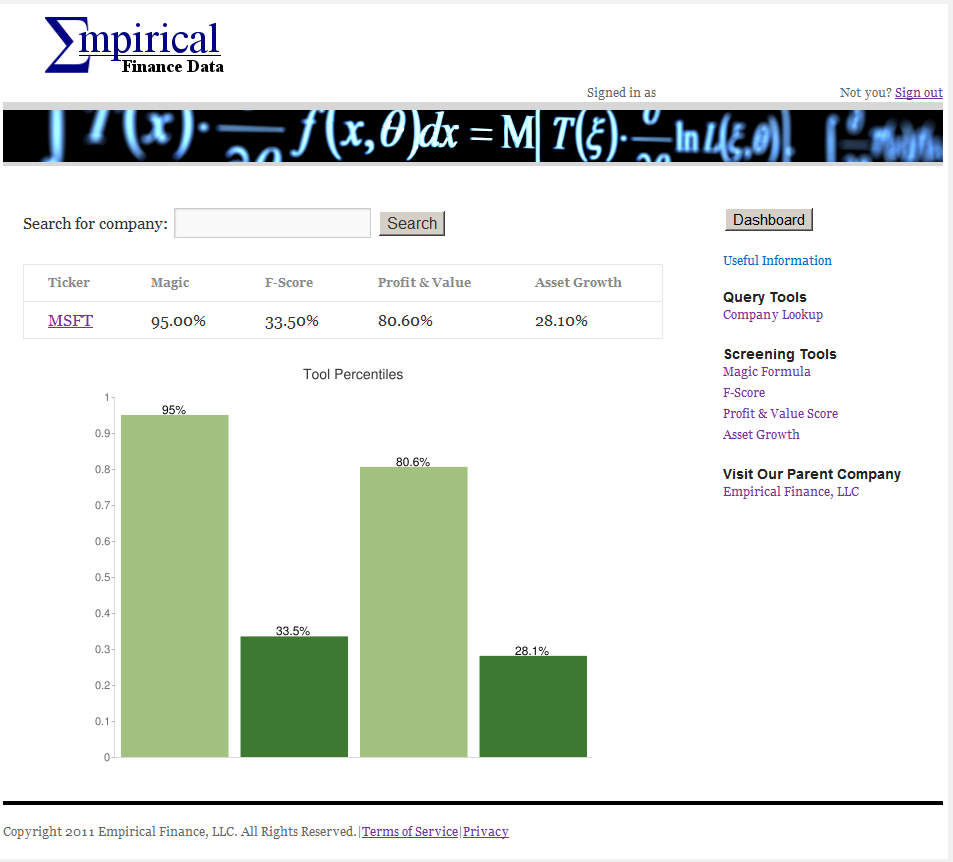

AlphaClone has been indispensable to building this portfolio (that image is from AlphaClone). I wrote about how AlphaClone is the cure to investor insanity in 2009 and I still believe it’s a very important tool for all investors to build tested, defined strategies that build on the research done at the world’s top hedge funds.

The point here though is that just buying a stock willynilly that Carl Icahn is targeting on a buyout or that Warren Buffett just put $1B into, isn’t really a strategy. For hedge fund replication to really work, you need to spend the time understanding how certain funds can best be piggybacked.

There needs to be a method to the strategy for this to really work — one that removes and individual’s decision making (ah, I like this stock OR, nah, I wouldn’t buy that — it’s a dog!) throughout the process. I found this to be the hardest part of implementing this quasi-quantitative strategy.

How to build a custom piggybacked hedge fund portfolio

There are simpler strategies on AlphaClone that are just plug-and-play, no research needed. You can see 6 different ways people are tracking hedge funds which don’t require a ton of work. Some of these work amazingly well, but I personally wanted something customized to some of the things I’m working on at Tradestreaming.

Here’s how I built my Tradestreaming Guru portfolio and how you can begin doing it in just under 1 hour with AlphaClone.

1. Understand how funds can be tracked: Some funds are hard to replicate. From what I’ve seen the best funds to piggyback hold positions for at least a few months at a time, have a value approach, and don’t have a problem taking big swings on individual stocks (meaning, have a sizeable % of their assets in individual names).

*Important point: Sometimes (and AC helps here, too), it’s not an individual fund’s picks that are the most exciting. Instead, it’s the most popular stocks held by a family of funds (say, the Tiger Cubs). Or, the most popular (that’s its technical name) stock in a certain industry or market cap held by all hedge funds (say, technology or transportation).

Here’s a list of the most tracked funds on AC to get you started (though AlphaClone literally tracks thousands of funds):

2. Determine what your ideal portfolio looks like: If you look at the list above, these funds perform pretty damn well (at least at the 3Y mark), but their clones are portfolios comprised of the funds’ top 10 holdings. If you tracked a handful of these funds, you’ll end up with a pretty large portfolio of individual stocks.

Before you begin, it’s important to envision what type of portfolio you want:

- Do you want to design a portfolio of 100 positions or 10?

- Are you comfortable following picks from just one hedge fund or do you want more diversity?

I personally didn’t want a portfolio larger than 10-15 stocks (read below).

3. Determine which strategy will get you to your ideal portfolio: When you play around on AC, you’ll see that certain funds are best replicated by a strategy that buys their top 10 holdings. Others work better by just following the top holding. Still, some follow the newest holding.

I wanted an easy-to-manage portfolio of about 10 stocks (to get diversity and focus on different sectors) and I didn’t want a portfolio of 100 stocks (10*10). Instead, I targeted funds that worked well by just buying their top or newest holding. If I’m following 10 funds, that would leave me with a 10 stock portfolio (1 stock from each fund).

4. Screen, screen, screen

I used AC to screen for funds that:

- performed well

- had high Sharpe ratios

- lower drawdowns

- I looked for returns over 3 to 5 years

- and that replicated well by using a single stock pick to represent their returns

I was also looking for funds that had focuses on different sectors (like biotech or tech or small caps, for example).

5. Add these funds to a Fund Group

As you find the funds that fit your strategy, add them to what AC calls a Fund Group.

Once you’re logged in to AlphaClone, go ahead and click the Create a Clone Group button under the Your Custom Groups tab. The feature can be used to combine and filter a group’s holdings by sector and/or market capitalization then backtest performance.

Before we checked how each individual clone performed over time. Now, with a group, you can see how the whole portfolio performs. You can add or subtract funds to get your portfolio right.

I settled on a strategy that tracked 9 different funds. I’d suggest a portfolio that has more holdings in it. Occasionally, the funds I’m tracking held the same stock (Apple $AAPL was everyone’s favorite in 2011) and that meant I had few positions and the portfolio fluctuated more than I would have liked.

6. Rebalance quarterly

AlphaClone updates every quarter, a month after hedge funds file. You’ll see what was bought and sold and you can make any changes in your real-money portfolios based on the new names in the portfolio.

Creating a piggybacked portfolio works — both in practice and in the research.

Will it continue to work? Who knows, but like tracking insider trading, it makes sense that it should and AlphaClone is essential to doing this the right way.

Was this helpful? Let me know in the comments.

I find this compelling because it’s one of the first hedge funds that’s designed (so publicly, at least) to trade on changes in social media sentiment.

I find this compelling because it’s one of the first hedge funds that’s designed (so publicly, at least) to trade on changes in social media sentiment.