From Checks to Digital: J.P. Morgan and Codat discuss the changing landscape of B2B payments

- J.P. Morgan and Codat have joined forces to revolutionize B2B payments, aiming to transition businesses from checks to digital payment methods.

- Their partnership introduces Codat's new Supplier Enablement data product, designed to boost virtual card usage, with J.P. Morgan as an early adopter for its B2B virtual card offering.

Codat and J.P. Morgan have recently announced a partnership aimed at facilitating the transition from checks to digital payments for major banks in the United States. This collaboration has resulted in the launch of Codat’s new Supplier Enablement data product, designed to increase virtual card usage, with J.P. Morgan as an early adopter for its B2B virtual card offering.

To discuss this development and its implications for the B2B payments sector, we spoke with two key figures: Stephen Markwell, Head of Product Strategy and FinTech Partnerships for Global Banking at J.P. Morgan, and Peter Lord, the Co-Founder and CEO of Codat.

This partnership comes at a significant time for B2B payments. Despite the availability of digital alternatives, approximately one-third of B2B transactions continue to use cash and checks. This persistence of traditional methods, even with established options like ACH and the growing adoption of virtual cards, indicates both challenges and opportunities in the modernization of B2B financial operations.

In this interview, Markwell and Lord discuss the benefits of virtual card adoption, current trends in B2B payments, and strategies for addressing barriers to digital transformation. They also provide insights into upcoming innovations that could shape the future of B2B payments, offering practical perspectives for organizations looking to enhance their payment processes in an evolving financial landscape.

The following Q&A was with Stephen Markwell, Head of Product Strategy and FinTech Partnerships for Global Banking, J.P. Morgan

What specific challenges have you observed in the transition from checks to digital payments in the B2B sector, and how has JPMorgan successfully addressed these challenges?

Change isn’t easy and shifting to digital payments methods, like virtual card, is no exception. It requires

technology, security and other process considerations. One common challenge is making sure businesses have the right controls set up and ensuring the readiness of their payment recipients before

transitioning to fully digital.

We’re able to work closely with businesses of all sizes and industries to understand their needs and offer the best digital solutions for them today as well as tomorrow—from accounts payable and embedded ERP integrations to bill pay solutions. We’re uniquely positioned to support our clients as they grow and scale.

Can you share examples of how clients have benefited from adopting virtual cards through this partnership, in terms of operational efficiency and cost savings?

This virtual card offering is helping our clients more easily onboard new suppliers where information is systematically stored as opposed to the tedious, manual offline check process. In turn, businesses get better and consistent data to optimize their spending by gaining higher virtual card rebates, driving spend with new suppliers and seeing an expansion of card spend over time.

What are the key trends in B2B payment adoption that professionals should be aware of, and what lessons can they take back to their organizations to stay ahead of these trends?

All trends point back to seeking better optimization and efficiencies.

For example, integrating payment solutions with ERP and accounting systems is becoming a top priority to streamline financial operations. Payment platforms that can easily integrate with existing ERP and accounting software ensures smooth data flow and easy reconciliation.

Additionally, globalization and international trade are pushing businesses to find more efficient and

cost-effective solutions for cross-border payments. To meet these needs, businesses have considered

options that offer lower fees, quicker processing times and better exchange rates for international

transactions.

Lastly, leveraging AI-powered data analytics to gain insights into payment patterns, cash flow and

financial performance is becoming a key driver of efficiency and growth.

What upcoming innovations at JPMorgan could further enhance the B2B payment experience, and how can organizations leverage these innovations to gain a competitive edge?

Today’s payments environment is complex and changing faster than ever. To succeed, you must be both

agile and innovative. We’re focused on discovering digital-first solutions that help clients navigate change and risk, innovate to grow and deliver an outstanding customer experience.

As an example, J.P. Morgan has developed a proprietary closed-loop payment innovation that seeks to

solve pain points for both our clients and their suppliers. The payment solution originates as a virtual

card but settles as an ACH to their suppliers. The unique value from this solution balances our clients’

desires to increase digital payment adoption while improving their working capital and creating an optimal experience for their suppliers. This solution can reduce processing costs for suppliers with a

digital direct settlement, leverage automation to enhance the reconciliation experience and often times

will improve their DSO (Days Sales Outstanding) with customized terms.

