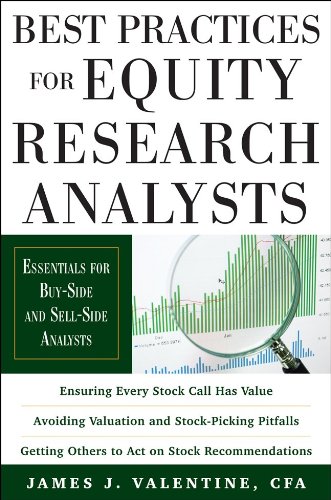

This transcript is of a conversation I had with James Valentine, author of Best Practices for Equity Research Analysts: Essentials for Buy-side and Sell-side Analysts.

Miller: Hi! I’m Zack Miller, author of the recent book TradeStream Your Way to Profits: Building a Killer Portfolio in the Age of Social Media, and you’re listening to Tradestreaming Radio, our home in the internet radio space. This is our place to discuss how technology is helping investors to become better, smarter, and more accurate at what they do.

You can find this podcast on iTunes. You can also find lots of other material relating to this podcast, as well as archives of our programs at my website www.tradestreaming.com There’s lots of other great content there as well, and I recommend you check it out.

We’ve got a great interview set up today. Joining us will be James Valentine, CFA, who’s  the author of the recent Best Practices for Equity Research Analysts: Essentials for Buy-side and Sell-side Analysts. He’s the founder of Analysts Solutions: providing best practices, training and career advancement services for equity research analysts. He’s held a number of roles at four of Wall Street’s largest firms, including most recently Morgan Stanley, where he was Associate Director of North American Research, as well as the director of training for the firm’s global research department.

the author of the recent Best Practices for Equity Research Analysts: Essentials for Buy-side and Sell-side Analysts. He’s the founder of Analysts Solutions: providing best practices, training and career advancement services for equity research analysts. He’s held a number of roles at four of Wall Street’s largest firms, including most recently Morgan Stanley, where he was Associate Director of North American Research, as well as the director of training for the firm’s global research department.

He was also an established research analyst where for ten consecutive years he was ranked by the major Wall Street institutional investor polls as one of the top three analysts in his sector.

I really enjoyed this book because it fills a gap in the literature, not only in terms of how to research stocks professionally, but also how to manage the practice of being a professional researcher.

Jim has a lot of his history and on the job experience built into this book. It’s as much a book about investing as it is the business of investing. I think it was a fantastic read. I recommend it. And, I hope that you’ll find this interview very engaging.

First up I asked Jim to tell us a little bit about his background.

Valentine: I started in the industry in the early ‘90s on the sell side. I started at Paine Webber and did that for about a year and a half as brand new out of grad school. I had a Master’s in finance.

After doing that I got an offer to go over to Smith Barney and be the senior analyst. So, I went and did that. I did that for about a year and a half. I had a lot of fun and learned a lot. Because I was a senior analyst I really didn’t have a mentor.

Then Salomon Brothers called at the time. I went over there. I was there for about three years. There is where I really started get my sea legs and kind of understand how to do the job, and work with clients, and do higher quality research.

Then Morgan Stanley called- this was in 1998, early ‘98. I went over there. I was there as an analyst for about eight years. Then I was getting burned out. I had been an analyst for fourteen years at that point. I said, “I want to do something else.” I moved into the global management team, where I did a number of things, but among those was worked on training development for the research department, which got about 1,000 employees globally.

I moved to London and I really enjoyed it, because when I was an analyst I was kind of known within the department for helping younger talent develop and I tried to do mentoring and those types of things to help these people succeed. So, I did this on a global basis. I enjoyed it. I did that for about two years.

Somewhere in the middle of that I came back to New York, and became the number two guy in the equity research department, in terms of management. I enjoyed that, although we started going through a lot downsizing in 2008. It became really just kind of frustrating watching the budget get cut, which was happening across all of Wall Street.

