Global e-commerce shines, but are retailers facing equally favorable conditions?

- Global e-commerce opens doors to a broader audience and opportunities for online sellers, yet brings challenges on a larger scale.

- Only a few online merchants are sailing past the string of obstacles tied to international e-commerce while many are falling short.

Engaging in global e-commerce broadens access to a wider audience and opportunities for online sellers, but also introduces a set of significant challenges on a larger scale.

Among other things, managing payments is a critical step for retailers to ensure a smooth customer experience from beginning to end. However, this constitutes one facet of several other associated elements that shape the cross-border e-commerce payments ecosystem. Factors such as authorization rates, simplifying payments processes for a secure yet user-friendly authentication, adhering to regulations, and addressing covert foreign exchange (FX) costs influenced by geopolitical instability and inflation all contribute to the system’s complexity.

Source: ResearchGate

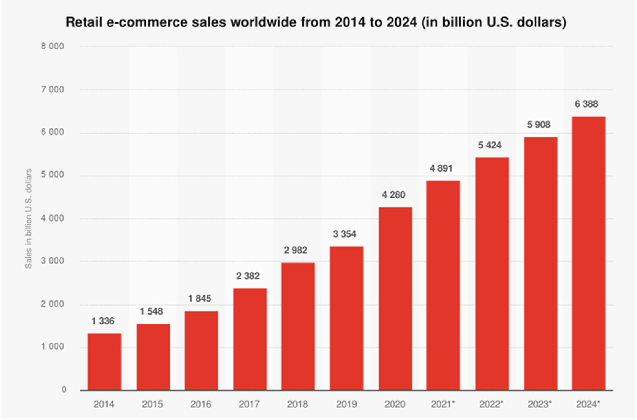

While annual projections indicate a continuous rise in the volume of retail e-commerce, there is a caveat. Only a few online merchants are sailing past the string of obstacles tied to international e-commerce while many are falling short.