The following Q&A was with Peter Lord, Co-Founder and CEO, Codat

How does the Supplier Enablement data product function, and what are the specific benefits for B2B companies? Can you provide a step-by-step example of its implementation?

Codat provides banks with a real-time view of their business customers’ financial data. Our newest product is for Commercial Card teams at issuing banks and it provides insights into their customer’s supplier relationships. These insights enable the bank and their client to run more effective supplier enablement campaigns and therefore migrate more AP spend to card.

The customer naturally wants to pay more suppliers by card, as they earn rebates and benefit from a working capital standpoint. They tend to be middle-market businesses whose AP spend is in the tens of millions each year and who may have hundreds or even thousands of suppliers. This not only means there is a potential to have a lot of impact but also that the business is generally complex enough that Finance teams need the issuer’s support in migrating suppliers to card payment.

Even collating an up-to-date supplier list and performing a preliminary spend analysis can be a lot of work and back-and-forth between the issuer and the client. By automating this process for customers, issuers can show the value of card much earlier in the relationship, resulting in a more efficient and higher-converting card sales process, as well as ultimately getting new card customers spending sooner.

By sourcing supplier and spend data directly from customers’ ERP systems and accounting software, we give the issuer a comprehensive, up-to-date view of their customer’s suppliers and spending. This view is constantly refreshed, which enables ongoing supplier enablement as well as monitoring to prevent suppliers reverting back to check.

At a high level the process looks something like this:

- A business starts a conversation with their bank about how they could use commercial cards to pay suppliers efficiently

- The business shares their supplier information directly from their ERP system in a few clicks, using Codat’s white-labeled consent journey

- In the background, Codat enriches this data with additional supplier payment details and transforms it into a complete and comprehensive spend file for Relationship Managers

- The detailed spend analysis enables the business to see how much spend can be moved to card and informs the rebate offer they are offered by the bank

- The bank uses the spend file to launch targeted campaigns to onboard the customer’s suppliers to accept card payments.

- Supplier and spend data are refreshed on a configurable frequency highlight new suppliers that can be transitioned to card payment without requiring clients to resubmit files.

What strategies have proven effective in convincing B2B companies to transition from traditional payment methods to digital solutions, and how can other organizations replicate these strategies?