After a few rounds of that I just got frustrated with dismantling a department that I was trying to build, and decided I was going to retire. After that, after about I’d say four or five months I decided that I wanted to write a book, and kind of help the next generation of analysts to take all this stuff that I had collected throughout my career and put it in a place where the next generation of analysts could learn from it.

Obviously a lot of the information within the book was on the job stuff that you picked up. Did you write this book more for incoming analysts? Somebody that aspires to be an analyst? Or somebody on the job who hasn’t necessarily been mentored, or learned the things that you did along the way?

Valentine: It’s kind of both in the sense that… the primary target was to somebody who’s right out of grad school, or college, or maybe a year into the job. If they were to read the book hopefully they would get something out of almost every section of it. But there’s also parts of it for more senior analysts who want to brush up, or improve on things.

One thing I learned as an analyst, and then also when I was managing a department of analysts, is that you never have every element of being an analyst perfect. There’s going to be some element of your job that you could do better. So, the book has some of the more advanced sections, which kind of start probably a third to halfway into the book, that could be valuable to even someone who’s been doing the job for let’s say ten years, because it just kind of gives you- it tries to give you a framework to think about how to approach all the different facets of the job.

One of the things that I picked up when reading through the book, again, I don’t have experience on the sell side. I was more on the buy side. But it was every bit as much about investing as it is about the business of being an analyst. Was that sort of what you sort of envisioned?

Valentine: It is. I wasn’t trying to create an every man’s investment book, but obviously being you’re a research analyst a big part of the job is successfully investing. I delved into that. I tried to approach it from a different perspective then what you might see out there in some other books, namely. There’s a lot written on evaluation. I think if you Google it, or go to Amazon you’ll see there’s like over 10,000 books on evaluation. Obviously there’s tens of thousands of books on investing.

What I was trying to do was approach it from a real practical perspective, namely, what do analysts really do day to day? Like I said, I got a Master’s in finance and I thought when I got to Wall Street that I’d conquer all of my competitors because I had all this academic knowledge.

What I realized is that a lot of it wasn’t really applied day to day in the job. So, when writing the book I said I’m only going to talk about things that people can really apply day to day. Like, there’s a lot of focus on how to use the P/E ratio and some of the downsides of the P/E ratio, whereas in academia they focus so much on discounted cash flows.

So, yeah. I try to make it as- I try to focus some element of discussion on investments, but really focusing on keeping it practical.

So, let’s talk about practicality. Obviously the title of the book is Best Practices for Equity Research Analysts, can you give us a couple?

Valentine: Sure. Well, I think starting off, and it’s a real simple one, but it’s understanding time management. And you might say, “Well, what does that have to do with investing?” But when you think about the research job- I like to say it’s similar to saying you went to the library and you read all the books. I mean it’s just- there’s no physical way you can do it. So, you have to prioritize.

Time management is really all about prioritizing your time, trying to figure out what’s really important, and then focusing your day on that.

When I look across analysts that I trained, analysts that I worked with, that I managed, if I had to say what’s the single biggest problem with the success, it’s not intelligence. It’s not drive. It’s the inability to manage their day, all the distractions, interruptions that they’ve had.

One of the best practices, candidly, is to take a one day time management class. There’s two firms out there that do this; Getting Things Done is one, and the other is the Franklin Covey Focus. And, by the way I’m not getting any reimbursement. I have no financial connection to these firms. But, I’ve always recommended- in fact I’ve made my new people who have worked for my team, I always make them go and take one of these one day courses, and it helped so much on their time management skills. So, that’s one thing.

I think another thing that may be getting more into the investment arena, in terms of best practice, is to identify the two to four critical factors that impact every one of your stocks. This kind of goes back into the time management thing. What I find is that there are a lot of really smart analysts who know a lot about other companies, but they don’t have a differentiated view from consensus on any particular issues that are going to drive the stock. Ultimately they become a company analyst, rather than a stock analyst.

