Inside Affirm’s strategy to get new cards in more users’ hands (a visual guide)

- Affirm's financial results have really picked up over the last quarter and part of that is due to the success it's having with its Affirm Card.

- Here's the story of Affirm's card growth strategy told in charts.

Affirm is looking to its Affirm Card as a wedge product to help it expand into a broader set of customers with bigger spending ambitions.

The product serves a broad spectrum of consumers. It accommodates those who lean towards debit for their daily expenses like groceries, while also appealing to the majority who opt for credit when making significant or planned purchases such as travel. According to the company, the Card has been successful in tapping new spend categories that were traditionally outside the scope of Affirm’s historical focus.

The Affirm Card offers both interest-free and interest-bearing payment plan options. The available options depend on factors including consumers’ creditworthiness, purchase amount, and whether they request a payment plan before or after purchase, among others.

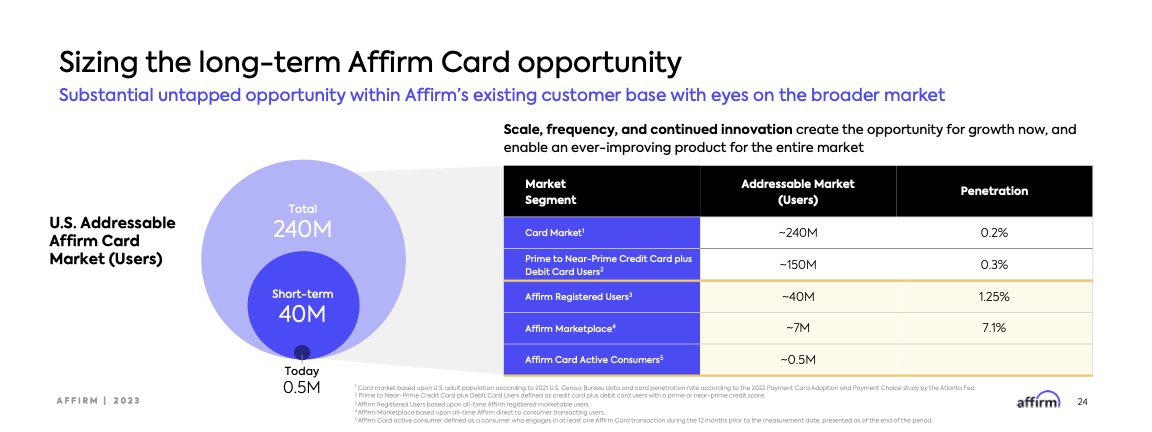

Sizing up the Affirm Card opportunity

Affirm believes it has a long runway to grow. It has about 40 million registered users. That’s a lot of captured interest to expand beyond the 500k users that currently use its debit card. Beyond that, the US market has a total 240 million cardholders.

While Affirm is still in the early stages of rolling out its card, it’s employing a tried and true strategy to grow its card program: