Serving the resilient spirit of small businesses

- In the face of macro challenges, SMBs are still optimistic that their businesses will grow in the upcoming year.

- SMBs are looking to FIs and fintechs for help with managing cashflow and they're looking to AI to help them with automation and scale.

Join us for Tearsheet’s flagship The Big Bank Theory Conference this September. This year we’re 100% focused on SMB finance. See why you should join us here.

Small businesses are optimistic despite economic headwinds like inflation and labor crunches. Understanding their drive and evolving tech needs is key for banks to better serve this vital segment.

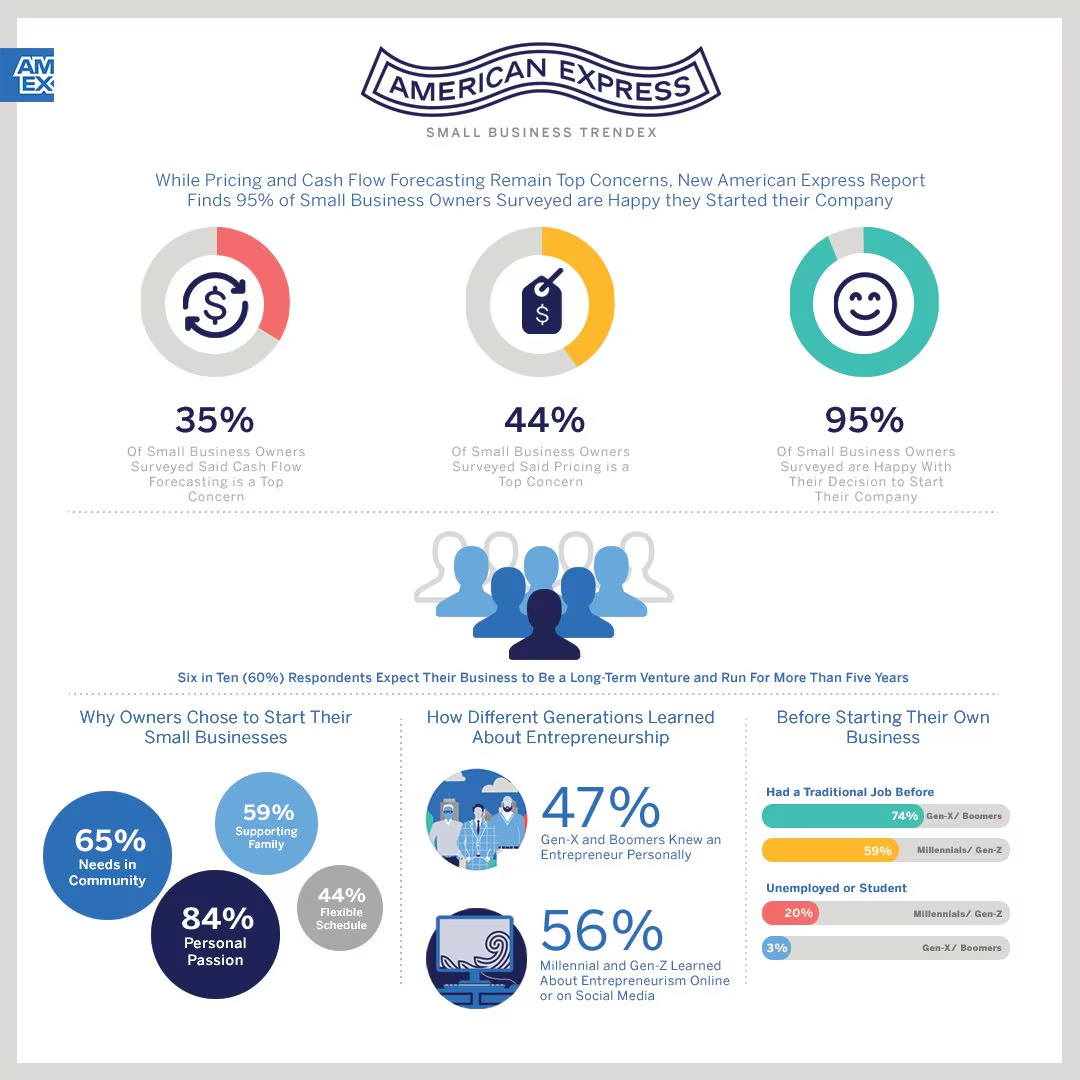

SMBs believe in their businesses in spite of the challenges. 95% of small biz owners happy they started a company (source: Amex Trendex Findings).

- Patience: 60% see it as long-term venture (5+ years)

- Motivations: Personal passion (84%), filling community needs (65%), supporting family (59%)

- Doing well: 67% of small biz owners say business is thriving (source: Chase for Business survey)

“Small business owners are concerned about issues like pricing and cash flow forecasting, but they are overwhelmingly happy that they chose their career path as an entrepreneur, and most intend to be small business owners for the long run,” said Gina Taylor Cotter, EVP & GM, Small Business Products & Business Blueprint at American Express.

SMBs current growth needs

More than half (58%) of small businesses surveyed said they plan to expand in the next 12 months by introducing new products, increasing marketing efforts, or hiring more staff. This percentage is even higher among Chase clients with 69% saying they plan to expand, versus 47% for Chase prospects.

Ben Walter, CEO for Chase for Business, said, “It’s encouraging to see the resilience and optimism displayed by small business owners despite the challenges they’ve faced in recent times. I’m pleased that Chase for Business clients are particularly upbeat about the future, with a strong willingness to invest in their businesses.”

But things are also challenging for SMBs

- 63% face pressures like inflation (39%), supply chain woes (21%), labor shortages (19%)

- Top concerns: Cash flow, staffing, revenue growth

The turn to data and AI to power SMBs

SMBs are looking to better automation and data to help scale themselves: 82% likely to use data for decision-making.

- 33% plan to add ChatGPT in next year

- 42% adopting other AI apps, up 14% since Nov.

- Strong interest in data for competitor analysis (64%), customer insights (59%)

Generational shift for entrepreneurs

Younger entrepreneurs are finding their way as they grow their businesses, turning to influencers and technology to power their efforts.

- Millennials/Gen Z are more likely to learn about entrepreneurship online/social media (56%) vs. knowing someone (47% for Gen X/Boomers)

- Younger cohorts are twice as likely to believe wealth is required to start biz, that “entrepreneurs do it alone”

- 33% Millennials/Gen Z credit tech for navigating challenges (18% for older gens)

So what’s next for SMBs?

As small biz leans into tech, FIs can tailor:

- Financial products

- Cash flow management tools

- Guidance on data/AI adoption

By understanding their evolving needs, FIs can power small business resilience and growth.