So the best practice, in effect, is to do some research, figure out what are those two to four critical factors, and then focus all your time on those for your companies, as opposed to all the other factors out there that are, in effect, noise.

Why do you think so many investors get that, what you call materiality, wrong? Obviously the media does, because the media doesn’t necessarily know how to size those up correctly, at least as a stock analyst, not as a company analyst. Why is that so hard for investors?

Valentine: I think, at least the way I saw a lot of analysts, both sell side and buy side, approach their job was kind of a CYA mindset, that they had to make sure that any piece of news that came out on their stock, whether it be the newswires, or it be a sell side piece of work, they felt like they had to at least take a look at it. If you’re trying to do that all day long- let’s say you’re following twenty stocks on the sell side, or fifty stocks on the buy side, if you’re trying to pay attention to every piece of material that comes out during the day, that’s all you’re going to be doing is basically reacting to news.

The constant of being a really good stock picker is to figure out, proactively, how you differentiate from consensus, and find a place where you differentiate from consensus. Well, you can’t proactively go and do proprietary research if you’re spending- which by the way, I think if you’re doing this proactive work- I call that doing research offensively- that you can’t do the offensively type research if you’re spending all day doing defense and be trying to read the news tape and trying read every consumer thing out there.

Nobody wants to be caught off guard. Nobody wants their boss to come in and say, “Hey, piece of news just got announced on this company, why don’t you have a view on it?” Or, “What is your view on it?” And then you’ve got to scrabble to figure it out. But the reality is that I’d say at least eight out of ten, even nine out ten of those pieces of information have no impact on moving a stock. So, the analyst shouldn’t spend much time focused on that, or any time for that matter. They need to focus on those two to four critical factors.

It’s tough to shift your mindset because you are going to be in a situation in where on the buy side your portfolio manager is going to ask you a question, and you won’t have the answer, because it’s something that’s trivial, and you haven’t focused on it. On the sell side you’re going to have a client that’s going to ask you something, and you’re going to say, “I don’t know the answer,” because it’s in effect trivial. But the good news is you will have the answers on the key things that are really important, that are going to move the stocks.

So, in terms of gauging what’s critically important, in the book you described Google News Alerts as killer apps for analysts. Can you explain why?

Valentine: Sure, well, specifically about the killer apps, it’s fine tuning your news alerts and also to some extent any other kind of email alerts that you have, anything that you’ve got that alerts you to what’s going on. As analyst the killer app here is creating filters, because as you know, there’s hundreds, if not thousands, if not millions of pieces of information coming out everyday, and you want to filter it down to make sure that you’re not getting distracted by noise, but that you are picking up the information that is going to potentially help you on those two to four critical factors for everyone of your stocks.

What I try to go into on the killer app is that as an analyst you have to always be fine tuning these news filter, or the Google filters, or Google news alerts, whatever it is, you’ve always got to be going in there fine tuning these, because you’re going to find that if you go too far you’re going to wind up with too much noise. You’re going to be getting three hundred pieces of information. You’ve got to read it. That’s too much.

On the other hand if you go too restrictive you’re going to miss key pieces of information about your industry. But if you do it right you’re going to be getting it might be ten, it might be twenty, it might be fifty alerts a day on key things that you want to be looking at that are ultimately going to help you have a differentiated view from consensus, without having information overload.

Jim just brings a huge repertoire to the whole professional investing process. And part of the book really looks at how professional investors should size up companies and industries. So, in the next part of the interview I asked Jim about some of the techniques that he describes in the book.

[music]

So one of the things that I found, as a new buy side analyst, I really cut my teeth on the job, was just something that you talked about, and you call ‘food chain analysis’, where you’re trying to understand the entire sort of value chain within an industry. Particularly for new industry it takes time to sort of drilldown and figure out how that works. Why is food chain analysis so important in being able to have an opinion on the stock?