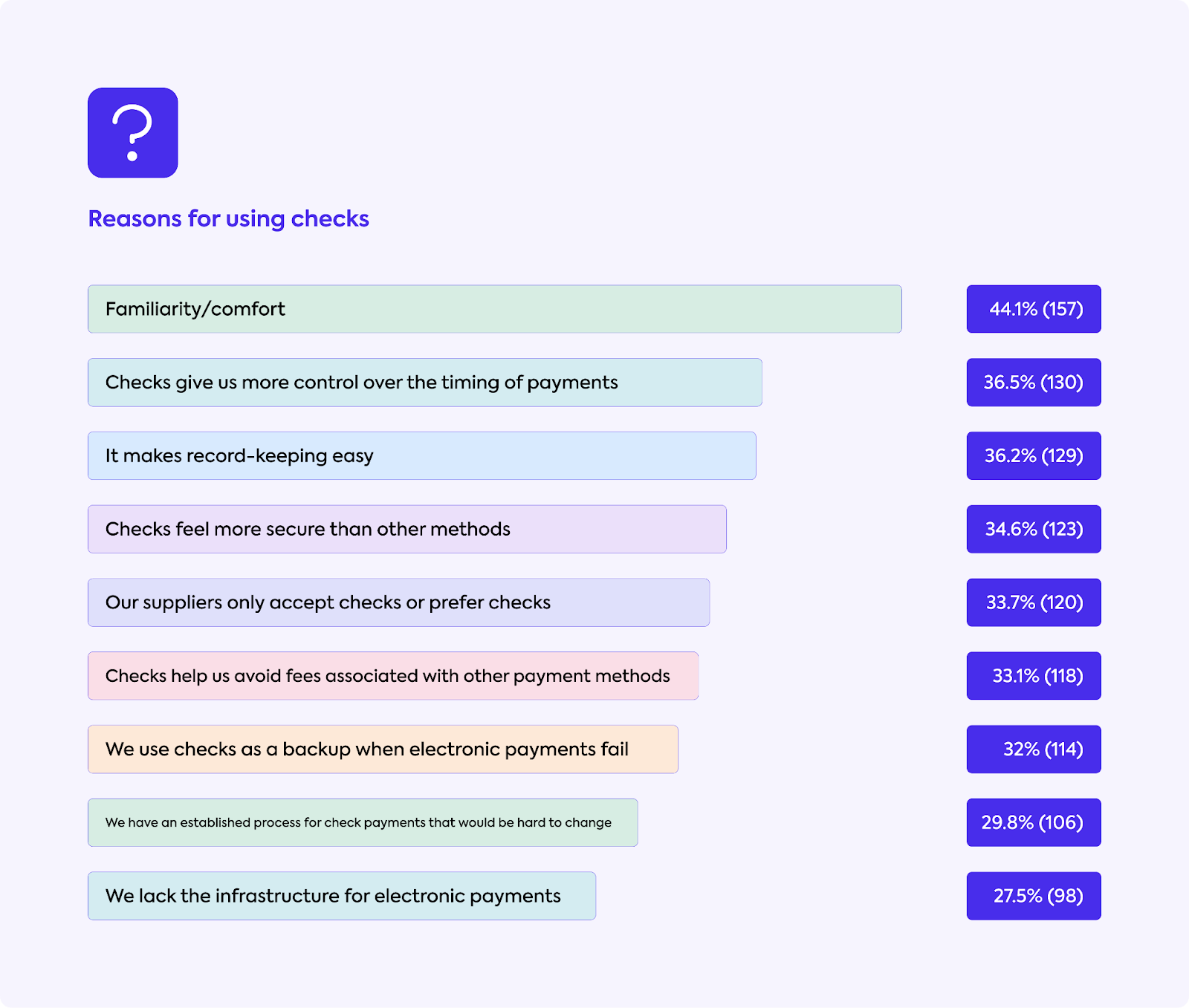

We recently surveyed 500 mid-market US businesses to understand how banks can better support the transition to virtual card. Respondents said that they continue to use checks mainly because it’s familiar (44.1%), they give control over the timing of payments (36.5%) and they were perceived to make record keeping easy (36.2%).

