Nine months into her role as Chief Product and Technology Officer at Temenos, Barb Morgan is focused on a simple principle when it comes to product strategy: quality over quantity. “We want to build less, but build it better,” Morgan said during a conversation at the Temenos Regional Forum Americas 2025 held May 28-30 in Miami.

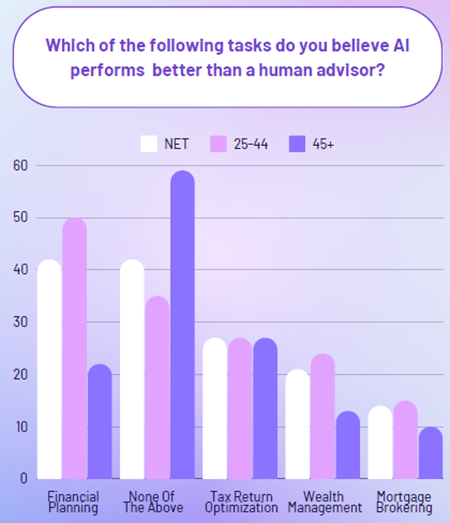

Temenos’ approach centers on co-creating meaningful solutions with bank customers rather than rushing to market with multiple products. Morgan emphasized that the company is “really focused on making sure that whatever we put out there is meaningful,” as the industry navigates what she calls the “AI hype curve.”

Morgan’s insights reveal why many banks struggle with AI adoption despite the technology’s promise. The real barriers aren’t about computing power or algorithms — they’re messier problems involving decades-old data systems that were never designed for AI and organizational cultures that haven’t caught up to the pace of technological change.

Her conversation also detailed Temenos’ bet on bringing innovation closer to customers, such as through its new hub in Orlando designed for co-creation, and why the company is taking a strategic and deeply integrated approach to AI that enables banks to deploy AI-powered solutions faster and safer.

Listen to full podcast

A three-pronged AI strategy

Temenos has structured its AI approach around three core components: Gen AI embedded directly into its platform and products, agentic AI with a first solution for sanctions screening already live at one Tier-1 bank, and an AI studio for custom use cases. “We have a lot of customers coming to us with very unique use cases, and so we want to provide them a platform that’s pre-built with banking modules,” Morgan explained.

The company’s focus on embedded AI addresses a common industry challenge. “Having it embedded, versus our customers trying to figure out how to bolt it onto our product, is really important to us,” she said. This approach allows banks to access AI capabilities without investing too many resources into integration.

Banks are ready for AI – their data isn’t

One of the biggest obstacles to AI adoption isn’t fear of technology, but foundational data issues, shares Morgan. “A lot of banks over the past 10 to 15 years went through this huge digital transformation, but what they didn’t transform was the data in the back end,” Morgan noted. “In order to leverage the power of AI, you have to have your data clean.”

This reality has shifted many of Temenos’ client conversations toward data readiness rather than AI capabilities. “Our clients also want to leverage their own data systems. So how clean is your data? Is it really ready? Because for secure AI products, you have to have your data in order,” she said.

Cultural change is the harder challenge

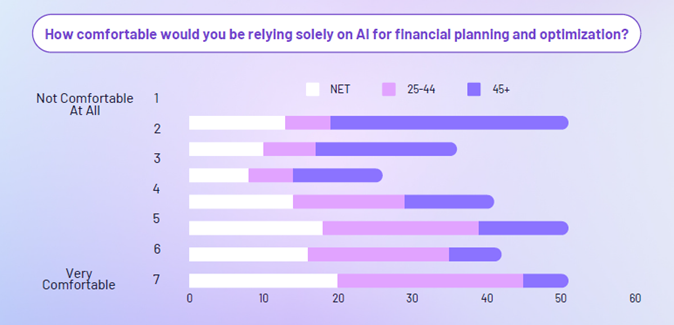

Beyond technical hurdles, banks face significant organizational resistance to AI implementation. “I was talking with one of our US banks last week, and he said I underestimated the amount of cultural change that’s necessary, because so many people are afraid of AI,” Morgan shared.

The fear stems from job displacement concerns rather than technological limitations. “They think it’s going to take my job away, versus thinking of it as augmenting their job and being more of a side by side partner,” she explained. This cultural aspect has to become a major focus for banks that want to succeed with their AI implementations.

A gradual approach to AI deployment

Temenos’ strategy acknowledges these cultural and technical challenges by allowing banks to phase in AI adoption. Morgan described how one tier-one bank using their agentic AI product FCM AI Agent started with just 5% of its traffic, then gradually increased it to 20%. “It wasn’t because they didn’t trust the technology. It was because they were getting the rest of the organization comfortable,” she said.

This incremental approach extends to customer-facing applications as well. “A lot of people, it seems, have their favorite [Gen AI] tool on their phone,” Morgan observed. “I think maybe the banks have underestimated that the customers are actually ready to interact with AI.”

Bringing innovation closer to customers

Part of Temenos’ US expansion includes the opening of its Orlando Innovation Hub, designed specifically for co-creation with bank customers. “Instead of just expanding one of our existing offices, we’re actually going into a brand new building,” Morgan said. “It’s all about being able to do the design workshop, but then the space can transform to doing co-development together.”

The facility will include spaces that can replicate bank branch environments. “There’s a space where we can make it feel like you’re walking into the branch of the bank, and so we can actually recreate exactly what it’ll feel like for their customers,” she explained.

Market-centric over centralized delivery

The Orlando hub represents a broader shift in Temenos’ delivery model. “Over the past 30 years, we have had a pretty centralized delivery team, and this is about bringing it closer to our customers,” Morgan said. “Versus centralized delivery, it’s more about market-centric innovation.”

This approach is driving the firm’s hiring, with plans underway to recruit for 200 positions at its Orland Innovation Hub. “At a recent hiring event, every candidate who received an offer accepted,” Morgan noted. “They were really excited about the co-innovation and the ability to actually work how we want and bring our best selves.”

Building products that actually ship

Morgan has instituted a new discipline around product announcements, moving away from proof-of-concepts toward deliverable solutions. “We’re only going to announce things when they’re live and ready to use now,” she said.

The company has also allocated 25% of its development capacity specifically to customer-driven features. “We’ve actually allocated about 25% of our capacity to just listening to customers and putting their needs on top of what we would already have planned,” Morgan explained.

This customer-centric approach extends to the broader organizational transformation Morgan is leading.