Valentine: I think that we get caught up in our sectors based on what’s assigned to us, based on very often it’s the GICS sectors, or S&P sectors, and these create these silos, these artificial silos, that make it tough to really see a difference in terms of having a different view about something relative to consensus.

I’ll give an example. If you’re following the airline industry you’re likely not responsible for Boeing ($BA), which is an aircraft manufacturer, and you’re not going to be responsible for a leasing company that leases aircraft, that’s more of a financial services company. So, you’re not going to know those two other companies, unless you go out of your way to do this food chain analysis where you understand the upstream and downstream effects.

And, those analysts who take that extra time, they are more likely to discover some critical factors that are going to move the stock that the Street is not going to pick up on.

In this day and age of post Reg FD, we’re seeing now a crack down on some of the primary expert networks, it seems that it’s getting harder and harder necessarily to find that critical information. In the book you talked about triangulating, or mosaic theory, and what analysts need to do to be able to sort of piece the investment puzzle together.

Are you finding that it’s becoming harder within the industry to get this type of information? How do you consult with analysts to be able to sort of overcome some of the new obstacles?

Valentine: It’s definitely harder than pre- Reg FD, but candidly, I as an analyst liked when Reg FD came in place, because I had been doing a lot of really in-depth fundamental research on proprietary surveys. I had my own proprietary contacts. And, so it was frustrating when I knew that one of my competitors could just make a phone call to a CEO, or CFO, or control of a company and get kind of an understanding of what the quarter was going to be. Meanwhile I had spent all this time, and he got the same piece of information.

So, I guess what I’m trying to get at is for analysts to do the hard work, the deep work, the research, having more and more of these regulations and requirements is a good thing, because presumably this extra research is going to actually give them an edge and help them generate some alpha.

But conversely because middle managers are less likely to talk about things, and it is harder to get information, you have to follow fewer stocks. Studies have shown that analysts over the last ten-fifteen years are following fewer and fewer stocks.

I don’t know what that magic number is, but I talked a little about it in the book, it feels like having about seven stocks per team member on the sell side is about the right coverage, and having somewhere between thirty and fifty stocks on the buy side is about the right number. Those numbers are lower than they would have been ten or fifteen years ago, partly because of the restriction on how much information you can get from people.

That’s so interesting. One thing that I found when I was reading through the book is that- you focus very much on sort of the persona of a professional analyst, what it takes to become an analyst, to be a successful analyst. Some of the things that sort of hit me when I was reading through the chapters was that behavioral finance continues to sort of bubble up sort of the short comings of mankind, particularly in the investment field. And, certainly professionals are subject to those same sort of short comings. They’re sort of embedded within human nature.

So, how can some professionals, or aspiring professional investors sort of avoid the same pitfalls that afflict the rest of us?

Valentine: I guess there’s a few thoughts. One is, and you may have seen there’s a chapter in there, how to avoid the psychological pitfalls, those are more inherent, and those are going to be inherent for anybody regardless of their personality.

The other is that I guess being more self-aware, and self-awareness is a skill that you have to work on. There has been work done in the past, academic work done in the past to try to identify investment styles. They show that if you’re- there’s two scales. One to do with whether you’re very careful, or you’re very impetuous. And the other scale is whether you’re very confident, or you’re very anxious.

What they’ve shown and discussed makes a lot of sense from a practitioner’s perspective, that if you’re too careful, and if you’re too anxious at those ends of the spectrums that you’re never going to pull the trigger and make a decision, because even the best analysts and portfolio managers know that you’ll never have 100% of the information to make the call on stock.

On the other hand if you’re too confident and you’re too impetuous when you’re making stock calls you’re going to wind up out there making too many stock calls that aren’t well-based, fact-based. They’re not bound by the research from real good work.