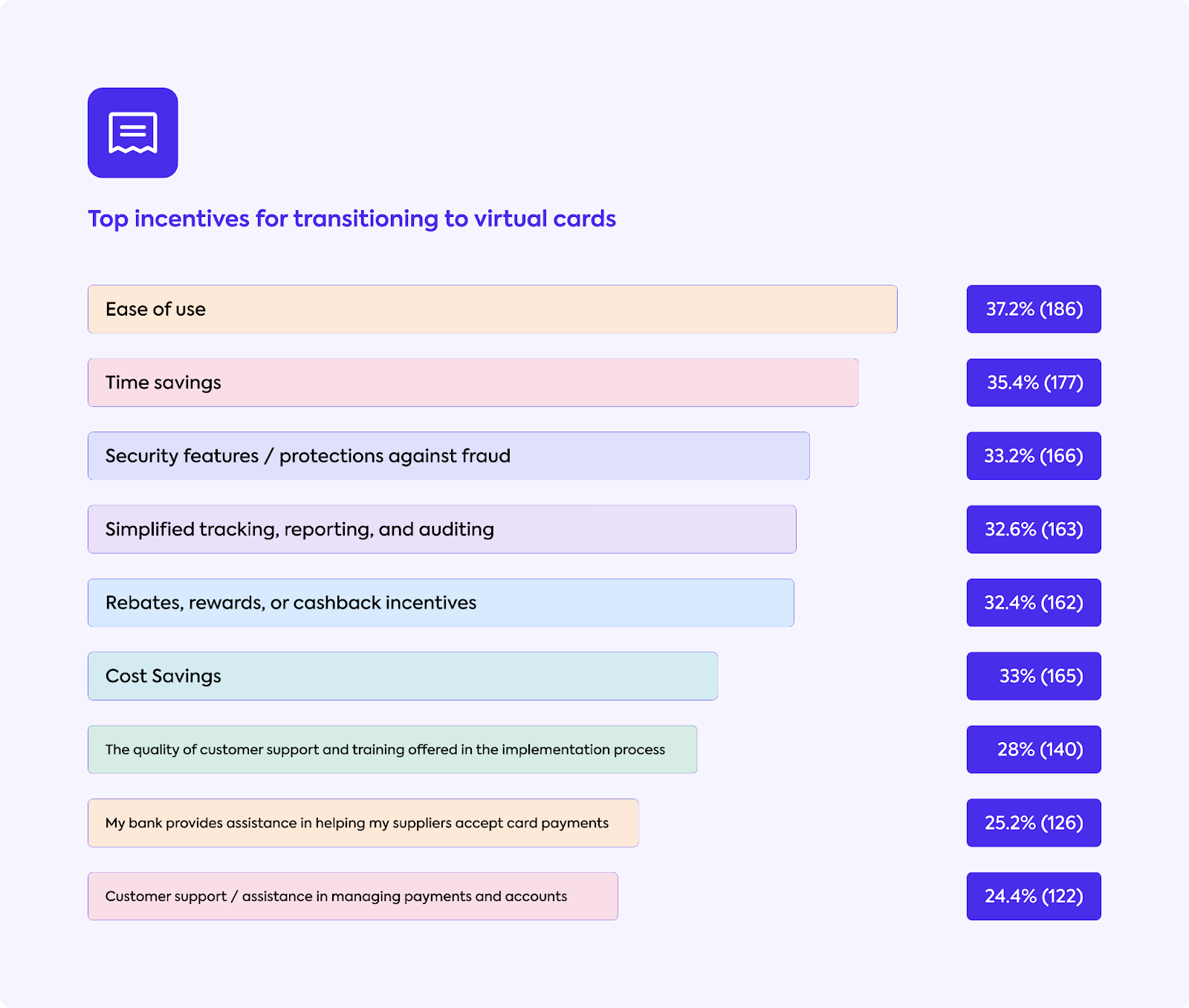

In terms of influencing the decision to adopt virtual cards, ease of use was seen as the most important factor (37.2%), followed by time saving (35.4%) and additional protection against fraud.

Although the familiarity bias towards checks is a big one to overcome for Finance teams, 60% of those we spoke to said they were either open to or likely to adopt virtual card in future, indicating that it is certainly possible.

How has the collaboration with JPMorgan influenced the development and success of your Supplier Enablement product? Are there any notable case studies or success stories that other organizations can learn from?

JP Morgan have been an invaluable partner in this process, working with us from the beginning of the product’s inception. Having regular, direct feedback from the teams on the ground running commercial card and supplier enablement processes today has enabled us to tightly tailor the means of accessing supplier data to fit in with JP Morgan’s existing workflow, and to quickly iterate on the initial prototypes. For example, through feedback, we realized how often supplier payment method can be missing from ERP records – a critical data field for the supplier enablement process. To overcome this, we now use a machine learning model to predict payment method based on a range of inputs derived from the high-volumes of accounts payable data that we have processed over the years, ensuring that supplier enablement teams always have a complete and comprehensive spend file to work from.

What insights can you share about the current market landscape for digital B2B payments, and what strategies can organizations use to overcome barriers to adoption?

Commercial payments account for 56% of all money moving around the world, so successfully transitioning businesses to faster, more convenient and secure payment methods will substantially move the needle on global productivity and prosperity.

Research confirms the market opportunity – virtual cards as a payment method for B2B transactions is projected to reach $13.8 trillion by 2028, according to a Juniper Research study.

But what’s surprising is that one-third of B2B payment volume in the US is still clinging to cash and checks. We live in a world teeming with innovation in payments – ACH was introduced decades ago – yet so many businesses are still relying on ancient methods.

Meanwhile, B2C payments are quick to adopt the latest innovations. But unlike consumer payments, with B2B payments there is more to consider than a simple transfer of money – it involves navigating workflows, approval processes, payment terms, schedules, currency conversion and much more.

Again, our strategy comes down to removing as much friction as possible. Businesses are averse to change unless the process is easy and the benefits are undeniable. That’s where Codat comes in – we seek to remove that friction and make the benefits of virtual card obvious.

What is Codat’s long-term vision for transforming the B2B payments industry, and how can other organizations align their strategies to benefit from this transformation?

We envision a future where B2B payments are seamlessly integrated, largely automated and intelligently recommend the best payment methods and technology for each transaction.

While fintech solutions have made significant strides in streamlining these workflows with AP automation software, B2B payment networks, and procurement automation software, end users are still held back by the basic challenge of data in so many different files, formats and places.

Streamlining the flow of the metadata surrounding B2B payments, from supplier details, to payment methods and terms, holds the key to finally converting the many millions of American businesses clinging to cash and checks. Right now, there’s productivity value that’s being left on the table by businesses that haven’t moved on from traditional payment methods, and we plan to change that.