Payments

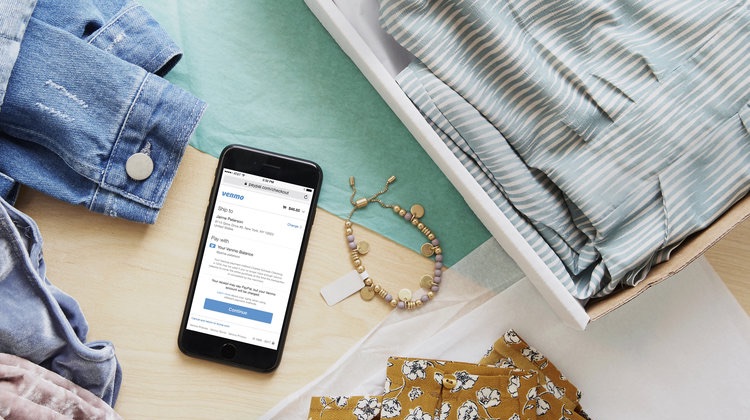

With debit card, Venmo eyes retail partnerships as path to monetization

- Venmo's debit card ties it to brick-and-mortar retail experiences, opening up new possibilities for monetization

- Through tie-ups with Venmo, the platform could generate additional revenue beyond transaction fees for merchants and customers