As an analyst you have to kind of find that sweet spot, that you’re willing to take a little bit of risk, maybe even more than a little bit of risk if you’re at a shop where they want you to take more risk, but not willing to take so much risk that you have stocks that are huge blow-ups, and hopefully if they do blow up it’s not because of sloppy research. It’s because of something that just couldn’t have been foreseen.

My first boss when I was at the hedge fund, as I was an incoming analyst, sort of gave me a library of books and other types of information I needed to read through just to kind of get up to speed. I remember one book he gave me, which sort of surprised me, besides the Jim Cramer book that he gave me, was a book on technical analysis.

You devoted a section in the book to technical analysis. So, I’m just curious sort of- it was my experience that people either fell in either camp. Either you’re a fundamental analyst, or a technical one. And you sort of see the intersection of those two. Can you talk about how you use that in your stock picking, and how you recommend analysts to use technical analysis?

Valentine: Sure. Very early on in my career, I’d say it was within a few months of taking the job, I actually started talking a little bit about technical analysis to my boss. He said something along the lines of- he said, “Do you know what we’re going to do? We’re going to cut open the chicken’s liver and we’ll see which way the blood flows to decide whether we’re going to go war.” I think that dates back to either the Romans or the Greek in terms of, you know, I guess some superstitious ways of going to battle.

And there are people out there that believe that typical analysis is a bit of witchcraft or superstition. What I hope- what I’m trying to do with fundamental analysts is to say there’s definitely some benefit. It helps you to understand the psychology of the stock. It gives you another dimension. And it’s not that overly complicated, meaning it doesn’t takes months and months to learn this stuff. And, I think it’s helpful.

So, what I did is I partnered up with Barry Sign [assumed spelling], he’s a well regarded professional who’s a technical analyst, and he has some experience as a fundamental analyst as well, and we tried to write it from a practitioner’s prospective.

When I was analyst, and specifically when I was at Morgan Stanley, we had a technician who would help us. So, first we had to get the fundamental call right. And by the way I heard this over and over again, I interviewed 75 people for the book and a number of them said the they always would require the fundamental analysis to be done first, and then you can look at the technical analysis.

Basically if you say, “Look, I’m about ready to upgrade the stock, because of these fundamentals. I think consensus is too low,” you can then go to the technical numbers and charts, and say, “What is it telling me? Is it telling me that this thing is ready to break out? Is it telling me that the stock has been oversold, or maybe it’s been overbought?” So, what we’re were trying to do is say, “Look, this is one more tool to your toolbox. It shouldn’t be this single method you used to try to pick stocks. It can give you a competitive advantage.”

We always used it sort of exactly the way you described. Like, “Go do the work on the stocks, speak to as many people as you can. Make sure you get the numbers right,” and then look at the chart for really timing on the call, right? To try to, like, at least put it into context with the stock price movement as opposed to just making outright call off of a chart.

Valentine: Exactly. And one thing Barry really taught me, and I guess I learned somewhat on the job, is that technical analysis will never spot the infliction point before it happens, whereas in fundamental work we’d like to think that we can figure something out before the rest of the Street and get in while the stock is cheap, and then it ultimately starts to move and we look like heroes.

In the technical world the stock has to start to move. Things have to start to go in a certain trend before you can say, “OK, the trend is starting here, now we can get on it.” And, I think that’s a little bit of a mind shift for a fundamental analyst to say, “Hey, wait. The trend is already starting, and now I’m getting on,” but very often the trend will continue, as we discussed in the book.

Can you talk about one of those instances in your career, whether it was you directly or somebody you were managing where you got it right? Where you went in, you did the work, you sort of went against the Street and stuck your neck out on a call and got it right?

Valentine: Yeah, I’d say probably one of the highest profile calls I had was on- I guess the one we’re talking about is on Union Pacific ($UNP), and I guess it just helps illustrate the whole point of doing fundamental work.

At the time in this whole food chain analysis- Union Pacific is railroad, and they haul all kinds of chemicals. The chemical analyst at our firm was saying, “Hey, I’m hearing of some trouble.” This by the way was ten years ago, so it’s not a current issue with Union Pacific. He said, “I’m hearing of some trouble with chemical shippers in Union Pacific.”

