Member Exclusive, Payments

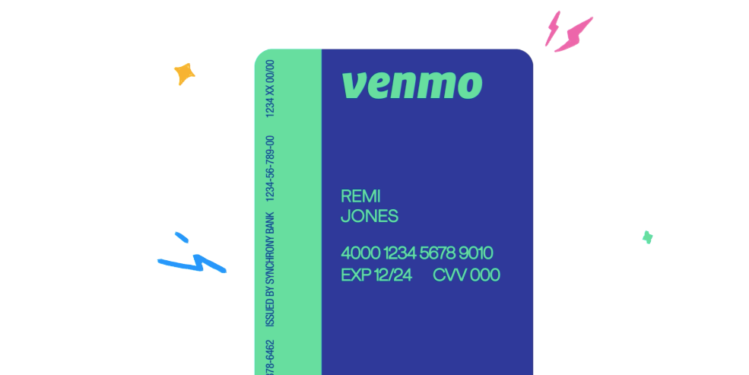

Venmo launches its first credit card

- Venmo launches a new way for users to pay via Venmo.

- Joining its debit card, Venmo Credit Card offers up to 3% cash back.