Payments

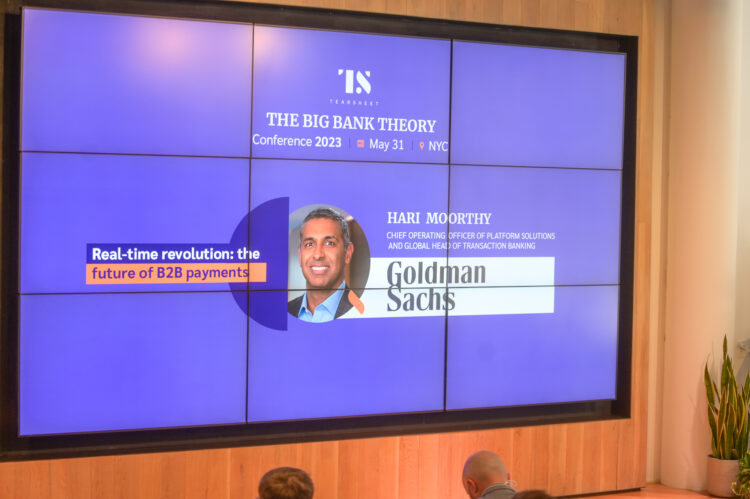

‘There’s no one system that can solve the problems across the B2B payments landscape’: Goldman Sachs’ Hari Moorthy on what lies ahead for B2B payments

- Without interoperable common standards for international payments, there's more work to be done in B2B, according to Goldman Sachs' Hari Moorthy.

- Supporting the idea of new payment rails and remodeling existing ones may be the way forward in enabling interoperability across different payment systems.