I had heard there was going to be a shipper meeting down in Houston, so I got on a plane, flew down there. It was the Friday before Labor Day weekend, so it wasn’t necessarily the place I wanted to be. And there were like 300 shippers in this ballroom that were just hopping mad with the service. What it made me realize was that the company was really struggling with the acquisition they had done prior to that, six months earlier.

Ultimately they went negative on the stock. I think most people, including myself, had been fairly [inaudible; 0:25:03] at that point. The stock collapsed and had major problems for the following year.

I guess my point is it was due to getting out in the field and actually doing some fundamental research, as opposed to trying to just read the news tape and have a differentiated view.

There is a give and take there though, right? Between being too much in the field or too much in the office? Right? It seems to me like to be successful at what you do you’d have to- in either way you’re sort of influenced by your surroundings, right? So, how do you sort of balance that as a analyst?

Valentine: Yeah, I don’t know that I’ve ever met someone who felt like they were out of the office too much, or that they did a bad job. If anything I think that I would say over the years the people who I met who were the best at their job were the people that would be most willing to get on a plane and go somewhere.

To your point, you can’t spend 52 weeks of the year on the road, although with laptops nowadays, and mobile phones, smart phones, and everything else, there’s no reason from a technology perspective why you couldn’t. But you’re right, to the extent that you need to be working, communicating with your colleagues and making sure that your ideas are being put in the portfolio, or on the sell side that your clients are adopting your ideas.

But I guess on the whole point I would say the more an analyst, especially in the first five years of their career, the more an analyst is out on the road the greater the likelihood they’re going to do high quality work, assuming they’re using their time proactively. I mean going to some far remote place to meet one company for two hours and spending the whole day and that’s all they do is a problem, but if they can be working remotely on their laptop and keeping news flow and doing some research while they’re traveling, I think that actually helps analysts out a lot.

Let’s just reaffirm this a little bit, within the book, and obviously as an outsider looking into the industry, technology obviously is changing our inputs in terms of where we’re getting our information, and the speed of information.

What’s interesting for a sell side analyst is that’s only one side of the business. The other side of the business is obviously communicating your ideas.

How have you seen technology sort of transform how analysts are helping to disseminate their ideas?

Valentine: Well, I’ll maybe just punch out that the buy side I really haven’t seen much difference because almost in all instances it’s in-house. But on the sell side it’s clearly been-

Although that’s not exactly true. I don’t know if you saw like last month Whitney Tilson who was short Netflix ($NFLX) went very public with that short. The CEO of Netflix came onto Seeking Alpha. There was this back and forth between why- basic premises on sort of the thesis there. So, I’ve seen successful hedge fund guys now go to the media- I mean this is an age old issue, but it’s happening faster and I think more frequently that buy side guys are going out making their portfolio picks public.

Valentine: Yeah, that’s a really good point. There are some- I’m not sure how big of a population it is, but there’s definitely some I guess more activist type investors, specifically hedge funds, that are willing to go out and get their message out there.

So, you’re right. That absolutely happens.

But when I think about technology transforming the way- communication of stock messages- I tend to think more of the sell side in that there still is this regulatory concern, and rightfully so, that you have to disseminate all material information to all your clients at the same time.

We like to think that, “Well, great. Now you’ve got instant messaging, and you can use your smart phone to do all these things, communicate your ideas as an analyst,” but the reality is that as a sales analyst you’re going to go out and share an idea that is material you’ve got to get it out there to everybody, which means you’ve first got to write at least a short note, have it go through legal, your compliance, and then ultimately it gets sent out.

But the good news is that when it gets sent out now it can go out to smart phones, it can go out via the web. I remember fifteen or twenty years ago, starting off you had to have a dedicated first call machine, and you had to like walk over to it and use it for your whole department to pull up any new information that was coming up out of the sell side.

