Payments

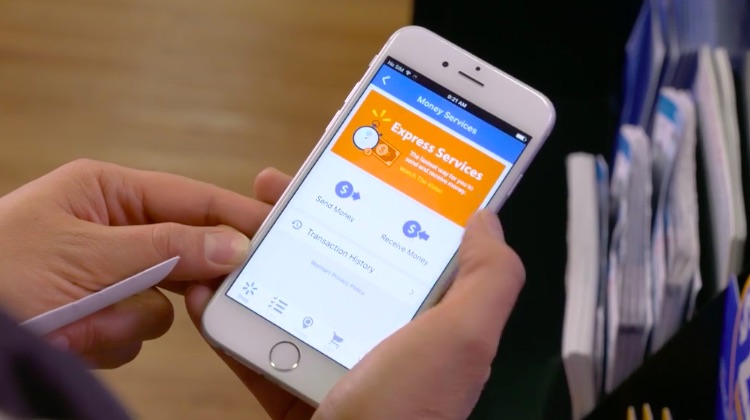

When it comes to mobile payments, banks need to learn from retailers

- Mobile payment adoption among Apple, Android and Samsung Pay are low, and customers say playing with cash or card works just fine for them

- Loyalty and rewards incentives may not be enough to make consumers like mobile payments, but it's on retailers to find what would keep people coming back to their mobile wallets