Now it’s ubiquitous. You can get this anywhere in the world, assuming you’re a [inaudible; 0:29:37] client of the sell side firm, you can get the research, and so yeah. It definitely had a big impact. Information is disseminated so quickly that as an analyst if you get something, a few pieces of information, you’ve got to move very quickly on that.

Ten or fifteen years ago you could say, “Let me spend another day, or two, or three, really double checking and making sure I’ve got all this understood.” But nowadays with so many eyes out there that have access to ultimately the media, they’re all going to self-publish what they discover, that you don’t have that luxury, as much of a luxury to wait.

I guess I’m colored obviously because of where I sit, and sort of the media side of things, but I sort of see analysts, both on the sell side and on the buy side, becoming more and more media type personalities, as time unfolds. Are they getting training internally or externally, in terms of how to manage messaging, like, when they’re on a live show, like on CNBC, or speaking to reporters?

Valentine: It really depends on the firm. Some firms have very strict policies and say only certain level- vice president or managing director and above- can talk to the media, and they need full blown training. Other firms are more flexible, and their attitude is, “You can talk to anybody you want.” That, by the way, is on the sell side. On the buy side my experience has been only the most senior people are allowed to have these discussions and they very often do get media training.

This is a weird questions, but I ask this of all the guests on my radio program- what do you do during your day? What sources of information do you find useful, as an analyst? What would you recommend to analysts of sources of information? Books to read, things like that. I just like to help bubble those up for our readership.

Valentine: Sure, now are you talking about to do day to day research on a particular stock, or are you saying to get smarter, to be a better analyst?

Both.

Valentine: Well, I think in day to day research I think that the- there’s two elements for your sectors, or your companies, and that is there’s obviously the newswires and the print media you’ve got to keep an eye on, and once again hopefully you’re only focusing on the things that are really likely to impact your stock.

Then there’s the more specific trade journals and things that are in your sector, and unfortunately, because it’s sector specific I can’t necessarily give you names, but every analyst out there better have at least one or two industry-specific trade journals that they find useful, that they’re scanning periodically, otherwise they’re going to miss on the trends. They’re going to have to wait until the general media picks up on them.

In terms of how to be a better analyst, obviously I wouldn’t have wrote the book if I didn’t think that there was a hole there. So, I do think that’s one of the ways, obviously.

But, there are some books on evaluation. Unfortunately a lot of them are fairly academic.

Professor Damodaran from NYU has got two or three books out there that I think are very good. He is looking at them from more of somewhat academic, but he has more of a practitioner’s vent than I’ve seen from a lot of other authors.

I think on the buy side, obviously priorities are different whether you’re on the buy side or sell side, but buy side is consuming every type of media you can possibly think of, right? They’re on Twitter, and they’re mining that to try to find any morsels that may move stocks, or that maybe pertinent to a particular thesis.

Are sell side guys also sort of attune to some of the changes in the consumption of media now? Or are they still sort of innoculated from that?

Valentine: It really depends on the person, and this kind of goes back to part of the reason I wrote the book, is that every analyst out there is allowed to kind of adopt whatever practice they want. I would say if you find- most analysts who are on the job that are 30, or maybe 35 is the right age, threshold and older, not convinced that they’re all out there mining Twitter, or any of the other social media to try to stay ahead, but I would say most analysts under the age of 30 are probably trying to do those things.

The key thing though, and this goes back twenty years, at least, as far as I know in my career, there is always something that comes out that people think is going to be the panacea, that’s going to be, “Here’s the place to find the good information.” And the reality is that you have to filter it down to what’s really relevant to you. Then once you filter that down you’ve got to figure out, “Well, is this really going to impact my stock, and if so what’s the magnitude,” and then do the research.

It’s kind of going back to when we were talking about killer apps, this idea that using social media, and this is more your area than mine, but using social media is clearly important, but you’ve got to be able to harness it, so you’re not sitting there for eight hours a day scanning things defensively, and not really doing your job, namely, getting out there and proactively being on offensive and trying to figure out how you can have a differentiated view. Because if it’s already out there in social media it’s out there, and you’re not necessarily going to be able to make a big difference.

Just lastly, in terms of building that differentiated view that you talk so much about, you talk about this innerplay this communication between the buy side and the sell side. Obviously each one is looking for something different from each other, but when we were at the hedge fund we definitely found this sort of dream team of sell side analyst from different firms that we reach out to for different things that we felt had a really valuable perspective for us when we were building our thesis.

Can you talk a little bit about that, about how to use each other I guess to sort of harness the different perspectives in terms of finding out where stocks are going to go?

Valentine: Sure. Well, in terms of the buy side using sell side, one of the thing I think every analyst should do before they start calling around and figuring out who their favorite analyst is going to be is to look at the numbers. Starmine does a really good job of this. I believe Factset and Bloomberg also have methods to evaluate analysts on two dimensions, both their stock picking skills, as well as their earning accuracy.

There’s a number of studies that have shown that the analysts who are more accurate with their earnings estimates are also better with their stock picks. So, figure out who in your industry ranks on that scale, and use it as a foundation, and then start making the phone calls.

Look, the buy side might use a sell side analyst because he/she has a great relationship with the CEO, or because they’ve got a great historical perspective. So, I’m not saying only use people based on the statistics, but know when you’re going to call someone, if you begin to develop a relationship, that they are number 9th in the industry in terms of stock picking skills, because you only have so much time to invest in each relationship. You can’t be friends- not friends- but not necessarily have a good, strong working relationship with ten analysts in every sector. It’s probably going to come down to two or three.

Then on the sell side in terms of relationships you do on the buy side, part of this is getting clients to vote for you and say they like your work, because that ultimately results in commissions, which is ultimately how sell side analysts, their firms are paid.

But there’s also the factor of sell side analysts should make sure they’re staying close to the smartest buy side analysts, because it makes them smarter. It makes them better. It definitely helps them understand the psychology of the stock. There’s a number of places in the book where I talk about the only way you’re going to really know whether you differ from consensus is to understand consensus.

Consensus isn’t necessarily just the number that’s out there for the quarterly earnings, or the annual earnings. Very often consensus can be a whisper number. It could be the psychology behind whether a company is going to get a new patent, whether they’re going to get drug approval. And, the only way you know what that consensus is, is to get out there and talk to some of the smart investors. So, point being that I think the sell side always needs to make an effort to stay close to smart buy side clients.

Smart buy side clients, they don’t always wind up being in the biggest commission paying firms. So, sometimes you have relationships with these people that are in smaller firms, but they hopefully make you smart.

I also, just harkening back to something you said, I definitely feel that there was a void in the industry and that your book definitely fills this need that there isn’t this sort of overarching publication that tells people how to be better at their job. I know it’s sort of a sink or swim very competitive industry, where you sort of just learn on the job or you don’t. I just want to commend you on putting together a really sort of end to end book that I think addresses the entire business in a very practical way.

Reading the book, I appreciate your time today. This has been very intuitive for me.

Valentine: Well, thank you.

Miller: Good luck.

That was Jim Valentine, the author of a new book, Best Practices for Equity Research Analysts: Essentials for Buy-side and Sell-side Analysts. It’s put out by McGraw-Hill. You can find it on Amazon. I’ll link to it from my blog as well.

Check out my blog at www.tradestreaming.com You’ll find an archive of all of our previous podcasts, and conversations with new authors, discussions about using technology to become better, more accurate, more profitable investors. Thanks for joining us. I hope you’ll drop us a line, let us know what you think of the podcast. And I hope you’ll listen next week.

More Resources

Learn more about the book and Jim Valentine

And it’s pretty nice.

And it’s pretty nice.